Been there, done that - for a long time

Updated: 2016-01-01 08:18

By Amy He(China Daily Europe)

|

|||||||||||

Patience is key to success in China, says C.v. Starr's Greenberg

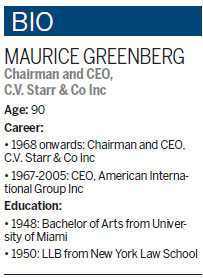

Maurice "Hank" Greenberg, at age 90, still travels to China about three times a year. After four decades of numerous trips to the country for business, the chairman and CEO of C.V. Starr & Co Inc, a privately held insurance company, knows how to beat jet lag.

Every time he goes to China he tries to time his arrival for between 4 pm and 6 pm. After arriving at his destination, he has an hourlong business meeting, followed by a workout and then sleep.

|

Maurice Greenberg, chairman and CEO of C.V. Starr & Co Inc, in his Manhattan office in New York. Amy He / China Daily |

The next morning, he gets up early, works out again, and just like that, he's officially on China time.

His latest visit to China was a couple of months ago when he flew to Shanghai, where Starr has its headquarters, and where Greenberg was named an honorary citizen in 1997. It's also where insurance giant American International Group Inc, which he led until 2005, was founded in 1919.

"It's always been one of the leading cities in China, and we have a lot of history there. History is important to us," he says in an interview with China Daily. Shanghai also is an attractive city to Greenberg because "the weather's a lot better than it is in other places in China", he jokes.

Born in 1925, Greenberg followed an unconventional path to become CEO. Raised in New York on a dairy farm, he later joined the US Army during World War II after lying about his age to get in.

He found himself fighting in yet another war in 1952 in Korea, rising to the rank of captain and earning a Bronze Star for his service. Days after returning to the United States from the war, he joined the insurance industry and has been embedded in the sector since.

Greenberg joined AIG in 1960 and eight years later, when AIG founder Cornelius Vander Starr died, Greenberg was named successor.

He stepped down in 2005, three years before AIG received a US government bailout during the subprime mortgage crisis. Under his tenure, the company saw exceptional growth, and became one of the first companies to provide risk management services for large corporations. It also was one of the first Western insurance companies to establish joint ventures with those in foreign countries, like Poland, Hungary, Romania and China.

For that reason, Greenberg has more experience with China than most. He has seen more of what China has gone through over the past 40 years than any other US businessman, including how the country's relationship with the US has changed.

Greenberg spoke to China Daily at his Park Avenue office in Manhattan about his long and deep connection with China. Following are edited excerpts:

C.V. Starr & Co Inc has a long history in China. How did the company grow in China under your tenure?

We have very few complaints about doing business in China. We've been there for a long time. I first went to China in 1975. It took until 1992 to get a license. It's a long time. But we were patient. We were doing business in 130 countries, so we understood how to do business in different countries. I think we brought a lot of knowledge to China in things that we do.

I'm never very patient. But I knew that one day, China would have to open up. A country with 1.3 billion people could not be left out of the world's trading system and be isolated. It was only a matter of when, not if.

What is your long-term goal in China?

To grow, and continue to do things that benefit us and benefit China. If we're creative and introduce new products, then we can help Chinese companies that want to invest outside of China. We can either help them in investing or we can help them by providing insurance coverage for their investments outside of China.

How has the Chinese insurance industry changed?

Automobile insurance is relatively new in China. Automobiles are relatively new. The roads are very crowded. The drivers are not that experienced, so there are more losses than say in five or 10 years from now. Also, the expense ratio is very high compared to the US. That too will have to change. You have to become more efficient. I don't say this critically; I say this is a reality of the market today. The large insurance companies in China - PICC, Ping An and others - are very happy with the results. If they were unhappy, they would change.

There are other classes of insurance business, very important classes of business - construction, complicated property and casualty risks. There are a lot of things to learn. You don't learn it by yourself, except through bitter experience. You have to know what you're doing. The insurance industry can learn, and they have to learn and they will learn. It'll take time, but they'll learn.

What are the challenges facing the Chinese economy?

China has to continue to redirect its economic policies. Only about 30 percent of the economy is consumer-driven. It's about 70 percent consumer-driven in the US. If China gets the consumer part of it going faster, it will grow much faster. It'll benefit the people, it'll benefit the economy. I think it will happen. It will happen over time. You can't rely only on the state-owned enterprises for growth. They're not the most efficient, so it's got to come from the consumer side.

What do you see as the role of banks in China?

You have to have banks that are consumer-driven, that can help small, medium-sized companies have access to capital and loans. As they grow, they hire more people. The more they hire people, the more they become consumers and start buying more things. It's like a rolling stone. It gets going, faster and faster.

What do you think the US should do with China in terms of a trade agreement?

I advocated and publicly stated that we need a free trade agreement with China. The US and China should have a free trade agreement. It may take 10 years to negotiate, but so what? It took us 10 years to negotiate with South Korea for a free trade agreement. It took China 10 years to have a free trade agreement with Australia. We should begin discussing that. As for China being a part of the Trans-Pacific Partnership, the big issue is the state-owned enterprises.

Are you optimistic about the US-China business relationship?

I'm optimistic because I think a country as large as China will continue to change. Since I've been going to China, I've seen many changes, for the good. And if China does what I said - becomes a more consumer-driven economy - it will be the largest economy in the world.

amyhe@chinadailyusa.com

( China Daily European Weekly 01/01/2016 page23)

Today's Top News

Storm Frank batters northern Britain

Over 1 million refugees fled to Europe by sea in 2015

Germany to spend 17b euros on refugees in 2016

Demand booms for high-end financial talent

Abe expresses apology for Korean victims of comfort women

North China encounters gas supply shortage

Asian Infrastructure Investment Bank launched

Russia says it has proof of Turkey's support for IS

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|