Digging deeper

Updated: 2013-03-08 08:53

By Andrew Moody (China Daily)

|

|||||||||||

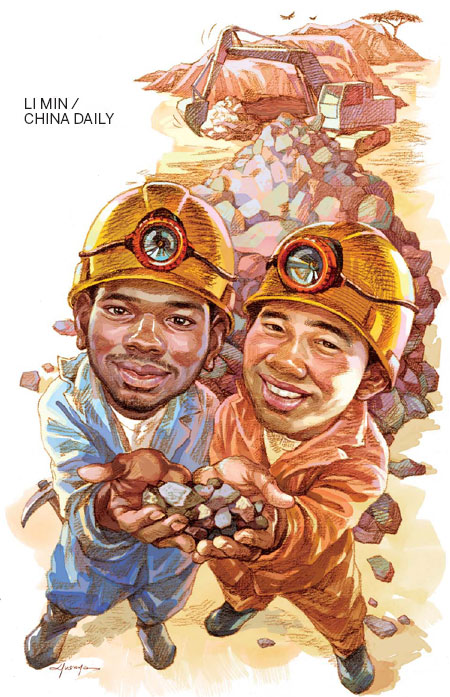

Chinese investment in African mining industry comes in different forms and is crucial for both

The relative slowdown in China's economy was one of a number of factors casting a shadow over the recent Mining Indaba Conference in Cape Town. The mining sector in South Africa has other problems closer to home, including labor unrest and the threat of increasing government regulation.

But the demand for resources from the world's second-largest economy - as for the rest of the continent - remains an important lifeline for the mining industry.

The sector has been hit hard by the global financial crisis, and the Johannesburg Stock Exchange remains highly sensitive to economic data coming from China.

Last year was particularly bad for the iron ore industry, with prices slumping to a three-year low in September to $88 (67.5 euros) a ton on fears about China's recovery.

China, the world's largest consumer of steel, is the destination for half of the world's iron ore exports.

|

||||

China's Hanlong Group is also set to complete a $1.45 billion takeover of Sundance Resources, the Australian company that owns important West African iron ore supplies, including the Mbalam mine straddling Cameroon and the Republic of Congo.

Another major Chinese acquisition could have been African Barrick Gold, Tanzania's largest gold mining concern, had talks between China National Gold Corporation and Canadian Barrick Gold Corporation over a $3.9 billion deal not collapsed in January.

David Humphreys, principal at DaiEcon Advisors, a London-based consultancy specializing in the mining industry and one of the keynote speakers at Indaba, says the mining industry, particularly in Africa, has become obsessed with China.

"As a result any suggestion that China will slow down sends shockwaves through the thinking of the industry," he says.

He says the big fear is that China will follow the same path as Japan whose huge appetite for resources in the 1960s and 1970s leveled off and has been on a plateau since.

"That is where a lot of the debate is now focused, whether China will follow Japan or whether it is a false analogy. The difference could turn on just a small percentage either way."

Michael Power, investment strategist at Investec Asset Management, says putting the blame on China for any fall in commodity prices is perverse.

"The reason why prices have fallen across a range of commodities is that demand in the West has collapsed. You watch CNBC and Bloomberg and they have a hissy fit when China's growth rate is 0.1 or 0.2 points down, but it doesn't tell you what was going on in dollar terms."

Power, a veteran of the African mining scene who was speaking from his huge flat in central Cape Town bedecked with African artifacts, says many observers do not do their sums.

"People don't understand the mathematical mechanics of compound interest. China's growth might have slowed slightly but the base is huge. Last year China added another Australia to its GDP, by 2018 this will be another Germany and by 2021, another Japan and that will be every year. The volume demand for resources will not decline," he says.

The significance of China at this year's Indaba was further reinforced by the first-ever official Chinese delegation led by Wang Min, China's vice-minister of land and resources.

He told the conference the number of Chinese mining investment projects in Africa accounted for 34 percent of its global total and 22 percent by value.

"Mining is a traditional area for Chinese investment in Africa. Chinese mining companies have made progress in their mining investment projects in South Africa, Zambia, Angola, the DRC, Sudan and other countries, promoting local employment and economic development."

He said there was a natural synergy between resource-rich countries in Africa and countries such as China that had huge markets.

"China and Africa need to deepen practical cooperation in the mining sector. We need to strongly implement the agreements on mineral exploitation, investment and mineral commodities trade."

Chinese resources companies such as China Nonferrous Metal Mining (Group), CITIC Group Corporation, China National Petroleum Corporation, China Railway Resources Group and Beijing Haohua Energy Resources Company have been dominant players in Africa over the past decade or more.

Related Stories

A 100-year investment 2013-03-08 08:53

Tanzania wants to power ahead 2013-03-08 08:53

Picking the winners 2013-03-08 08:53

Mining for growth 2013-03-08 08:53

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|