Outbound ventures

Updated: 2014-02-21 08:29

By Andrew Moody (China Daily Europe)

|

|||||||||||

Andre Loesekrug-Pietri, founder and managing director of A Capital, which has offices in Beijing and Brussels, says this represents a big shift.

"Resources are no longer the big story as far as China's ODI is concerned. Far more interesting is what is happening to industry and services. This is now where China's ODI is targeted," he says.

Loesekrug-Pietri's firm has come up with its own reference indicator, the A Capital Dragon Index, to chart the growth of China's ODI.

Starting at 1,000 in 2001, it had grown to 2,483 by the end of the third quarter of 2013, a near 2.5 times increase.

"What essentially this means is that the Chinese economy is 2.5 times more globalized than it was in just over a decade ago," he says.

"Nominal ODI has actually increased 10 times over the same period, but it doesn't mean there is 10 times more activity since China's GDP has quadrupled. This is a very significant increase, however, and shows how international China is becoming."

Johnson Chng, Greater China managing partner for international management consultants AT Kearney, believes Chinese ODI is very much on an upward curve.

"We have seen more outbound investment from Chinese companies over the past 18 to 24 months and I think definitely it will continue to pick up pace.

"We also have seen this change in pattern from the largely state-owned enterprises' resources-type investment to more commercial investment not just by private enterprises but by state-owned ones too."

Chng says the Chinese companies also have a clear geographical focus of what sort of targets they will find in which geographical locations.

"They look at Germany for high-precision engineering, France and Italy for high-fashion luxury goods targets and to the US for high-tech companies. They are very clear in their minds where to look for what and for what purpose," he says.

Paul M Cheng, chairman of Hong Kong-based private equity concern China High Growth and a former member of the Hong Kong Legislative Council, says Chinese companies are taking advantage of the fact that valuations in Europe and the United States are now cheap as a result of the financial crisis.

"I expect to see a lot more investments over the next five to 10 years. It is an opportunity for Chinese companies to acquire technology instead of relying on their own home cooking research and development.

"They can also acquire consumer brands. Very few Chinese companies have global brands and even their names are a no-go as far as Western consumers are concerned."

What is the significance of ODI becoming bigger than FDI? Most economists agree on it not being of any great macroeconomic importance.

However, if there was a major imbalance between the two, there could be issues for capital inflows and outflows that could be destabilizing.

ODI does also provide an alternative for China to pare down its foreign currency reserves, which hit a record $3.82 trillion in January, without the usual recourse to buying US Treasury bonds, which typically do not generate very high returns.

Klaus Meyer, professor of strategy and international business at the China Europe International Business School, says the equalization target itself has little real relevance.

"I think it is largely of symbolic value reflecting that China is now an outward player and not an inward player. The government likes to set symbolic targets to motivate people. It catalyzes effort and gets people moving."

He says there could be scenarios when increased ODI would be adverse for the China economy.

"The worst-case scenario is that some companies take their money out of the country as in capital flight, which would not be good for China. There is a not insignificant part of Chinese overseas investment that goes to such places as the Bahamas and British Virgin Islands, although some of that comes back."

Pelham Smithers, managing director and founder of Pelham Smithers Associates, a London-based research firm, which focuses on technology issues, says it is important to be careful when comparing China's current ODI efforts with the heady days of Japanese investment in the 1980s.

"It does strike me that compared with Japan in the 1980s, China is still surprisingly reticent. I think partly the reason for this was that Japan developed a bad relationship with Washington 25 years ago and there is sense that this could happen very quickly with China if they were to step up activity."

He says those who think that Lenovo buying IBM's low-end server business for $2.3 billion in January is a trend forget that its purchase of the US company's PC business took place almost nine years ago.

"To say this is a trend in Lenovo's case is questionable given that they were such an early mover on this. The clue to the significance of this deal is in the term low-end. The US will remain very protective of the high-end technology that China purportedly requires."

There is also a changing pattern in Chinese ODI into Africa.

|

The cumulative stock of Chinese investment in Africa had risen from just $500 million in 2003 to $22.9 billion in 2012, according to The China Analyst produced by Beijing Axis, the international advisory and procurement firm.

Data from A Capital points to Chinese ODI to Africa growing by 144 percent from $3.2 billion in 2012 to $7.8 billion last year.

Michael Power, global investment strategist at Investec Asset Management, based in Cape Town, says there is a definite trend away from Chinese companies buying up mines and more toward buying commodities on the international markets.

"In a buyers' market - as now - you can afford to deal with the vagaries of that international market. Five years ago when China was doing a lot of deals it was a sellers' market and coming into to Africa and owning 45 percent of the equity or whatever of a facility was a very clever way of doing it," he says.

Power says one of the main changes recently is the increased competition China is facing not just from Western companies but those from emerging markets like India, Indonesia and Thailand.

"Because there are more players the Chinese are not getting a clear run at it anymore. Some of the big government-to-government deals have already been done for the time being and when there is a private sector seller there is all this competition," he says.

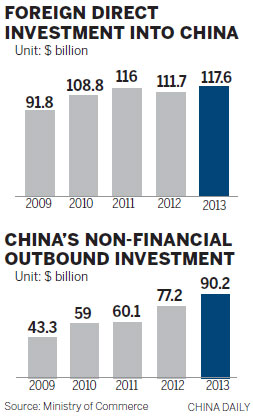

While China's overall ODI might be roaring ahead, FDI into China is changing in character.

From the 1990s onward much of the FDI into China was in low-cost manufacturing.

Today's Top News

Pandas arrive in Belgium

China urges US to correct mistakes on Tibet

9 punished for spreading flu rumor

Beijing upgrades haze alert

Ukrainian parliament dismisses president

China strongly opposes Obama-Dalai meeting

Tax refunds to lure overseas tourists

Prosecutors tackle food crimes

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|