There's a serious side to the shi-san-wu

Updated: 2015-11-06 07:38

By Andrew Moody(China Daily Europe)

|

|||||||||||

Central planning in China has become a lot more fun. A three-minute cartoon video explaining the significance of China's next and 13th Five-Year Plan (2016-20) has gone viral worldwide.

Many in China, and even elsewhere, are finding themselves humming the catchy tune, which ends with a chorus: "If you wanna know what China's gonna do, best pay attention to the shi-san-wu (or '13-five')."

Produced by Xinhua News Agency, the perhaps uncharacteristically jaunty film serves as a lighthearted curtain raiser for what, despite the levity, is very serious business in China.

|

George Magnus, senior independent economic adviser at UBS in London. Nick J.b. Moore / For China Daily |

The Fifth Plenary Session of the 18th Communist Party of China Central Committee met in Beijing between Oct 26 and 29 to discuss China's roadmap for the next five years, giving pointers to the final version that will be published in March.

What has so far grabbed the headlines across the world is an end to China's more than 35-year-old one-child policy.

In the future, couples will be able to have two children, and the timetable for the reform is likely to come in the plan itself.

The central economic target is for China to join the club of developed nations and become a "low high income" economy by 2020, avoiding the so-called middle-income trap that has blighted many Latin American economies, in particular. The aim is for average per capita income of $12,000 (11,070 euros) a year by 2020.

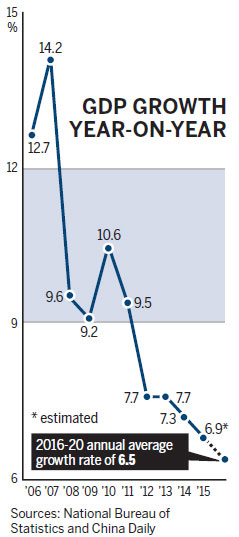

This will involve a doubling of both the country's 2010 GDP and per capita income levels by 2020, the final year covered by the plan.

President Xi Jinping told the plenum, as reported on Nov 3, that 6.5 percent growth would "be the minimum required" each year to achieve that.

The target for 2015 is about 7 percent, and in the third quarter of this year the economy grew by 6.9 percent.

According to the communique issued after the conclusion of the meeting, the plan is set to include a major extension of healthcare insurance with the aim to cover 50 percent of the cost of treatment for those with major diseases.

Lack of healthcare provision is seen as one of the barriers to developing a more consumption-driven economy because people have to save to ensure they can afford future medical bills.

Affordable housing is also likely to be big on the agenda, with the government looking to build on the 21 million affordable homes built during the current plan period. This is expected to benefit middle and low-income groups.

Further measures are expected to reduce pollution, particularly in major cities like Beijing. By 2020, the government wants to see carbon emissions relative to GDP down by 40 to 50 percent from 2005 levels.

For now, however, it will be the moves on the one-child policy that will get the most attention. Some 90 million Chinese couples will become eligible to have a second child.

The one-child policy, which was phased in in the late 1970s, was designed to stop China's then largely poor, agrarian population hurtling toward an unmanageable 2 billion.

It is believed to have prevented up to 400 million births but has led at the same time to an increasingly aging population.

The proportion of people of working age between 16 and 59 in China, has declined from a peak of 74.5 percent in 2010 to just 66 percent in 2014.

The planned relaxation may not see a sudden surge of new births. Couples in China have largely become conditioned to having just one child, and the expense of education and childcare remain a barrier to having more children.

A previous relaxation at the end of 2013 - allowing couples where one spouse was an only child to have two children - only had limited take-up. By June this year, only 1.5 million of the 11 million eligible had applied to have a second child.

Some population experts believe the new move will have a more significant effect, leading to spikes in the birthrate. It will take more than 15 years to have an affect on the working population, however.

Yuan Xin, a population scientist at Nankai University in Tianjin and who sits on the expert panel of China's National Health and Family Planning Commission, is one who thinks it will ultimately help to redress the population imbalance.

"The new initiative will be much better received among the Chinese people than the previous policy relaxation and will help boost China's labor supply in the long run," he says.

Joy Huang, research analyst at Euromonitor International in Shanghai, however, believes the new policy only removes the legal barriers to having a second child.

"The high living cost is the main reason that stands in the way of couples to have second child, especially in first and second-tier cities," she says.

"People have a very hectic life, and living costs are high. In China, parents are also expected to eventually buy a property for their children and with soaring property prices that could make having a second child very expensive. I think couples will therefore be cautious."

China becoming a "moderately well-off society" by 2020 is the standout goal of the five-year plan.

To move from being one of the poorest agrarian societies in the world in the late 1970s, when former Chinese leader Deng Xiaoping's reform and opening-up process began, to be classed as a high-income nation in the space of just more than 35 years would be a unique achievement.

It would only be comparable with Britain's "Industrial Revolution" between 1760 and 1820 and the emergence of the United States as a major industrial force in the early part of the 20th century - but achieved in a considerably shorter period of time.

Ruchir Sharma, head of emerging markets and global macro at JP Morgan in New York, is an expert in nations making the transition from emerging to developing nations.

In his book, Breakout Nations: In Pursuit of the Next Economic Miracles, he outlined the dangers of countries falling into the so-called middle-income trap when they perpetually fail to achieve high-income status.

"As all those traffic warnings go, it is better for China to arrive late than never arrive at all. I don't think it really matters whether China becomes a high-income country by 2020 or, say, 2025 or 2028."

He believes the danger for China is in making too big a dash for growth and stoking up debt in the process. China's debt to GDP ratio, by some estimates, is now 250 percent and above.

"The biggest source of imbalance in the Chinese economy is that debt is growing twice as fast as the economy as whole. If you look at every single economic miracle in history from South Korea and Taiwan to Japan, they all ended on a similar note with a debt explosion at the end of a cycle."

Sharma also believes there are external headwinds that China may face over the next five years, not least another global recession.

"Our own research shows that over the past 50 years, global recessions - where global growth falls below 2 percent - have occurred every eight years. I think there is more than a 50 percent chance of such a recession over the next five years."

Zhang Jianping, director of the International Economic Cooperation Institute of the National Development and Reform Commission, believes the government is right to stick with the momentum of "medium to high speed" growth, which 6.5 percent amounts to.

"Economic transformation and restructuring cannot be ensured without sufficient growth," he says.

George Magnus, senior independent economic adviser at UBS in London and an influential commentator on the Chinese economy, says China's leaders will have to strike a difficult balancing act over the next five years.

"I think China's leadership understands all the points in principle about the risks in the economy but at the same time it is difficult to wean the economy off a targeted rate of growth."

He believes the temptation for policymakers is always to try to do too much at the same time.

"My advice to them would be not to try too hard. They want to rebalance the economy, carry out important reforms and also deal with current problems and issues as they come up all at the same time. It is a difficult challenge, and often policies conflict. If anything, they need to focus on current issues."

One of the key elements of the next five-year plan will be reform of state-owned enterprises.

There are 110 SOEs controlled by the central government under the supervision of the State-owned Assets Supervision and Administration Commission of the State Council, and some 150,000 others under local government control.

They include companies in the key strategic industry sectors of the economy such as oil and gas but also in industrial and commercial sectors that some believe would be better served by the private sector.

They have assets of $15.7 trillion and generated total profits last year of $2.48 trillion but the criticism is thatthey are inefficient, take up too much of the nation's labor and capital resources and act as a barrier to the future development of the economy.

This is something the government fully recognizes and the State Council on Sept 13 issued new guidelines that called for reform and a new generation of more entrepreneurial managers to be in place by 2020. These guidelines are likely to be the basis of reform measures announced in the next five-year plan.

Thomas Luedi, managing partner, energy, mining and chemicals at management consultants AT Kearney, based in Shanghai, believes SOE reform is now central to China's overall economic reform.

"Twenty years ago when labor costs were very low in China nobody really cared about the productivity of these enterprises. When growth was going like crazy what mattered was that they produced every last tonnage of what they were producing.

"Now we are in a different environment with labor costs rising. They now might be more than half as efficient as their equivalent Western businesses."

Luedi believes the government is right to prioritize bringing in higher quality management to these enterprises but he says the new generation of managers need to be given the freedom to rationalize the businesses and drive efficiency.

"The problem with the state-owned enterprises and many high-profile ones is that they are not single entities but often a conglomeration of more than 100 single-entity companies which in many cases just act independently. This just leads to inefficient capital allocation and a lot of duplication of work. Management teams need to be empowered to right size these companies."

Another key focus of the plan will be financial reform and the opening of the capital account.

HSBC predicted in 2014 that by 2020, China will have liberalized its capital account and that the renminbi will be fully convertible by 2020.

After a technical adjustment to the exchange rate mechanism resulting in a small depreciation of the yuan resulted in financial market mayhem across the world on Aug 11, the Chinese government may tread with caution.

There will be much focus, however, on whether there are any new plans for China's free trade zones.

The Shanghai free trade zone was launched in September 2013 and there are now others in Tianjin, Fujian and Guangdong.

The aim is for these to be trial zones for liberalization with fewer restrictions on capital flows in and out.

Zhu Ning, deputy dean and professor of finance at the Shanghai Advanced Institute of Finance, believes the next five years will see modest reforms in this area.

"I think it will just be steady as you go. I don't expect there to be any target for fully open capital markets by 2020.

"I think there was a certain level of surprise among policymakers that the depreciation in August drew such international attention. I think instead of trying to accelerate things, they will put all this on hold for a bit. It is not really clear how many real changes they will outline in the five-year plan."

Julian Evans-Pritchard, Singapore-based China economist at Capital Economics, says there was a problem with communications with the exchange rate adjustment in August.

"The communication difficulty forced policymakers to have to intervene in the markets more than they otherwise would. We still believe it was a relatively mundane change. I think they are still committed to reform in these areas in the long run but I think they will proceed with caution," he says.

The plenary session indicated there would be further reform of the hukou household registration scheme.

Without being properly registered in cities, citizens are denied proper access to healthcare and also education for their children, allowing them only a precarious existence.

In 2010, just 35 percent of citizens had urban household registration, even though half of the population lives in cities. By last year, this had only risen to 36 percent while the urban population had grown to 54.7 percent.

Luedi at AT Kearney believes there could be major economic benefits across the whole economy as a result of hukou reform.

"It will allow people to move from the countryside where they are largely underemployed and into more productive service sector shops," he says.

"The other aspect of this, however, is that it would also allow for a modernization of the agricultural sector. If providing employment was no longer a priority, we could see the development of larger mechanized farms, driving up crop yields. It would help China meet its targets to be self sufficient in most food commodities."

With China now being the world's second-largest economy, the success of the shi-san-wu (13-5), as Xinhua's cartoon styles it, is not only important domestically but globally too.

Worldwide, many will be going through it line by line and page by page when it is finally published in March for various nuances of policy development.

"Broadly speaking, it looks like it will be a good plan and moving China in the right direction in terms of reform. I think the government is intent on making progress in a lot of areas," Evans-Pritchard says.

Lan Lan and Shan Juan contributed to this story.

andrewmoody@chinadaily.com.cn

|

Zhang Youran, 9 months old, was born in Yichang city, Hubei province, after the family planning policy was relaxed at the end of 2013, when couples where one spouse was an only child were allowed to have two children. Li Chuanping / For China Daily |

(China Daily European Weekly 11/06/2015 page6)

Today's Top News

UK unveils new spying powers, raising privacy fears

UN chief commends efforts by China, France to push for climate pact

China and Europe to jointly fund scientific research and innovation

Merkel calls for European solution to refugee crisis

China, France made progress in nuclear energy cooperation

More than 100 UK investment projects revealed

Hollande highlights green growth during visit

Tougher controls leave migrants stuck in Austria

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|