'China collapse' argument mistaken

Updated: 2016-02-26 08:57

By Robert Lawrence Kuhn(China Daily Europe)

|

|||||||||

Those who profit from exaggeration - certain authors, analysts and short-sellers - keep repeating debunked claims

"China is taking over the world" was a casual remark by an American blue-collar worker, said in a resigned sort of way.

"I know something about China," I replied, "and China has serious problems."

"That's good," he said.

"That's not good," I responded. "Do you want to pay higher prices for lower quality goods?"

I described how the well-being of Americans is linked to China. Either we succeed together, increasing our mutual standards of living, or we suffer together. I can't say I made a convert but I think I undermined a stereotype.

I recalled the conversation when musing about the rash of the "China collapse" speculations of late and why this cyclical and long-debunked claim has credence.

I analyze the "China collapse" theory in three parts: What is the argument? Who are its advocates? Why does it resonate? I explain why the theory is either misconceived or underdetermined, and at best (worst?) categorized incorrectly, evolving issues under a simplistic, inflammatory title.

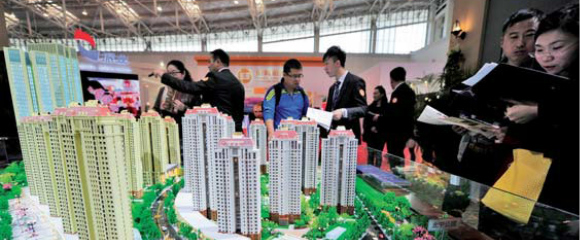

The "China collapse" argument is that China's economy is facing a constellation of severe, debilitating forces: slowing growth, market volatilities, social imbalances, industrial overcapacity, excessive debt, rising wages, reduced competitiveness, overbuilt housing, unproductive infrastructure, massive pollution, insufficient state-owned enterprise reform - the list is not short.

These issues are real. Each one of the issues is the natural result of unprecedented economic development in a compressed period of time. But what follows? Each issue is being addressed, imperfectly of course, but in a coordinated manner. China's focus on innovation, entrepreneurship, science and technology, Made in China 2025, residency reforms to help migrant workers, and the like, are all part of China's 13th Five-Year Plan (2016-20). When mistakes are made, such as tight circuit breakers on stock market volatility that fueled rather than doused anxiety, they are corrected rapidly.

What does collapse mean? In mid-2015, China's stock market "collapsed", as it were, but stability was restored (hopefully with lessons learned), and obviously the stock market continues on. Economics run in cycles, boom and bust, with peaks and troughs higher or lower. So those who predict "collapse", loosely defined, must be "correct" at some points in the cycle (much like a clock that has stopped working must be "correct" twice a day).

A fallacy of China's slowing GDP growth is using year-on-year percentages as the benchmark. If China's GDP grows at 6.5 percent this year, on a base of almost $11 trillion, the absolute increase (about $700 billion) is roughly double what it was 10 years ago (in 2006, when the economy grew at 12.7 percent). Moreover, because China's population is now only slightly larger, the incremental GDP per capita today is well larger than what it was in those so-called high-growth years. Yet the problem of China's unproductive growth is real, which has lead to overcapacity in industry, housing and infrastructure. China's story is not a simple one.

Who advocates "China collapse"? Some economists are pessimistic about China's short-term prospects, but almost none would use the term "collapse". Rather, some of their comments are taken, selectively, by those who have a vested interest in China's "collapse" - book writers of sensationalized doom, political analysts viscerally opposed to China's system of governance, financial short-sellers seeking short-term profits, and the like.

I've been amused that purveyors of the "China collapse" theory are often also purveyors of the "China threat" theory. How China could "threaten", which requires power, at the same time it "collapses", which reduces power, is a mystery. Although self-refuting, the threat-collapse nexus reveals a common connection, as "threat" and "collapse" both emanate from a built-in bias towards China. But even as "China collapse" advocates remain few in number, the idea has gained in prominence. Why?

Two factors drive "China collapse" in the public eye. First is not so much that China's economy has become more fragile but that world markets have come to depend too much on China's growth. China is still a developing country and cannot bear the world's burden. Second is that China's increasing clout generates a natural backlash (exemplified by that American worker).

Foreigners exaggerate China - in both directions. "When China was called 'the sick man of Asia', we weren't so 'sick'," a Chinese minister told me; "and now that foreigners think China is so strong, we aren't so strong." The relevance is direct. Even though China's economy has internal contradictions, like overcapacities, and remains vulnerable to external shocks, like global slowdowns, although China's economy is slowing, it is not collapsing.

Politically, there are no broad, boiling tensions as collapse advocates contend. The vast majority of the Chinese people want social stability, a watchword in China, which is required for increasing standards of living. The Chinese government is exquisitely sensitive to instability and reacts rapidly to even early indicators of unrest. This can lead to stricter regulations, such as in media and social media, but almost everyone would accept the trade off.

China's economy will cycle but it won't collapse. I'm sorry if this disappoints a few false prophets, but assuming that people do what is best for them, other than the handful that make their money bashing China, no one should root for China's collapse. China's success is the world's success.

The author is a public intellectual, political/economics commentator, and international corporate strategist. He is the host of Closer To China with R.L. Kuhn on CCTV News. The views do not necessarily reflect those of China Daily.

Today's Top News

Inspectors to cover all of military

Britons embrace 'Super Thursday' elections

Campaign spreads Chinese cooking in the UK

Trump to aim all guns at Hillary Clinton

Labour set to take London after bitter campaign

Labour candidate favourite for London mayor

Fossil footprints bring dinosaurs to life

Buffett optimistic on China's economic transition

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|