Chinese firms making inroads in UK

Updated: 2016-01-15 07:41

By Cecily Liu(China Daily Europe)

|

|||||||||||

|

Chinese and British flags and paper lanterns are strung across Gerrard Street in London's Chinatown in October, 2015, during President Xi Jinping's visit to Britain at the invitation of Queen Elizabeth II. UK-China trade and investment was boosted by Xi's visit as almost 40 billion pounds in deals were signed. [Photo provided to China Daily] |

Trend gains ground, especially in areas like consumer goods, technology and green industry

Chinese companies are making rapid inroads into the United Kingdom, covering an increasingly broad range of industries and geographical locations, as they become more familiar with the UK's market and environment.

Leading the wave of investment are firms in technology, media and telecommunications, financial services, retail and energy sectors. All are emerging industries under China's current emphasis on achieving a structural shift from high growth that relies on exports to sustainable growth led by consumption.

UK-China trade and investment was boosted by Chinese President Xi Jinping's state visit to the UK in October, during which almost 40 billion pounds ($58 billion; 53 billion euros) in deals were signed.

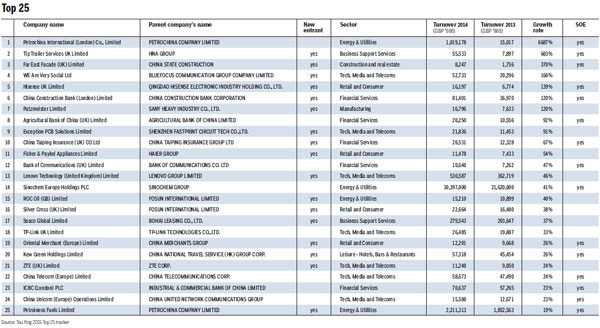

According to the Tou Ying 2015 Top 25 tracker, total revenue for the 25 fastest-growing Chinese companies in the UK in 2014 was 35 billion pounds, up from 25 billion pounds in 2013 and 17 billion pounds in 2012. Together they employ more than 2,500 people.

Overall, the growth of the top 25 companies in 2014 was 44 percent, higher than the previous year's average of 38 percent. In comparison, the UK's economy grew by 2.6 percent in 2014, the fastest pace since 2007.

The tracker, compiled by the accountancy firm Grant Thornton in collaboration with China Daily, identifies the 25 fastest-growing Chinese businesses in the UK that have parent companies in China, based on annual changes in revenue. The tracker is in its third year, and the latest version monitored revenue growth from December 2013 to December 2014. In Chinese, touying means investing in the UK.

Simon Bevan, partner and head of China Britain Services Group at Grant Thornton, says the latest tracker analysis shows that Chinese companies continue to play an important part in maintaining a vibrant UK economy.

Bevan says in particular, Chinese private sector firms are making a bigger contribution to overall investment. Also, China's growing consumption market is leading an increasing amount of emerging Chinese investment in the UK in the retail, leisure and entertainment industries.

"The country's booming technology sector, especially in mobile communications and social media, is becoming a hotbed of innovation, rather than a producer of copycat Western goods and services. Increased investment in tourism and leisure reflects a boom in Chinese overseas travel," says Bevan.

In the tourism industry, for example, China's HK CTS Metropark Hotels Co Ltd acquired British-based hotel management group Kew Green in August.

Kew Green Hotels Ltd owns 44 UK hotels with 5,179 rooms and manages a further 10 UK hotels for other owners. It manages the iconic Grand Brighton Hotel, a Victorian seaside institution.

The Grand is owned by Wittington Investments. Kew Green, under its new Chinese owners, will continue to manage the hotel.

Similarly, Chinese conglomerate Fosun acquired well-known British pram maker Silver Cross in July to help give the brand a boost in China's booming consumer market.

Silver Cross, a 138-year-old manufacturer whose prams have carried royal babies over the years, and now carry Princess Charlotte, has placed a special focus on China.

"China represents huge growth opportunities for us, and we want to expand in the country properly with our own team to support our distributors," says former chairman Alan Halsall, who took over the running of Silver Cross in 2002.

Although historically manufactured in the UK under Halsall's leadership, Silver Cross has already outsourced about 90 percent of its manufacturing to China. All those links Silver Cross already had with China laid the foundation for the Fosun acquisition.

New entrants in the Tou Ying tracker such as Kew Green and Silver Cross underline China's more consumer-focused economic shift.

Maggie Zhao, a partner at the law firm Clifford Chance, says that the emergence of the Chinese middle-class very much has been the driving force behind Chinese investments in the leisure sector.

"It is a relatively easy, win-win situation for both the Chinese investors and the established Western brands. Chinese middle-class consumers like to buy into an established Western brand that they can easily relate to. The investment in turn allows the Western brands access to the much needed capital and more importantly, a huge domestic market," she says.

Zhao adds that her staff is also seeing increasing Chinese interest and investment, both in terms of the size of individual investments and numbers of transactions, in technology, finance and the leisure industry, which includes dining, lodging, traveling and entertainment.

Another key trend is for Chinese firms to establish research and development capability in the UK to create products for the UK and the wider Western market, particularly because Britain has excellent academic R&D capabilities.

Michelle Chen, a partner at the law firm Squire Patton Boggs, says this trend is due to Chinese companies' appreciation of the UK's innovation and R&D strength, and similarly the UK partners want to work with these Chinese companies as they appreciate China's big market.

"R&D is very important for China, particularly as China wants to develop new and advanced technology and improve innovation under its 13th five-year plan," Chen says. The 13th Five-Year Plan (2016-20) is the policy that will govern China's development for the rest of this decade.

One notable firm that has keenly embraced Britain's R&D opportunities is the telecommunications firm Huawei, which is a trendsetter in 5G R&D as a founding member and industry partner for the University of Surrey's 5G Innovation Center.

Another example is the Chinese automotive manufacturer FAW Group Corp, which has invested in R&D work at the University of Nottingham, focusing on thermal management and improving thermal efficiency of electric and hybrid vehicles, so that it can become a leader in these emerging technologies.

Cooperation between Chinese and UK partners has led to the development of some cutting edge technology. BGT Materials, a major Chinese manufacturer of graphene, invested 5 million pounds in 2013 to open an R&D center at the National Graphene Institute of the University of Manchester, and consequently it was able to showcase its research results to Xi during his October visit. The company showed the president its latest technologies, demonstrating graphene used in lighting and in security. Graphene is a form of carbon used in electronics.

Chung-Ping Lai, CEO of BGT Materials Ltd, says his staff decided to invest in Manchester because it is a great hub of both early stage research and later stage development of graphene.

The projects BGT Materials has worked on in Manchester have yielded useful results, including heat dissipation pastes and coatings, which it has started to use in lighting fixtures, and also the development of antennas printed with graphene, useful for radio-frequency identification of items and Wi-Fi.

Energy and infrastructure is another key area, as many Chinese infrastructure and construction firms want to demonstrate their strength in mature economies, and the UK needs more investment to upgrade its infrastructure and provide for its energy needs.

Chinese nuclear company CGN signed an agreement during Xi's visit with the French energy firm EDF to jointly invest in the UK's Hinkley Point nuclear power plant. Hinkley Point, the 18 billion pound nuclear project in Somerset, is led by EDF, and this means CGN would invest 6 billion pounds in the project.

Chinese railway company CRRC Corp Ltd also established a representative office in Britain in May, with the aim of bidding for the UK's High Speed 2 project linking north and south.

Looking to the future of Chinese investment in the UK, Bevan says he thinks they are more likely to be led by a new generation of entrepreneurs, often Western-educated, particularly because the first wave of Chinese private sector businesses are starting to hand the reins to the next generation.

"In particular, greater international experience may alleviate some of the issues around deal strategy and negotiation, lack of due diligence and poor post-deal integration that have hampered some Chinese global growth plans, as well as encouraging a greater focus on corporate governance and use of experienced advisers with in-depth local market knowledge," Bevan says.

His staff is also expecting more investment in the UK green tech sector from China, in line with the green development goals of China's latest five-year plan.

"This includes a commitment from the Chinese government to strive to improve the environment, promote clean industrial production, low-carbon development and energy conservation to ensure sustainable growth over the next five years," he says.

Betty Yap, partner and head of China practice at the law firm Linklaters, says she thinks more Chinese firms will look for opportunities abroad as the Chinese economy becomes more geared towards meeting increasing domestic demand.

"Despite a softer overall growth outlook in China, companies will still look to the UK for strategic investments. Consumer-driven demand has a long way to run in China as the economy continues to expand, albeit at a different pace," says Yap.

cecily.liu@mail.chinadailyuk.com

( China Daily European Weekly 01/15/2016 page1)

Today's Top News

Xi to deliver speech on Middle East policy

Chinese firms making inroads in UK

Value addition

IS claims Jakarta attack, targets Indonesia for 1st time

Chinese people most optimistic in global survey

COSCO offers 700m euros for Greece’s Piraeus Port

Istanbul bomber entered Turkey as refugee

Bird flu case confirmed in eastern Scotland

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|