|

|

|

spotniche markets DESPITE DOWNTURN, SOME INNOVATIVE COMPANIES ARE SETTING THEMSELVES UP FOR A BRIGHT FUTURE IN CHINA

While the lingering economic downturn is hampering global industry, a group of small and medium-sized manufacturing companies in Germany has managed to weather the storm. In this environment, a company needs a very good reason to make only one set of products. But, as the world's leading machine tool makers, these German producers are quietly writing their own success stories. As small enterprises, they tend to have a stable business model, are usually family-run, operate in a low-key style, focus on one area of expertise and stay close to their market. Known as "hidden champions", they make an important contribution to Germany's consistent position at or near the top of world industrial production. These companies are now looking to China for new areas of growth, despite temporary market saturation there. Trumpf GmbH Co KG, the world's largest maker of laser cutting machines, saw its sales in China grow 9.5 percent year-on-year. Located northwest of Stuttgart, the company produces machines for laser processing, cutting and welding that are widely applied across the steel, automotive and medical sectors, among others. Trumpf entered China in 2000, starting with a job shop in Taicang in East China's Jiangsu province, where there was optimal infrastructure with many potential customers and suppliers in place, says Nicola Leibinger-Kammller, president of the company. [More] |

energy boom FRENCH INDUSTRIAL GAS PRODUCER PLANS MORE INVESTMENTS IN CHINA TO CASH IN ON GROWTH OPPORTUNITIES Air Liquide Group, the world's largest industrial gas producer by revenue, has launched the second phase of its investment program, called Tengfei II, in China this year. The programs cater to the country's growing demand for oxygen, nitrogen, hydrogen and other gases. The French company started the first phase of its investment program, Tengfei I, in 2007. The program planned investment of 300 million euros and employment of over 500 new employees every year. Currently, the company has 4,000 employees operating 64 plants in 16 provinces.

Remi Charachon, president of Air Liquide (China) Holding Co Ltd, says Tengfei II will run till 2020 and the French company will continue strong investment and maintain good profitability in China, especially in its west and northwest regions. The new investment will be spent on expanding Air Liquide's manufacturing facilities, on-site production, technology research, medical gas supply network and Chinese companies' outsourcing production of non-core products. Industrial gases and related technologies are indispensable to a wide range of industries. They can be applied in healthcare, such as medical oxygen and anesthetic gas, clean energy, high-tech industries such as advanced coal gasification, metallurgy, chemicals, petrochemicals, automotive, food and pharmaceuticals, which are among China's top development priorities. "China's policies to cut greenhouse gas emissions and improve energy efficiency have offered industrial gas makers great opportunities to maintain a fast growth rate in the world's second-largest economy," says Charachon, who became Air Liquide's China head in 2004 and is also chairman of Singapore-based Asia Industrial Gas Association for China. [More] |

| TWO VIEWS |

|

Pessimists ignore China's strengths By Oliver Barron [The author is head of the Beijing branch of UK-based investment bank NSBO.] THE ECONOMY IS STILL ATTRACTING FOREIGN INVESTMENT, AND THOSE FUNDS WILL SUSTAIN ITS LONG-TERM GROWTH

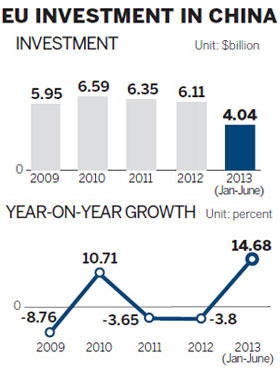

China is slowing. Repeat, China is slowing. Is China's annual growth going to fall below 7.5 percent? Can the economy continue to function at 7 percent? Dare we ask what would happen if the economy slows to 6.5 percent? Won't the wheels come off if it slows any more? If you talk to a portfolio investor, it seems that China has no way out. The argument is that, since China has too much debt that needs to be repaid, a slowdown is not an option as slower growth means less revenue that can go toward paying back debt. On the other hand, if the country keeps growing fast, it will only add more debt that can't be repaid, as each additional yuan invested becomes less productive. It presents a sort of "damned if you do, damned if you don't" scenario. There is a lot of pessimism about China's current situation. Take a step back, however, and you will see that the people making these comments, whether they are media or fund managers, do not have a lot invested in China's future. When you look at those who have invested in its future, a different, more optimistic picture begins to emerge. As China's growth has slowed this year, from 7.9 percent in the fourth quarter of last year to 7.5 percent in the second quarter of this year, foreign direct investment has been increasing, rising from the previous year in each of the past five months and growing by 20.1 percent in June to $14.4 billion (10.86 billion euros), the fastest pace in two years. There are clearly many reasons to be optimistic about the long term. China is no longer just the world's manufacturing base, and rising wages in a country of 1.3 billion people who have shown an affinity for buying luxury goods makes China a market that can't be overlooked. [More] |

Pull of China complements push by Euro SMEs By Sun Yanhong [The author is with the Institute of European Studies at the Chinese Academy of Social Sciences. She specializes in European industrial economics and policies, and the Italian economy.] SMARTER, SMALLER COMPANIES OFFER IMPROVED VALUES SOUGHT IN CHINESE ECONOMIC REFORM In the first half of 2013, foreign direct investment from the European Union grew rapidly, up 15 percent year-on-year - a great improvement considering the continuing international economic downturn. Small and medium-sized enterprises played a vital role in this recovery. SMEs' direct investment from Germany, the Netherlands and France grew significantly, but it also increased from Italy and other southern European countries. And they have all shown increasing interest in operating in China. This comes as a result of the companies' rational assessment of the EU and Chinese markets under pressure of a continuing crisis, and the policies adopted by the two sides.

Expectation of development prospects in both markets was a direct reason for European SMEs adding more investments in China. Since late 2008, European countries have been hit by financial crisis, economic crisis and sovereign debt crisis, and they are not out of the recession yet. Although the debt crisis has gradually subsided, the economic governance and reforms aimed at solving the fundamental problems are still far from complete. Therefore, a downturn in investment and consumption in Europe will linger in the short term. Given that SMEs are generally vulnerable to such a crisis, they have stronger motivation to seek breathing space and expansion outside their own market. From the Chinese perspective, although economic growth this year is slowing mildly, China is still able to maintain a growth rate of about 7 percent, and profit margins for investment are still quite large. [More] |

|

Related readings: |

|