Future power

Updated: 2012-11-02 10:24

By Li Xiang (China Daily)

|

|||||||||||

Demand for clean energy gives Chinese nuclear companies ample opportunities in overseas markets

Unsatisfied with being just a market and testing ground of new reactor technologies for developed countries, China is now looking to be an energetic developer of nuclear power plants around the world with ambitions that are poised to reshape the global nuclear industry.

Such trends became more visible after the Fukushima disaster in March 2011, as many Western nations like Germany, Italy and Switzerland decided to shelve nuclear energy plans due to safety concerns. The lingering financial crisis has also prompted many Western nations avoid overseas nuclear projects, thereby opening the doors for China in the global nuclear energy market.

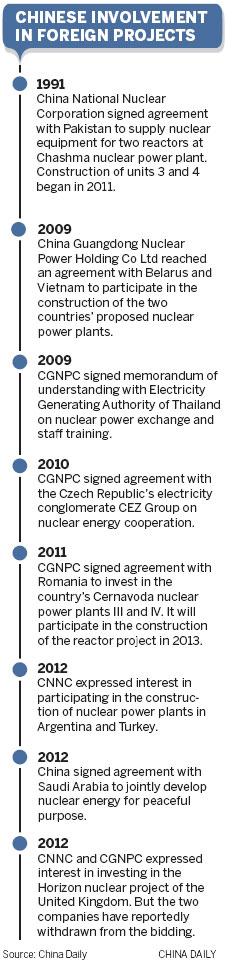

The latest example of China's growing interest in foreign nuclear projects was seen in the bid made by China Guangdong Nuclear Power Holding Co Ltd and State Nuclear Power Technology Corporation, a subsidiary of China National Nuclear Corporation for the Horizon nuclear reactor-building program in the United Kingdom.

Although the two companies have reportedly withdrawn from the bid for reasons that remain unclear, industry experts say the attempt was worth it, as it was the first time that Chinese enterprises have expressed interest in the nuclear project of a developed country. At the same time, it was also an ideal opportunity for Chinese enterprises to gain the valuable international partnership experiences that they previously did not have.

"If you can be at the top table in the UK, that's a great selling point around the world," a person close to the UK project was quoted by the Financial Times as saying.

|

The Torness power station near Edinburgh, Scotland. Reactors at the nuclear power station have been shut down after huge numbers of jellyfish were reportedly found in the sea water entering the plant. David Moir / Reuters |

Building footprints

The home market has long been the focus of Chinese nuclear enterprises as China currently has the world's largest number of reactors under construction. A relative newcomer in the nuclear industry, China has so far built overseas reactors only in Pakistan.

But the situation started to change in 2005 when the National Development and Reform Commission, the country's top economic planner, mooted the idea of internationalizing China's nuclear industry.

Since then Chinese nuclear enterprises have begun to expand their global footprints with ambitions that are likely to change the pattern of the global nuclear energy development.

Take the CGNPC for example. The State-run nuclear enterprise established its international development department in 2006 and started to look for business opportunities in Southeast Asia, Eastern Europe and Africa.

While some countries have decided to slow the development of nuclear energy after the Fukushima crisis, many others, particularly the emerging economies, are still committed to building nuclear power plants to feed their energy demand and drive economic growth.

Nuclear energy got a big boost last month when China decided to resume work on the domestic nuclear projects that were kept in abeyance after the Fukushima disaster.

So far, CGNPC has signed agreements with countries like Belarus, Vietnam, Thailand and Ukraine for cooperation on development of nuclear power projects and exploration of uranium mines.

The company also reportedly expressed interest in teaming up with Romania's State-owned company Nuclearelectrica to invest in units 3 and 4 of the country's Cernavoda nuclear power plant.

|

CNNC, the domestic rival of CGNPC, has reached an agreement with Argentina on the transfer of nuclear reactor technology, for use in two future power plants in the South American country.

Other possible markets for China's nuclear enterprises include Turkey, South Africa and Saudi Arabia, which are all looking to China as potential investors for their proposed nuclear power plants.

"Although China has a booming nuclear industry at home, nuclear power still accounts for less than 2 percent in its overall energy mix. In that sense, the domestic nuclear market is still quite limited and hence it becomes a natural choice for the large State-owned nuclear enterprises to look for opportunities abroad," says Julie Jiang, China program officer at the International Energy Agency.

Analysts say that the potential risk of overcapacity of China's nuclear equipment manufacturing due to massive expansion over the past several years may also prompt enterprises to seek projects overseas.

Charles-Emmanuel Chosson, an energy expert at accounting firm Ernst & Young in France, says that the fast growing nuclear market at home with more than 25 nuclear reactors being built will enable China to develop and reinforce its own nuclear technology and export it abroad.

"China can provide all the necessary equipment needed to construct nuclear power plants and has the ability to build the entire plant, apart from the nuclear island," he says.

The recent success of South Korean energy company Kepco, which won a reactor contract in the United Arab Emirates' nuclear project, shows that it is possible for newer players to enter the bidding competition and be successful with proven technologies, Chosson says.

"While the Chinese solution is still based on the design of second-generation reactors, it may be more competitive than solutions from other developing countries," he says.

China is also providing technical support for the first time in the building of a third-generation nuclear power plant in the United States.

State Nuclear Power Technology Corp Ltd said on Oct 26 that it had signed a technical support service contract with Shaw Power Group related to the building of the Vogtle AP1000 project in Georgia, the first new reactor approved by the US government in nearly 30 years.

The cooperation involves sending Chinese employees to the project over the next four years, with the first batch of six people expected to include planners and electrical engineers, all experienced in building AP1000 projects, commonly known as third-generation reactors.

As the first engineers to participate in the building of a US nuclear power plant, they will not only share their knowledge learned in China, but also gain great experience working on a project outside the country, says Wang Binghua, chairman of State Nuclear Power.

Shaw Group, together with Westinghouse Co, will be responsible for the design, supply and technical support in building reactors No 3 and No 4 at Vogtle, which were approved in February.

The reactors were also the first in the world to get the green light after the Fukushima nuclear crisis in Japan last year. The units will cost about $14 billion and could be operational by 2016, according to a Reuters report.

|

||||

Eli Smith, Shaw Power Group's president and Chief Operating Officer, says his company has been working with State Nuclear Power for a number of years, "so selecting them was easy for us, because of their good reputation".

Besides Vogtle, the two sides area also planning joint bids for other major global nuclear projects, Smith says.

Cost advantage

As an extremely capital-intensive industry, the building of nuclear power plants requires huge initial investments including the overnight construction costs of materials and labor as well as capital funding.

Overnight cost is the term used to describe the cost of a construction project, especially in the power sector, if no interest was incurred during construction, as if the project was completed "overnight."

China's strong capital position has made it an increasingly attractive investor when many developed countries are faced with budget constraints amid current economic woes and an unprecedented need for capital to upgrade aging nuclear energy facilities.

In addition, China's ability to build nuclear power plants more cheaply than its Western counterparts also allows it to beat international competition easily, analysts say.

According to an IEA/NEA study on the cost of generating electricity in 2010, the overnight costs for Chinese plants using AP1000 reactor stood at $2,300 (1,778 euros) for every kilowatt of capacity while overnight costs for an EPR (European Pressurized Reactor) in Belgium could reach $5,400 per kW.

Western nuclear companies including the France-based Areva and US-based Westinghouse are already looking to export new nuclear reactors in collaboration with Chinese partners.

"The cost of building nuclear plants have been rising in order to meet the required higher safety standards since the Fukushima crisis," says Pierre Gadonneix, chairman of the World Energy Council and former chief executive officer of French energy firm EDF.

"China's involvement in building nuclear plants can make the costs as low as possible," he says.

The British government previously looked to deep-pocket Chinese investors to help revive its aging nuclear power sector. But the withdrawal of Chinese enterprises in the Horizon project may cause the country to suffer a major blow in its nuclear development plan, analysts say.

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|