Looking for the right mix

Updated: 2016-09-02 08:37

By Andrew Moody(China Daily Europe)

|

|||||||||

The G20 Leaders Summit in Hangzhou, set against the backdrop of weak global growth, will seek to find new economic drivers

How to breathe life into a slowing global economy when many of the policy tools have already been exhausted will be one of the key challenges for leaders at the G20 summit.

The meeting in Hangzhou, hosted by Chinese President Xi Jinping, takes place against a difficult economic backdrop.

Eight years after the global financial crisis, the world has failed to return to anything that would have been considered normal prior to it.

The International Monetary Fund cut its forecast for global from 3.2 to 3.1 percent in July in the aftermath of the UK's Brexit decision.

China - despite fears of a slowdown at the beginning of the year - is one of the few bright spots, recording 6.7 percent growth in the second quarter, and the Washington institution actually raised its annual forecast for the country.

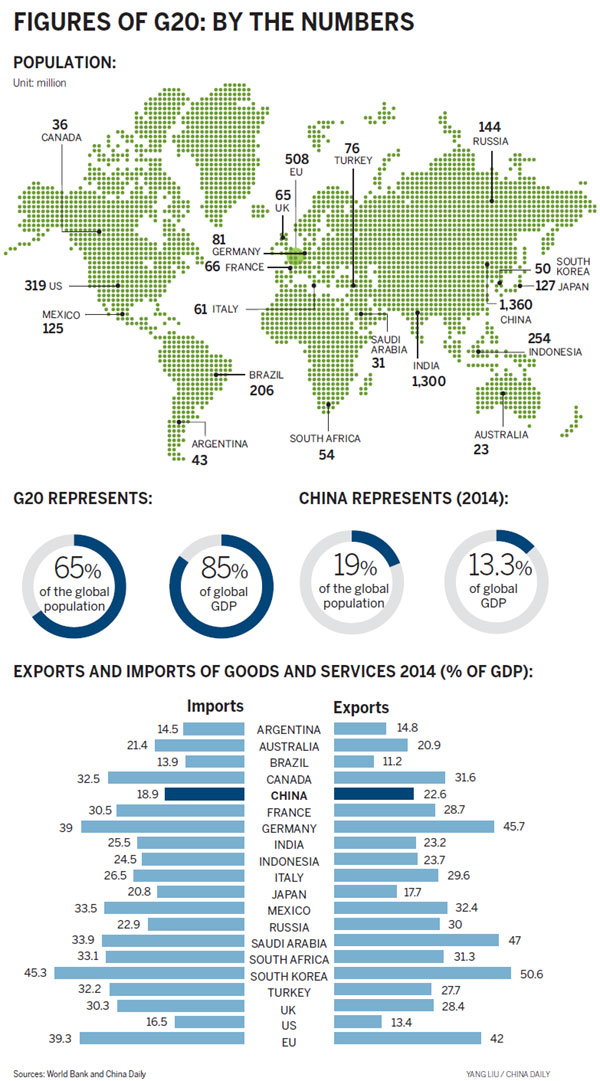

When world leaders met in Brisbane for the G20 summit in November 2014, they set the task of raising the GDP of G20 nations by 2 percent by 2018 through structural reforms.

On Aug 26, Chinese Finance Minister Lou Jiwei stressed the importance of such measures in driving up productivity and said they would again be high on the summit agenda.

What many observers will be looking for is any indication as to new policy initiatives.

Although US Federal Reserve Chairman Janet Yellen indicated in her speech at the Jackson Hole, Wyoming, symposium on Aug 26 that there could be a further hike in US interest rates this year, monetary policy almost elsewhere remains loose.

The Bank of Japan imposed negative interest rates in January following the European Central Bank, which has held its deposit rate for bank holdings below zero since 2014.

The Bank of England slashed the UK base rate to 0.25 percent after the Brexit vote in June.

Some believe the only way forward is to have a concerted global move on fiscal policy, taking advantage of low interest rates to invest in infrastructure and other projects that could kickstart other activity.

But Stephen Roach, senior fellow at the Jackson Institute for Global Affairs at Yale University and former chairman of Morgan Stanley Asia, wonders about the wisdom of going on a fiscal spending spree.

"My concern is if there is a huge increase in fiscal deficits at this point, what will happen when interest rates eventually go up? The debt burden associated with the commitment will be far more onerous in the future than it appears at today's interest rates. I think there is a little bit of myopia involved with the fiscal policy advocates," he says.

"The pressures (on interest rates) are certainly not immediate, but when you make deficit commitments they tend to be for the long term, and they cannot be financed in perpetuity by low short- term interest rates."

Louis Kuijs, head of Asia for Oxford Economics, based in Hong Kong, understands why fiscal action is on the agenda.

"It is not completely new but the debate is moving that way. We are reaching the limits of central banks' ability and monetary easing to boost growth," he says.

He believes China and other Asian economies are in better shape to pursue fiscal expansion than most European countries or the US.

China, for one, increased its infrastructure spending by 20 percent in the first half of this year, with much of it being directed to projects linked to its Belt and Road Initiative, which focuses on connectivity and cooperation among countries in Asia, Europe and Africa.

"We have seen a greater reliance on fiscal policy in China, and I think in Asia many governments, apart from that of Japan, have space to increase their fiscal deficits.

"It is a different picture in Europe, however. Italy and Spain, for example, have no space at all. In Germany, there is space for fiscal expansion but complete reluctance by the government to follow such a course. In the United States, it is not really on the agenda and there is certainly no discussion about it."

Miranda Carr, the London-based head of China thematic research at investment bank Haitong, believes the G20 finance ministers and central bankers meeting in Shanghai in February gave an indication of the direction of policy.

"Aside from the obvious statements about supporting growth and trade, there was a pronounced shift away from monetary policy toward fiscal stimulus. In the communique, there was a general pledge to use all tools - monetary, fiscal and structural - to promote growth, but the comments from individual delegates were more revealing about ditching austerity and turning on the government spending taps."

She says the British government under Prime Minister Theresa May, for whom the G20 summit will be her debut on the international stage, has indicated a major change of policy.

"It has abandoned the target to move its budget into surplus by 2020 and intends to invest in infrastructure project and a new industrial policy."

Ruchir Sharma, author of The Rise and Fall of Nations: The Rules of Change in the Post-Crisis World and head of emerging markets at Morgan Stanley in New York, believes the world has reached a stage where there are no immediate policy solutions to sluggish growth.

He believes this is because the global financial crisis has coincided with a collapse in population growth, pointing out that the US labor force grew 1.7 percent annually from 1960 to 2005 but only by 0.5 percent over the past decade.

"A lot of the sluggish global growth is to do with demographic changes that are taking place and with lower population growth. There is a knock-on effect on productivity, which is an area you can't really do much about."

He says one of the challenges for the leaders of the G20 nations might be how to alter the debate about growth altogether.

"We need to redefine the map of economic success, which is that we have lower economic growth everywhere and we just have to accept that. We have to begin to figure out what we can do relatively better in a lower economic growth world."

The summit, the main aims of which include promoting free trade, comes against a backdrop of growing calls for greater protectionism. The Republican nominee in the US presidential election, Donald Trump, has been vocal in calling for retaliatory trade measures against China, including a 45 percent tariff on imported goods from the world's second-largest economy.

Kuijs at Oxford Economics believes there has been more rhetoric about protectionism than actual measures.

"The incidents of retreating to protectionism have actually been fairly modest. What we are seeing more of is a backlash in public opinion against what the elites in many countries hold dear. These elites want more globalization, more market-oriented systems, open economies. The problem is that public opinion is going very much the other way."

Roach, the US economist and a long-term observer of the Chinese economy, believes China might combat the protectionist mood by unveiling a new bilateral investment treaty with the US at the summit.

"This would be a very significant event and it is something I have long been an advocate of. It might be the preferred way to launch the summit with a great fanfare and a major bilateral agreement between the two leaders, Chinese President Xi Jinping and President (Barack) Obama."

As a result of being held in Hangzhou, one of the China's more entrepreneurial cities and home to ecommerce giant Alibaba Group, the summit is likely to bring attention to how important the Chinese economy is to global recovery.

The Chinese economy contributed 30 percent to global economic growth in 2015, and Finance Minister Lou has said it will be the "driver" and "anchor" this year also.

Kerry Brown, a professor of Chinese studies and director of the Lau China Institute at King's College, London, believes the summit gives China the opportunity to demonstrate its importance to the world economy.

"In the US and Europe, China has stood accused as being one of the causes of the problems in the global economy, through overproduction, rather than as a solution.

"The summit offers the perfect chance to rectify this impression and to show the ways in which its consumption and service sector growth offers huge opportunities for the rest of the world to engage with it in a new way."

Momodou Sabally, a former economist at the Central Bank of Gambia and now director general of Gambia Radio and Television Services, based in Banjul, Gambia, says the Chinese economy is key to Africa's development.

"China remains the most crucial partner for Africa and her hosting of this important summit has only bolstered hope for Africa for a bigger and fairer space in global economic relations."

He says he is particularly encouraged by one of the aims of the Hangzhou summit to "initiate cooperation to support industrialization of Africa and less-developed countries in the world".

"China is uniquely qualified to push through this agenda. Its intervention is already a reality on the ground in terms of its impact on infrastructure development and industrialization of Africa."

George Magnus, senior independent economic adviser at UBS in London, says a remarkable aspect of the summit could be that the Chinese economy is no longer the story with Brexit and the US presidential election dominating the headlines.

"The China (hard landing) narrative has gone stale for the moment. If anything, China's economic stabilization will be welcomed and hailed as a contribution to a better growth environment.

"Of course, there are those who will claim this stabilization has been achieved through measures that will become counterproductive and unstable in the longer term."

One of the big items on the agenda will be structural reform and following up on the Brisbane target. China has set down nine priority areas and 48 guiding principles for such reforms for the summit.

Kuijs says setting such a wide range of goals shows that China is serious about leading on this issue.

"I am not sure if the attention span of everyone is that broad, but at least the technocrats would not be unfamiliar with that kind of language and detail."

Roach, also author of Unbalanced: The Codependency of America and China, says structural reform is difficult to achieve because every country's reform has to be different.

"It is a big world and you don't want to paint it with one brush. In China, it has been about moving more toward services and private consumption and getting a better grip on state-owned enterprises. In a country like the United States it is almost the opposite, where policies need to be put in place to promote savings so there are funds for investment."

He believes that China has done better on structural reform than the US. "It has to be given credit for the program of reforms it has put in place, which have already achieved results. Structural reform is something the rest of the world needs to think long and hard about as well."

The G20 summit may begin amid more short-term considerations. US jobs data published on Sept 2, which is expected to show an 180,000 jobs increase in August, could provide a pointer as to whether the Fed moves to raise interest rates as early as September. In an interview with Bloomberg TV on Aug 30, the Fed Vice-Chairman Stanley Fischer said "employment was very close to full employment".

Sharma at Morgan Stanley, however, says the Fed now does not have the latitude to control monetary policy in the way it often tries to imply.

"The Fed today is the central banker of the world and not just of the US, and there is only so much it can do when the rest of the world is looking to ease."

The longer-term questions that will be the most perplexing at the G20 summit are whether there the tools are available to finally move out of the shadow of the global financial crisis.

"The global economy is totally locked in a decidedly sub-par trajectory, growing way below is long-term trend," says Roach. "If there were to be a significant shock from anywhere, at this weak rate of growth it would be sufficient to topple the world back into a renewed recession."

Mam Sait Ceesay contributed to this story.

andrewmoody@chinadaily.com.cn

|

Three buildings in Hangzhou combine to display the G20 logo on Aug 28. Yin Dongxun / Xinhua |

(China Daily European Weekly 09/02/2016 page1)

Today's Top News

Mexico contradicts Trump on paying for border wall

British born Chinese face cultural challenge

UK house prices rise after Brexit hit

Brazil's Senate removes President Rousseff from office

EU to push for six priorities at G20 summit

Merkel opens Germany's 17th Confucius Institute

France's outgoing minister vows to 'transform' France

EU orders Apple to pay 13 bln euros tax to Ireland

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|