Jack magic

Updated: 2016-02-05 08:05

By Andrew Moody(China Daily Europe)

|

|||||||||||

Alibaba set to use huge war chest to again splash out on acquisitions this year amid some concerns over diversification

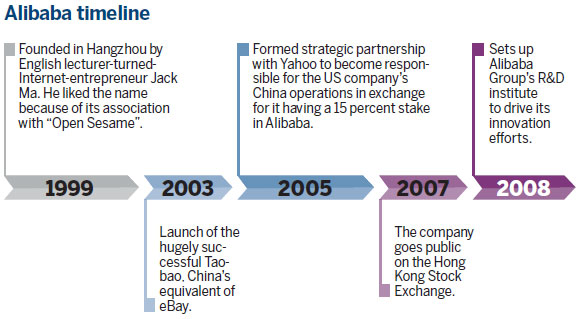

There are few greater success stories in China than Jack Ma, founder of e-commerce giant Alibaba.

The 51-year-old former English lecturer rose to be China's richest man in only a decade.

|

|

|

|

And although he was relegated to second behind property magnate Wang Jianlin, president of Dalian Wanda Group, on the Forbes 2015 rich list published in October, his personal wealth still amounted to a hefty $21.4 billion (19.7 billion euros).

Virtually everyone in China at some time has used the company's Taobao retail platform - China's equivalent of eBay and described by The Economist magazine as "the world's greatest bazaar".

On Singles Day, Nov 11, the company attracted some 115 million buyers to its platforms, which also include Tmall, generating sales of $14.3 billion.

The scale of the company was perhaps best reflected when it pulled off the largest IPO in US stock market history when it listed on the New York Stock Exchange in September 2014, raising $21.8 billion.

Jeffrey Towson, professor of investment at Peking University's Guanghua School of Management, says Ma is foremost in a generation of Chinese entrepreneurs, including Robin Li at China's Internet search engine Baidu and Martin Lau, president of Tencent, the company behind WeChat, China's hugely successfully instant messaging service, that have real ambitions to take on the world.

"The leaders of China's Internet companies are highly aggressive and highly competitive. They are seasoned entrepreneurs and risk takers in their prime," he says.

Alibaba, however, perhaps now faces more challenging times with the slowing Chinese economy affecting its performance.

While its fourth quarter financial results announced on Jan 28 revealed that the value of products sold on its platform had risen a respectful 23 percent year-on-year to 964 billion yuan ($147 billion; 135 billion euros), they were also down on the 28 percent rise in the previous quarter. This led to the company's shares dropping 3.7 percent as the New York market opened.

Maggie Wu, chief financial officer of Alibaba group, remained bullish, however, saying the company's performance remained "excellent".

"We achieved impressive revenue growth as we are increasingly monetizing the user activity on our marketplaces, particularly on mobile devices," she said.

Gil Luria, an analyst at Wedbush Securities, put the slowdown in Alibaba's sales to the wider factor of the Chinese economy easing.

"The reality is, from these numbers we see Chinese consumer spending is slowing as well," he told Bloomberg.

Alibaba also faces the imminent prospect of the e-commerce market in China reaching greater maturity with less scope for the almost exponential growth of recent years.

It is set to grow at only 16 percent per annum in 2018, according to Iresearch, the Beijing-based consultancy, compared to 70 percent in 2011.

This is likely to prove something of a wakeup call not just for Alibaba but the whole e-commerce sector in China.

Ma, who remains an iconic figure in the world's second-largest economy and a role model for many would-be entrepreneurs, has embarked on a courageous diversification strategy to offset slowing sales growth.

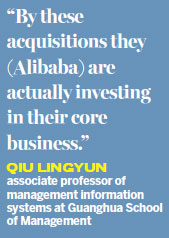

Since its IPO, it has been on something of a spending spree. It has acquired many businesses away from its Internet core, moving into finance, entertainment, big data, logistics and healthcare.

It even bought a 50 percent stake in the Chinese football club Guangzhou Evergrande in 2014.

The latest move to grab the headlines was in December when it bought the South China Morning Post, the Hong Kong newspaper, for $266 million.

The move echoed Amazon founder Jeff Bezos' 2012 acquisition of the Washington Post, although he made the investment privately and not through his company.

Many media commentators certainly have also highlighted the fact that the company's shares, after hitting a high of $120 shortly after the float, are now trading just below the IPO initial price of $68.

What has been concerning some investors is whether its diversification strategy is logical.

Some argue the group would be better served paying more attention to and investing in its flagship retail platforms.

Comparisons are made between Alibaba and its great Chinese Internet rival Tencent - founded by Ma Huateng and Zhang Zhiding in 1998 and now also spearheaded by Lau.

It has consistently focused on its core activities and, in particular, WeChat, which was launched in 2011 as China's answer to WhatsApp and now has 650 million active users.

Baidu has also hired Andrew Ng, who was once head of Google Brain, as its chief scientist to lead its research and development operations into the development of artificial intelligence in Beijing and San Francisco.

"I just don't think it is a great option for Alibaba. If you look at its Taobao core business, it is not growing as fast as before. How much can Alibaba gain from innovation? It is best going into other areas from which it can generate faster returns," says Lin Chen, assistant professor of marketing at China Europe Business School, or CEIBS, in Shanghai.

"Baidu is really investing a lot of time in artificial intelligence which is great. It is what US companies are doing right now but it is not a mature technology and, as such, it cannot be monetized right now."

Alibaba is unlikely to let up on its diversification strategy. According to analysts BNP Paribas, the company could even step on the accelerator.

It predicts the company has a potential war chest for acquisitions of some $38 billion in 2016, two-a-half times the $15 billion it spent in 2015.

Towson, also co-author of the best-selling The One Hour China Book, says Alibaba's love of dealmaking is partly driven by a need to gain greater scale.

"If your competitor becomes twice your size, you are likely at risk and just growing organically will not be enough. So Alibaba's activity is driven by a race to achieve size. This can often lead to competitive panic."

Qiu Lingyun, associate professor of management information systems at Guanghua School of Management, believes many misunderstand the logic of Alibaba's recent strategy.

"By these acquisitions they are actually investing in their core business. Their core competency is actually running a huge platform, which has now accumulated a huge amount of consumer data," he says.

"They need to find all kinds of ways to monetize this consumer intelligence. Many of its acquisitions are consumer orientated like online video, online gaming or what have you. So long as they are doing this, you can still say they are investing in their core business."

Wang Qing, professor of marketing and innovation at Warwick Business School in the UK, insists Alibaba is just taking advantage derived from freer regulation in China than in the US and Europe.

"They see what Alibaba is doing as risk and not an opportunity. What they often fail to appreciate is that antitrust regulation is not as well established in China as it is in the United States and Europe," she says.

"Amazon, for instance, would not be able to operate the way Alibaba has done because it would come across legislative barriers when making acquisitions."

Wang believes that is why it is wrong to compare China's so-called BAT (Baidu, the Chinese search engine giant, Alibaba and Tencent) companies with the Silicon Valley pioneering giants that emerged in the 1990s.

"The likes of Facebook and Google might have been groundbreaking in themselves but they emerged in a Western business environment that was quite well established. The Chinese firms have developed rapidly in an environment which in itself was very fluid and dynamic."

Max von Zedtwitz, the San Francisco-based managing director of Glorad, a partly Shanghai-based research center and think tank which specializes in innovation, says there are always risks for a company like Alibaba, which was something of a first innovator in China.

He says you have only got to look at Yahoo, which paradoxically still owns a 15 percent stake in Alibaba despite recent attempts to spin it off. The company was the leading search engine when the Internet took off in the 1990s but was largely swept aside by Google after it came on the scene in 1998.

"Perhaps the same thing might happen to some of these first wave Chinese companies like Alibaba. It might not have a big future at all. How many companies are able to maintain their leadership position over many decades? Certainly, very few Western companies have been able to do this," he says.

"We weren't talking about Alibaba 10 years ago and we might not be talking about Alibaba in a decade's time either. It may just be a temporary phenomenon."

But Towson thinks any doomsday scenario for Alibaba is unlikely.

"I think it has such a powerful competitive advantage with its e-commerce business. The economics of c2c (consumer-to-consumer) and b2c (business-to-consumer commerce) tend to naturally lead to one or two dominant players, like eBay and Amazon in the US. Yahoo never had such competitive protections in its business."

Qui at Guanghua says many people who pass judgment on Alibaba misunderstand the challenges it faces in what is a very unique China market. "The China market is way bigger than that of the US and it is also very diversified. You have people from rural areas who are very price sensitive and you also have those from the post-1990s generation who are looking for customized products," he says.

"It would be a difficult challenge for any company to serve so many needs."

andrewmoody@chinadaily.com.cn

|

|

Related Stories

Alibaba Health saw share prices plunge 20% 2016-01-28 16:15

Bears focus on Alibaba as investors fret over China's economy 2016-01-26 07:46

Alibaba payment company forms alliance with Russia's VTB bank 2016-01-22 19:16

Alibaba goes offline with brick-and-mortar store in Tianjin 2016-01-12 10:24

Alibaba's Ant Financial joins red envelope frenzy 2016-01-08 08:21

Alibaba's Ant Financial joins red envelope frenzy 2016-01-08 08:21

Today's Top News

Seven dead, hundreds injured after quake flattens buildings in Taiwan

Jack magic

Famous rebel with the golden gaze

Changan Automotive consolidates UK operations

Chinese students in UK enjoy fruits of the 'golden era'

Chopsticks shop draws all kinds

Foreign companies bet on China's consumers

Cruz bests Trump in Iowa, Clinton and Sanders tie

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|