China rivals? No, partners!

Updated: 2016-10-28 07:25

By Andrew Moody in Guangzhou(China Daily Europe)

|

|||||||||

Senior adviser at World Bank says teamwork is vital to ensure a brighter future for Africa

Jamal Saghir insists the World Bank and China are not rivals in Africa but partners.

The senior regional adviser at the Washington-based international financial institution says the view that they represent competing interests on the continent is wrong.

"This perception gives us trouble because it is unfair. China is quite clearly now open to a real partnership not only with us but also with Africa," he says.

|

Jamal Saghir, senior regional adviser at the World Bank, says China shows a willingness to work with different partners. Provided to China Daily |

"What we are witnessing is China showing a willingness to work with different partners. Many Chinese companies work on World Bank projects so this is not about competition."

Saghir, a 59-year-old Lebanese Canadian, was speaking after giving a presentation on infrastructure development at the 2nd Investing in Africa Forum in Guangzhou.

He says China showed its commitment to Africa when President Xi Jinping announced at the Forum on China Africa Cooperation (FOCAC) in Johannesburg that it was tripling aid to the continent to $60 billion.

"That is a lot of money, some $20 billion of investment in each of the next three years. The total World Bank lending is about $25 billion," he says.

"They have a very good model of actually operating. They just go in and build a road by deadline and it is completed. For many reasons, China is now an important partner for Africa. That is the reality. It has changed the rules for everyone."

Saghir says it would be wrong to conclude that somehow China, despite the scale of its investment, can do it all by itself.

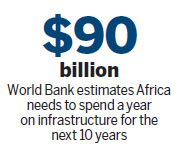

According to World Bank estimates, Africa needs to spend $90 billion a year on infrastructure for the next 10 years for it to reach a minimum effective standard, which is double the $45 billion it is currently spending.

"Two-thirds of what is being spent is funded domestically by the African taxpayer, by the private sector and the World Bank. So we are missing around $45 billion. If all China's new money was to be spent on infrastructure we would still be $25 billion short. That is the scale of the problem," he says.

The senior researcher says the poor state of infrastructure in Sub-Saharan Africa - in its electricity, water, roads and information and communications technology - deprives its economy of between 2 and 4 percent of growth it would otherwise have. Business productivity is reduced by as much as 40 percent.

He says electricity generation is a crucial weakness, with 70 percent of the population and 10 million small and medium-sized enterprises having no access to electricity.

"The state of the power sector, in particular, has a huge negative impact on growth because many enterprises don't have access to electricity and can't therefore produce. The total generation capacity of Africa is only 65 gigawatts, just the equivalent of either Spain or Argentina," he says.

"This is one of the major constraints in dealing with poverty reduction."

He says Africans also pay a high price for their electricity - around 20 cents a kilowatt on average and as much as 35 cents in countries such as Burkino Faso and Liberia - compared with just 10 cents in the United States.

"So you have this mismatch between cost and distribution. People are paying high prices but don't have full access to electricity."

Saghir says another major infrastructure problem is the lack of roads, with the whole continent having just 50,000 kilometers of highways, half of them in poor condition.

"African economies find it difficult to develop since it is difficult to carry out intra-national and regional trade because the roads are not maintained and in many places don't exist," he says.

"Flying is no better. Sometimes if you want to go from one country to another, say Cote d'Ivoire to Chad, you have to stop at at least two or three airports to get there. It can take you 8 hours. Sometimes you have to go to Europe to get back to Africa."

Saghir also cites other major problems affecting the continent. Only 15 percent of households receive piped water; broadband penetration reaches only 5 percent of the population; high-speed internet is the most expensive in the world; and agriculture yields lag behind the rest of the world, with Thailand exporting more food that the whole of Sub-Saharan Africa.

"I think China has a lot to offer in dealing with many of these issues. This is particularly the case with the transmission of power, building roads, ports, airports and other facilities," he says.

The adviser says China is a particularly good role model for Africa, with it moving from some 37 percent of the rural population having no access to electricity in 1978 to almost 100 percent access now for everyone.

"They started at a provincial level with homes connected to a hydropower source and did not put in a national grid until later. If you go to countries like Nigeria and Ethiopia, it will take at least 30 years to build a national grid. They need to connect people locally," he says.

Saghir, based in Washington and a professor of practice at McGill University in Montreal, was born in Beirut, but emigrated to Canada when he was 17.

He studied economics at Laval University in Quebec, where he received his doctorate in 1984.

One of his early jobs was as resident adviser to the prime minister of Tunisia in the late 1980s.

He joined the World Bank in 1990 with responsibility for privatizations in Central and Eastern Europe, among other roles.

He has held his current role, focusing on energy, infrastructure and water resources, since 2014. He has specific responsibilities for Africa.

He says one of the perceived problems of investing in Africa is always the security risk.

"We looked recently again at private sector perception of risks of investing in Sub-Saharan Africa and the broad consensus was that, while risks exist, perception is often out of sync with reality," he says.

"I believe we must identify real and perceived risks, disaggregate them into categories such as political, implementation, financial and demand-and-supply type risks. We can then tackle them through appropriate means."

One of the perceptions that have grown up over the past decade is that China is an easier partner for the Africa than the World Bank since the deals that it does come with fewer strings attached.

"I think it depends how you look at it," says Saghir. "People will perceive this, but you have to remember that our bank is using public money, taxpayers' money, and we have to go through a process of procurement and assessment. We have our own corporate responsibility. I don't think it is easier to deal with China, it is just different."

He says it is important to remember that the World Bank has been financing projects since the bullet train in Japan in the 1960s, which was financed with an $80 billion loan from the World Bank.

"The World Bank has developed. I have been with the bank a quarter of a century and we have a lot of expertise and know-how from working on all continents. We were there when the economies of Eastern Europe collapsed when the Soviets pulled out.We were there when Latin America was reconstructing itself," he says.

"We bring to this not only the good lessons but the bad lessons. My job is sometimes to say to a minister what he should not do and not what he should do."

Saghir welcomes new institutions such as the BRICS's New Development Bank, which is based in Shanghai, and China's Asia Infrastructure Investment Bank, which has more development capital than the World Bank at its disposal.

"It is sometimes easy to find the money, but what we have is the software and the hardware and the knowledge that we have built up over decades. This has involved listening and learning. We will be working, however, with the BRICS bank on World Bank projects. This is part of the discussion we are having right now."

He says the Guangzhou forum - which was organized by the World Bank Group, the Guangdong provincial government and the China Development Bank, one of China's two policy banks that play a key role in funding African projects - was an example of the new cooperation.

"The forum has been crucial. It is a way to learn from China and to show what it has to offer Africa, especially for our clients," he says.

andrewmoody@chinadaily.com.cn

(China Daily European Weekly 10/28/2016 page8)

Today's Top News

Party ramps up supervision

Queen Elizabeth visits new town Poundbury

UK retailers catering for homesick Chinese

UK government opts for new Heathrow runway

China's business leaders optimistic about UK

Workers tear down Calais 'Jungle'

UK university heads Chinese pregnancy research

Chinese hostages freed by pirates are heading home

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|