Expanding footprint

Updated: 2016-03-04 07:58

By Chris Peterson(China Daily Europe)

|

|||||||||

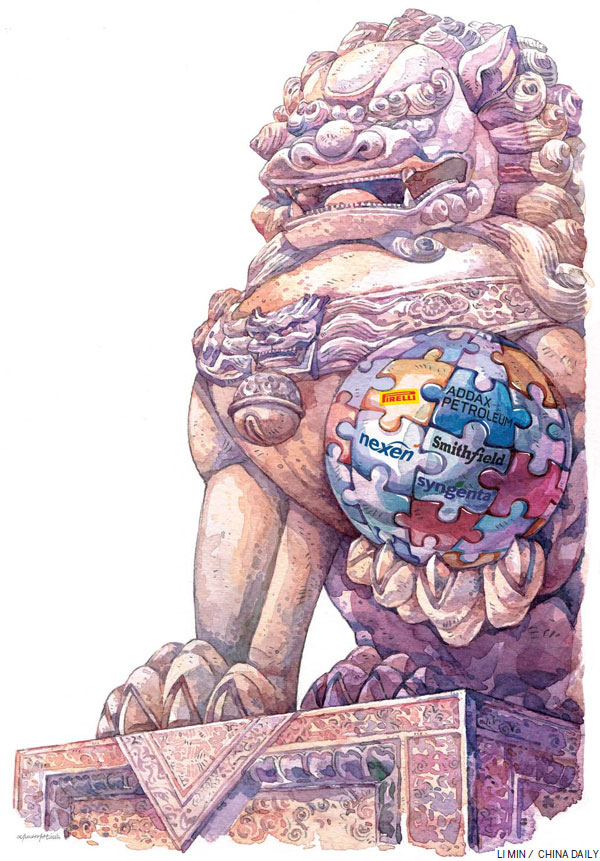

Record year set for Chinese overseas mergers and acquisitions

Chinese companies - large and small, private and state-owned - are embarking on a spree of overseas mergers and acquisitions, spurred by government policy that promotes foreign expansion.

The signs indicate that the M&A activity this year will break all records, even at a time of economic uncertainty.

But what are the targets? Where are they? And, more importantly, how are Chinese firms going to overcome the inevitable challenges?

Ministry of Commerce data suggest smaller rather than larger entities are behind the latest sudden surge. In January, China's nonfinancial outbound investment was $12.02 billion (11.04 billion euros), increasing 18.2 percent from a year earlier, almost three times the rate in December.

Of the country's total overseas direct investment in January, 92.5 percent came from smaller enterprises, up 175.2 percent on the same period last year.

More statistics from Morning Whistle Group show that private companies completed 76.78 percent of China's M&A deals in 2015, while state-owned enterprises accounted for 20.29 percent.

The target areas were technology, media and telecommunications, agriculture and food, and energy and mineral resources, the Whistle Group says. And that's expected to remain the same this year.

Commerce Ministry spokesman Shen Danyang puts the trend down to favorable Beijing government policies aimed at boosting cooperation between Chinese players and international companies.

Chinese investment in foreign manufacturing rose 87.8 percent year-on-year to $1.62 billion (1.48 billion euros) in January, with much of the money flowing into the telecom, electronic equipment, pharmaceuticals and automobile sectors, Shen says.

Meanwhile, Chinese investment in the United States soared to $1.56 billion in January, nearly four times the amount in the same month last year, according to the ministry.

So what are the factors driving this?

Plummeting commodity prices are making some foreign companies cheap to buy. Plus, many Chinese state-owned enterprises have the means to buy, while for private companies, big or small, historically low interest rates mean borrowing is easier.

There's another reason, too. The Belt and Road Initiative, seen by many as a key pillar in China's foreign trade drive, means government cash may well be available to SOEs to help fund acquisitions and make investments.

Today's Top News

Lavrov, Kerry hail progress in Syrian ceasefire

PM Fico's Smer party leads Slovak election: exit poll

Britain to take lead in promoting EU-China trade talks

Chinese brands make a mark in Europe

Expanding footprint

Spanish Princess testifies in tax fraud trial

Women driving growth of O2O in China

Trump, Clinton scoop up key wins on 'Super Tuesday'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|