|

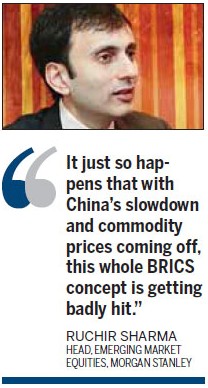

Can China break out of the middle-income trap? Many countries find the move from low to middle-income status straightforward but find the next step up a climb too far. In his book, Breakout Nations: In Pursuit of the Next Economic Miracles, which has just been published in Chinese as well as paperback, Ruchir Sharma, head of emerging market equities at Morgan Stanley and leading economic commentator, makes the case that China alone among the BRICS nations will make it to the next stage. He believes it will be able to move on from its 2012 per capita income level of $6,091, according to the World Bank, to around $20,000 within 15 years, making it comfortably high income. He makes the point, however, that it will be easier for China to move up the ladder if it sets its growth targets lower at a more sustainable 5 to 6 percent. Chasing higher rates of growth through excessive investment in infrastructure, he argues, carries the risk of a bust that could see it yo-yoing along in the middle-income trap like many other countries before it. He paints a gloomier picture for China's fellow BRICS members. He sees Brazil, despite the opportunity to showcase itself by staging next year's FIFA World Cup and the 2016 Olympics, as indebted without a manufacturing base and likely to remain in the middle-income mire it has been stuck in for 40 years. Its per capita income was actually down nearly 10 percent on its 2011 level of $12,576 at $11,340 last year. Russia, he argues, is entirely vulnerable to commodity prices, which are now in decline after soaring over the last decade. India, he points out, has, unlike China, been slow to urbanize and struggles because the IT revolution has only benefited an elite section of the population. Its per capita income of $1,489, according to the World Bank in 2012, means that it currently just makes it as a low middle-income country. South Africa, which became a BRICS member only in 2010, has a per capita income higher than China's at $7,508, but according to Sharma, is on a downward trajectory and may soon be eclipsed by African rival Nigeria as the dominant economy in Africa. The big question about whether China itself will eventually break through continues to divide economic commentators. George Magnus, senior independent economic adviser to UBS, believes that China has the necessary firepower to make it into the top league. "I think the necessary conditions are being able to build a world-beating, very competitive manufacturing capacity and, second, to be geographically close to or part of global supply chains. For the moment China ticks both boxes and a lot of other emerging markets don't. I don't think that there is much risk that China won't press on up the middle-income league over the next decade," he says.

"There are a lot of things that China has achieved spectacularly that you can only do once. You can't join the World Trade Organization twice, you can't keep piggy backing on a buoyant global economy as China has done and you can't continually transfer labor from low productivity agriculture to high productivity agriculture," he says. "There are only three things that sustain reasonably high rates of growth, which are labor, capital and what we economists nerdily call total factor productivity, which is about technical progress. "What China has to do is to improve the quality of its labor, which is essentially about education and making people equipped to make a more effective contribution to offset the physical drag that goes with an ageing and declining working population." There remain many different definitions of country income status. According to the World Bank, a country moves from low income to low middle income when it achieves a per capita income of $1,035. It moves into upper middle income at $4,086 and high income at $12,616. By this definition Russia has already achieved this at $14,037, according to the World Bank in 2012, but this is a low figure compared with what is generally accepted as being in the high-income league. To some extent, South Korea shows the way for China on $22,590 as well as the mainland's neighboring economies: Taiwan on $20,200 and the Hong Kong Special Administrative Region on $36,796. The real aspiration, however, has to be to achieve the income levels of the firmly wealthy countries such as the United States ($49,965), Germany ($41,514), Japan ($46,720) and Singapore, with one of the world's highest per capita incomes at $51,709. Tim Condon, managing director and head of research for Asia with ING Financial Markets in Singapore, says it is still not clear whether such a vast country as China can ever make it to these heights. "If you are talking about making it the same sort of level as the United States, European countries such as the UK and Germany, that is much more of a difficult leap," he says. "If it was just a matter of reading (former Singapore prime minister) Lee Kuan Yew's book (From Third World to First: The Singapore Story) and using it as a manual every country in the world would be as rich as Singapore. It is a very complex process of putting all the institutions together to support the economy and some countries make it and others don't." Condon says the one thing going for China is that it has been there before, albeit nearly two centuries ago.[Full story] |

|

-----------------------------------------------------------Experts' panel------------------------------------------------------ |

|

|

|

|

|

|

|

|

|

|

|

BRICS a force despite ifs and buts BRICS key to global financial overhaul |

|

|

China is the only one of the emerging BRICS nations that is likely to break out of the middle-income trap, Ruchir Sharma believes. The head of emerging markets and global macro at Morgan Stanley, however, says it will still be a difficult journey for the world's second-largest economy.

"I think it is a fair assumption that it will get to the next level and if its economy grows at 5 to 6 percent over the next 15 years, its per capita income is likely to more than double to around $20,000, making it firmly high income," he says. Sharma was speaking in the lobby of the Ritz Carlton Hotel in Beijing, where he was promoting his highly acclaimed book, Breakout Nations: In Pursuit of the Next Economic Miracles, which has just been published in Chinese as well as in paperback. He insists the biggest challenge now facing China is adjusting to a slower pace of growth, which he sees as something of a "psychological hurdle". He believes the new norm for GDP growth should be 5 or 6 percent and that chasing higher rates by artificial stimulus could be destabilizing and halt the country's climb up the global income ladder. "It is a step function down that needs to be made and it is an adjustment that everyone will have to make and not just in China. "China is in a similar stage of development as to where Japan was in the 1970s, South Korea in the 1980s and (the economy of) Taiwan in the 1990s. They moved on to the next level but with a slower pace of growth from that point," he says. His book is not necessarily about China doing well but more to do with the other BRICS countries doing badly. The BRICS, he argues, are "so last decade" and were largely lifted by a rising tide of global prosperity and a huge demand (apart from India), largely from China, for their natural resources. [Full story] |

|

-----------------------------------------------------Two views-------------------------------------------------- |

|

Are the BRICS countries losing luster? By Zhu Ning [The author is faculty fellow at the International Center for Finance, Yale University, and deputy director of the Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University.] DESPITE SERIOUS CHALLENGES, THE FOUNDATIONS FOR GROWTH IN EMERGING ECONOMIES REMAIN STRONG

On the one hand, emerging markets, which are best represented by the BRICS countries (Brazil, Russia, India, China and South Africa), have been the driving force of global economic growth in the past decade, even after the 2007-08 global financial crisis.

|

Raw materials vs industrial strength By Miranda Carr [The author is head of research, NSBO China.] IF IT CAN REBALANCE ITS ECONOMY AND CONTROL DEBT, CHINA SHOULD BE ABLE TO CONTINUE ITS STRONG GROWTH

The main difference is between the countries that have produced the resources (mainly Russia, Brazil and South Africa) and those that have used them (China and, to some extent, India). With the slowdown in growth in China and other parts of the world, it is the former countries that will face the stiffest challenge in maintaining growth due to the lack of domestic activity, whereas those that have built up domestic industry face a brighter future. The lesson from the history of last century's development provides two prominent examples of success: Japan and South Korea. These two countries followed similar models to China today - attracting significant inward investment, promoting technological upgrades, heavy protectionism of domestic manufacturing and service companies, and a relatively closed currency and capital account. As a result, they ended up with manufacturing enterprises that were competitive on an international scale, relatively advanced technologies, a skilled workforce and, as a result, economies that were in a better position to both create and benefit from global growth. (A key reason behind Japan's recent decline is a 4.5 percent decrease in its working population over the past 15 years, whereas South Korea has seen 25 percent growth in employees in the same period). [Full story] |

|

BRICS a force despite ifs and buts BRICS key to global financial overhaul |

|