Private push

Updated: 2013-08-30 09:50

By Andrew Moody, Chen Yingqun and Song Wenwei (China Daily)

|

|||||||||||

|

Lu Qiyuan, president of Qiyuan Group, which is planning a $1 billion development in Addis Ababa. Li Junfeng / for China Daily |

|

Xu Weimin, president of Jiangsu Dongdu Textile Group, says any overseas strategy needs to be thoroughly thought through. Li Junfeng / for China Daily |

Increasing number of Chinese companies spreading their wings abroad, especially in Europe and Africa

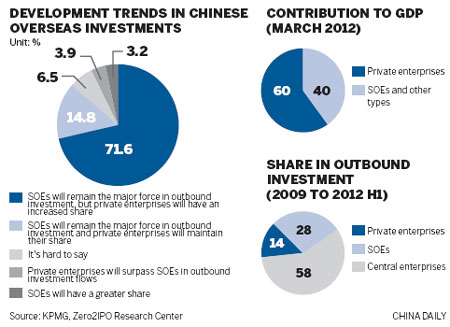

China's private businesses are poised to take a more dominant position on the world stage. Until recently state-owned enterprises have been at the vanguard of the world's second-largest economy's moves into international markets, particularly in resources and raw materials.

But already in the first six months of this year, four of China's top 10 outbound M&A deals have been by private companies, compared with just one during the same period last year.

The most high profile of these is perhaps Shuanghui International Holdings' $4.7 billion (3.5 billion euros) proposed acquisition of Smithfield Foods of the United States in May.

According to a new report by international business adviser KPMG, The Dream Goes On: Rethinking China's Globalization, which will be published in English soon, some 75 percent of respondents predicted major international advances for China's private businesses over the next five to 10 years.

According to the report, within three years, a third of private companies will set up an overseas sales network, around a quarter will establish offices abroad and about 15 percent will establish factories overseas.

Some private enterprises are being driven overseas because of the increasing costs of doing business in China with rising wage costs and higher value of the Chinese yuan.

But of those interviewed in the report only 8.2 percent did it for costs reasons alone. Seeking out new markets (cited by 19.2 percent), building international marketing networks (16.6 percent) and becoming an internationally competitive global company (15.7 percent) were more important factors.

The report concludes that, in fact, many Chinese private firms have reached a "tipping point", at where "going out" is an effective way to upgrade and transform their business.

"Many Chinese enterprises have realized that outbound investment is not just a way to achieve geographical expansion or acquire natural resources. Once enterprises have reached a certain stage of development, outbound investment is a way to break through development bottlenecks," the report concludes.

Oliver M. Rui, professor of finance and accounting at China Europe International Business School in Shanghai, agrees with KPMG's findings and says that what is forcing them abroad is that their old business model no longer works.

"They can no longer just be OEM players producing low design, low margin goods because the domestic markets they serve now want brands and higher quality products."

He says that China has exceeded a per capita income of $8,000, which has been a global benchmark when consumers demand better products and services.

"In Shanghai and in other parts of eastern China that is now $20,000. That is why you see many companies from there looking to make acquisitions," he says.

"They are increasingly going to go out to Europe and the United States to acquire brands and research and development capability that will strengthen their position in their own markets."

According to Ministry of Commerce, private companies now account for up to 70 percent of ODI in some of China's more prosperous eastern provinces.

One province the KPMG report highlights is Jiangsu, which is seen as a hot bed of Chinese private companies stepping up their global efforts.

At the Economic and Technology Park at Yangshe, 60 km from the center of the province's major city Suzhou, Xu Weimin was an early pioneer of the efforts of Chinese companies to go overseas.

The 60-year-old is president of Jiangsu Dongdu Textile Group, which has a turnover of 8 billion yuan ($1.3 billion; 980 million euros) and 26,000 employees, 10,000 of which are located in Southeast Asia.

"If China's economy wants to develop to a higher level, Chinese companies need to speed up the pace of going international, which is becoming a necessary and vital step for every company," he says.

A former local state-owned enterprise, it began selling overseas in 1993 and is now one of China's top 50 exporting companies.

He insists that although a third of its garments are made overseas in Vietnam, Malaysia and, in particular Cambodia, any company setting up overseas operations to save costs would be misguided.

"People think going global will help solve problems such as labor shortage and rising labor costs. We had thoughts like that at the beginning but even 20 years later we haven't made those costs savings.

"Going global is more for Chinese companies to participate in international competition, to find target markets in an overseas environment and get to know that market."

Xu, who spends two-thirds of his time abroad and works on behalf of the government advising Chinese companies about their overseas efforts, says the main problem with trying to achieve costs savings by establishing bases abroad is that Chinese manufacturing is among the most efficient in the world.

"From our own experience, if you invest in Southeast Asia the overall efficiency level is around a third of that in China. Companies from other countries are also trying to move to these locations so there is a lot of competition for resources."

In the conference room of his offices on the 16th floor of International Trade Tower on Suzhou's Xihuan Road, Wang Zhiming, vice-director of the Suzhou Bureau of Commerce, says the local private businesses are not afraid of going abroad since they have had long exposure to multinational businesses.

Nearly 300 sq km of the city is taken up by the Suzhou Singapore Industrial Park, which has attracted more than 3,000 foreign enterprises, including 77 Fortune 500 multinationals.

"The so-called Suzhou model for development was on foreign companies coming and investing in the various development zones around the city. That is how the city's regeneration began 30 years ago.

"Many of our private businesses grew up supplying to foreign companies on these zones. There are also export processing centers there."

Wang says many local businesses are now keen to make overseas acquisitions in their own right and there is no shortage of suitors. The bureau holds around six seminars a year from investment promotion agencies from the US, Sweden, the UK and Japan.

"One of the main problems for companies going abroad is the lack of information and these seminars provide information on investment opportunities. They are very much open to the idea of Chinese investment coming in even though there has perhaps been resistance to it in the past," Wang says. "We definitely want to encourage more business to also export and I think that transformation is happening now."

The ambitions of some Suzhou entrepreneurs go way beyond mere exporting, however.

Lu Qiyuan, president of the Jiangsu Qiyuan Group, used to be just a steel pipe maker but he now has bigger ideas.

The 48-year-old proudly shows a model of a $1 billion development he is planning to build in Addis Ababa.

If it goes ahead, it will feature a shopping mall, a five-star hotel and a major residential housing scheme on a 500,000 sq meter site.

He makes no apology that it will be a somewhat futuristic addition to the existing architectural lexicon of the Ethiopian capital.

"Yes, yes. Chinese city in the middle of Ethiopia," he proudly points out.

This is no pipe dream development. He has already shown the plans to the Ethiopian Prime Minister Hailemariam Desalegn, who he says he has met on a number of occasions. Despite not being a developer in China, Lu, who formed his company in 1994, has already built one of the largest Chinese enterprise zones in Africa, the Eastern Industrial Zone, 30 km outside of Addis Ababa.

It is home to a number of Chinese companies employing African workers and Lu predicts there will soon be between 30,000 and 50,000 people working on the site.

"The China real estate market has been fully developed and this is a new kind of business for us," he says.

"My view of Ethiopia, however, is that you are not working with a company but a country and you are helping that country through its first stages of industrialization."

In Beijing, Xu Hongcai, director of the information department of China Center for International Economic Exchanges, a government research body, says China's private enterprises are now finding it easier to go overseas than state-owned enterprises.

"When state-owned enterprises go global, they often meet with political resistance, but in comparison, private companies are given more leeway and can avoid these political issues and risks," he says.

He also believes that Chinese companies now have greater strength to meet the challenges of going overseas.

"After many years of development, private companies now are stronger in terms of both the capital they have and the talent of their people. They are also much more international in their outlook and have wider horizons," he says.

Peter Nolan, professor of Chinese management at the University of Cambridge and author of Is China Buying The World? insists, however, that Chinese private companies have yet to make major inroads in overseas markets.

"China has not bought the world and shows little sign of doing so in the near future," he says.

"Their presence in high-income countries is negligible. This is a remarkable situation for a country that is the world's largest exporter and its second-largest economy and manufacturer. In other words 'we' are inside 'them' but 'they' are not inside 'us'".

Xu at Jiangsu Dongdu Textile Group admits there are still many challenges and insists that any overseas strategy needs to be thoroughly thought through.

"We need to think why we want to go global, how exactly we need to do that and what goals we want to achieve by it," he says.

He says this is particularly important when making decisions about overseas acquisitions, which have often gone wrong for Chinese companies.

"We actually have many opportunities for acquisition. You cannot acquire just because you want to acquire, however. Any successful acquisition requires that the merged entities are greater than the sum of their parts," he says.

The biggest destination for China's ODI remains Asia, making up 60.9 percent of the total in 2011, according to the Ministry of Commerce, compared with 54.8 percent in 2004.

Africa, however, remains a steady destination for ODI, accounting for 4.3 percent in 2011.

Lu at Jiangsu Qiyuan Group believes Africa will become an increasingly important ODI destination for Chinese private company, particularly in manufacturing, because labor costs are beginning to climb in Southeast Asia.

Apart from his investment in the Eastern Industrial Zone, he set up a cement factory in Addis Ababa in 2009 and is planning to open a steel company next month.

"Labor rates in Southeast Asia will soon be similar to those in China. We have to pay Africa workers around a tenth we would have to pay a Chinese worker," he says.

"The fact is that if we buy just one plane ticket for a Chinese worker to Africa and back, it would pay for about five local workers for the year."

Lu says the company has attempted to localize as much as possible to meet workers' needs.

Rui at CEIBS says the main impetus behind Chinese private company ODI over the next decade will not be about low cost manufacturing but about acquiring brands and research and development capability.

China's ODI to Europe has already significantly increased five-fold as a proportion from 2.9 percent in 2004 to 11.1 percent in 2011. That to North America, however, has lagged behind, increasing from 2.3 percent to just 3.3 percent over the same period.

"What we have seen so far in terms of Chinese companies moving to low cost centers in Southeast Asia and to Africa and elsewhere is just what happened in China 30 years ago," he says.

"The new and more important trend, however, will be Chinese firms making acquisitions in the European market to acquire the brands, the research capability and management expertise. They want the soft business skills from these markets that they now lack. This, I believe, is very important to the Chinese economy."

Contact the writers through andrewmoody@chinadaily.com.cn

( China Daily European Weekly 08/30/2013 page1)

Today's Top News

France not to act alone on Syria: minister

SASAC head latest target in graft probe

Experts: US unwise to wage war on Assad

Eurasian nations focus on Net

Merkel in TV debate with rival

Manufacturing sees quick expansion

Sowing the seeds of sustained growth

British broadcaster David Frost dies

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|