Stormy skies on horizon for shipbuilders

Updated: 2011-12-14 13:53

By Zhou Siyu (China Daily)

|

|||||||||

BEIJING - It's still too early for Chinese shipbuilders to complain of a bad year, but they are likely to have reason to.

|

|

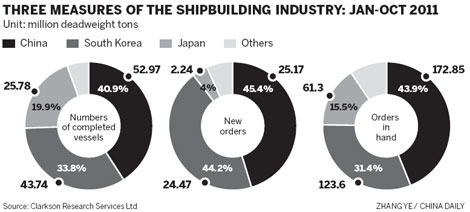

During the first 10 months of the year, Chinese shipyards produced 41 percent of all ships made in the world during that period, according to Clarksons, the largest shipbroker and shipping services group in the world.

And in the three biggest measures of the shipbuilding industry - numbers of completed vessels, new orders and orders in hand - China still leads the world. Even so, the industry's prospect have become dimmer.

A dwindling number of ship orders in recent times heralded the approach of lackluster years. From January to October this year, 29.75 million deadweight tons of new vessels were ordered from Chinese shipyards, a decline of 45.5 percent from the number ordered in the same period a year ago. In October, only 730,000 deadweight tons were ordered, 81 percent fewer than in the same month in 2010, according to data from the China Association of the National Shipbuilding Industry (CANSI).

"The next year will be the most difficult for the Chinese shipping industry," Zhang Shengkun, president of the Shanghai Society of Naval Architects and Marine Engineers, said at a recent industry forum in Shanghai.

The looming difficulties are by no means restricted to China's borders. Clarksons estimates that 66 million deadweight tons of new vessels have been ordered this year, fewer than half that of 2010.

The shipbuilding industry is the last link in an industrial chain that is being affected by the difficult economic conditions. Shipping companies throughout the world reported deficits this year, the consequences largely of surging oil prices and their own overcapacity. The many ship orders that were placed in the years of optimism that preceded the 2008 recession has led to an oversupply of seagoing vessels.

Few new orders for ships are likely to come to an industry that is already flush with ships, a fact that is bound to harm shipbuilders.

To maintain a strong shipping industry, "the overbuilding must be stopped and a new and lower level of vessels being launched into the world fleet must be found soon", said Torben Skaanild, secretary-general and chief executive officer of the Baltic and International Maritime Council, the largest association of shipowners in the world.

"That level will be established by owners placing fewer orders and yards utilizing the excess capacity for other purposes within or outside the shipping industry."

Skaanild said shipyards can improve their prospects by repairing old ships, placing fuel-efficient equipment on them and recycling them. They could also sell wind-energy equipment.

But even if Chinese shipbuilders take advantage of those opportunities, those looking to cope with low demand must overcome other difficulties. They need to improve their methods of vessel production, improve their management and innovate, said Zhang Guangqin, head of the CANSI.

Chinese shipyards have long been famous for their ability to quickly and cheaply churn out large numbers of simple vessels. The trouble is that an oversupply remains of exactly these sorts of ship, even while the demand has increased for more complex craft: mega-containers - large vessels capable of carrying vast amounts of cargo - ships that run on liquefied natural gas and drilling vessels.

Chinese shipbuilders have found it difficult to compete in the market for such vessels, in a large part because they have lagged behind shipbuilders in South Korea and Japan in the adoption of technology. During the first ten months of the year, South Korea received 73 percent of the global orders for mega-containers. Meanwhile, the country received 75 percent of all the orders for drilling vessels that were made in the world and 85.6 percent of the orders for vessels designed to transport liquefied natural gas.

"The dull market also offers an opportunity to these Chinese shipyards," Zhang said. "We saw too many management loopholes during the peak in 2010, which led to an enormous waste of resources. Now it is time to fix things and improve."

Zhang said he still sees reasons for hope. Benefiting from a highly concentrated shipbuilding industry, large shipbuilders in China have remained unscathed so far by the declining market, he said.