Economists call for slow monetary loosening

Updated: 2011-12-15 09:26

By Chen Jia and Joy Li (China Daily)

|

|||||||||

BEIJING / HONG KONG - Chinese economists have urged a gradual loosening of monetary policy to avoid a faster-than-expected cooling of the economy next year.

Their calls followed a statement issued on Wednesday from the annual Central Economic Work Conference, a policy guideline for next year, which said that monetary policy should remain prudent but with slight adjustments as necessary in line with the changing economic scenario.

The country will "use a variety of monetary policy tools (and) keep a reasonable increase in bank lending" to bolster economic growth, according to the statement.

China needs to ease monetary policy soon because its economic slowdown is accelerating, reflected by the cooling real-estate sector, weak stock market and decreasing exports, said Qu Hongbin, chief economist in China with HSBC Holding Co Ltd.

"GDP growth may slow to less than 8 percent in the first quarter next year," he said.

Qu forecast three more cuts in commercial banks' reserve requirement ratio in the first half of 2012. The central bank lowered the ratio for the first time since 2008 on Dec 1.

|

|

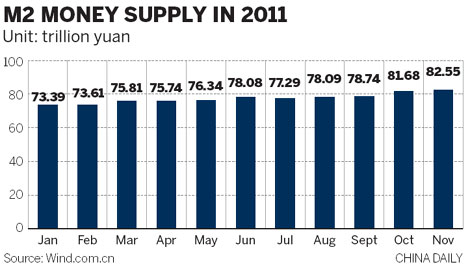

In November, the growth rate of M2, a measure of broad money supply, dropped to the slowest pace since March 2001.

M2 expanded 12.7 percent, compared with 12.9 percent in October, the People's Bank of China said on Wednesday.

"The main reason for the record-low money supply was that November's trade surplus rapidly narrowed, with the growth of exports slowing to 13.8 percent from 15.9 percent," said Xu Hongcai, a senior economist with the China Center for International Economic Exchanges, a government think tank.

The new loans last month fell to 562.2 billion yuan ($88 billion) from 587 billion yuan in October, although the authorities have vowed to increase financing for small companies.

At the end of the year, banks usually clamp down on credit to ensure they can extend adequate loans in the following year, Xu said. "But (the country) has room to increase bank loans next year to support economic growth," he said.

Xu said that more than 8 billion yuan in lending would be required in 2012.

Banny Lam, associate director and economist at CCB International Securities Ltd, said that a prudent monetary policy is a condition for further credit loosening.

"Next year, the emphasis will be more on the growth side as long as inflation is under control."

Some economists expressed concern that an increase in lending might rebound in the inflation rate in the coming year.

In addition, expectations of further US easing might drive up international commodity prices and exacerbate China's imported inflation pressure.

On Tuesday, policymakers at the Federal Reserve Board said that the US will maintain a loose monetary policy, which lifted investors' hopes for a third round of asset purchases, or quantitative easing.