Expanding footprint

Updated: 2016-03-04 07:58

By Chris Peterson(China Daily Europe)

|

|||||||||

There are pitfalls, though. According to Kyriakopoulou, the biggest ones can come after a deal has been struck.

"These are chiefly to do with the understanding of different regulatory systems, and the clash of corporate cultures," she says.

In 2005, Qianjiang Ltd, a state-owned Chinese motorcycle manufacturer, acquired Italian scooter maker Benelli for 59.7 million euros, including 52.7 million euros of company debt. Although Benelli's chief technical officer was appointed as deputy managing director, he left after four years because of repeated clashes with a Chinese executive brought in to head the operation.

"Cultural differences emerged in terms of staff behavior and different management styles," concluded analysis of the takeover by China Business Review. It added, "Communication has been a key issue."

Ultimately, the issues were overcome, and Benelli QJ now makes and markets a successful range of scooters and motorcycles.

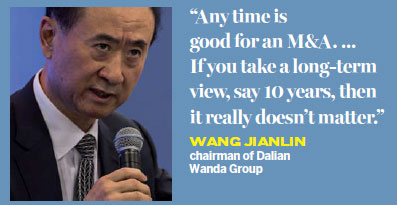

Wang at Wanda addressed the challenge of linguistic problems in M&As in Oxford. "English is our greatest challenge. We have a lot of senior employees in Wanda, but when going global in tourism, sports and entertainment, inadequacy in English is a huge challenge," he said.

"Although these people are good, they cannot be put to good use because of their lack of English language skills. When we recruit locally, we give preference to English-speakers and women. We receive a lot of expats in China, but they can speak good Chinese, so the language barrier is mitigated."

In terms of regulatory challenges, many law firms in London's financial district make a point of employing native Mandarin-speaking lawyers.

From a management point of view, many Chinese companies now accept that once a takeover or acquisition has taken place, it makes sense to keep most of the local management in place and to motivate them, rather than bring in Chinese nationals to replace them.

Wanda, for example, has a system of promising existing management 10 percent of the entity's profits as a way of encouraging growth and harmony.

Last but not least on the list of considerations is the effect of the fluctuating yuan on Chinese M&As.

Kyriakopoulou says the drop in the Chinese currency this year has surprisingly had little or no influence on M&A activity so far.

"If anything, we expect a potential continued devaluation of the yuan to actually intensify the incentives among Chinese companies to proceed with M&A deals, as they seek to acquire assets whose values are stable," she says.

"Fluctuations on China's stock market, on the other hand, could be potentially more damaging to the prospects of such deals by making it harder for Chinese companies to secure funding," she says, adding that many rely on bank loans, state finance or the so-called shadow banking sector. "The role of equity financing is pretty insignificant in China compared with its importance in American or European firms."

chris@mail.chinadailyuk.com

Today's Top News

Lavrov, Kerry hail progress in Syrian ceasefire

PM Fico's Smer party leads Slovak election: exit poll

Britain to take lead in promoting EU-China trade talks

Chinese brands make a mark in Europe

Expanding footprint

Spanish Princess testifies in tax fraud trial

Women driving growth of O2O in China

Trump, Clinton scoop up key wins on 'Super Tuesday'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|