Twinkle, twinkle fashion star

Updated: 2014-01-24 08:55

By Liu Lu, Sun Li and Hu Meidong (China Daily Europe)

|

|||||||||||

|

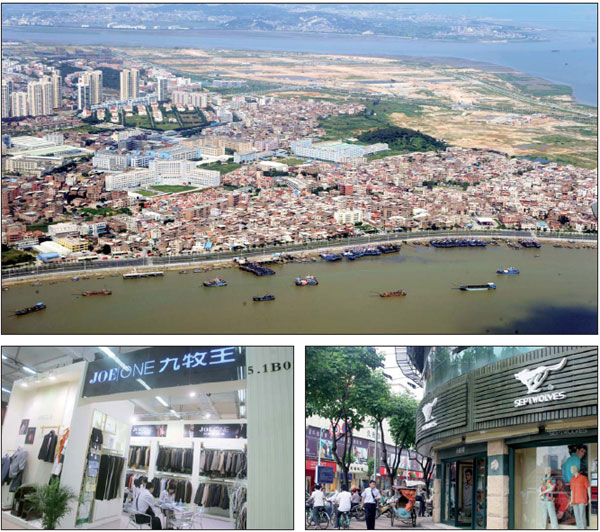

Quanzhou, a coastal city in East China's Fujian province, is keen to become the country's fashion capital by upgrading industry chains and building its clothing brands, such as Joe One and Septwolves. Photos provided to China Daily |

Quanzhou shines in the apparel firmament, helped by the sparkling debut of a first lady

Chinese clothing brands have reveled in the spotlight ever since Peng Liyuan, wife of President Xi Jingping, grabbed international attention by appearing in elegant dresses designed by homegrown brands during overseas trips last year.

The glamorous look sparked excitement about Chinese clothing labels and gave a huge fillip to the domestic clothing industry, pushing them to the forefront.

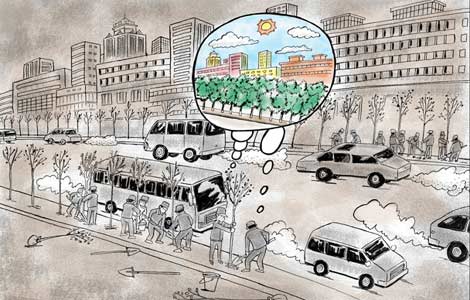

Almost a year after Peng stepped onto the world fashion stage, aspiring Chinese garment makers are continuing to draw on the first-lady effect in an effort to shed the country's image as a contract manufacturer for overseas brands and impress the fashion world with their own branded designs.

At the forefront of this new round of brand building are the garment makers of Quanzhou, in Fujian province. As one of the country's major clothing manufacturing and distributing centers with experienced artisans and budding designers, the centuries-old coastal city is keen to build itself into China's fashion capital.

Shi Zhengzhi, deputy secretary-general of Quanzhou Textile and Garment Chamber of Commerce, says: "The city is aiming not only to be an OEM (original equipment manufacture) base where big fashion houses such as Boss, Zegna find the perfect jacket or pants producers, but also wants to reinvent itself as the birthplace of international clothing brands by upgrading industry chains and strengthening brand-building efforts."

A key element in that effort is the competitive production capacity that the clothing and textile industry in Quanzhou has built over the past 30 years.

There are at least 10,000 textile and garment businesses in the city and they employ more than 500,000 people. Twenty-eight of the companies are listed either in China or overseas, the chamber says.

In 2012 they produced goods worth more than 200 billion yuan ($33 billion, 24.4 billion euros), more than 20 percent of the country's output for textiles and apparel. At times, jackets made in Quanzhou have accounted for a quarter of national market share.

Shi says: "Over the past 30 years Quanzhou has developed a wide range of garments under thousands of registered trademarks, some gaining a foothold domestically and becoming leading brands, such as Septwolves, K-Boxing, Joe One and Lilanz. They are likely to give Chinese garment makers a bigger role internationally."

However, the high-end market in the domestic fashion industry has long been dominated by foreign brands because of their know-how and brand building, Shi says.

"We hope Quanzhou's leading garment makers will soon break the monopoly."

For Zhou Shaoxiong, founder and CEO of Septwolves, the creation of a successful upmarket clothing brand is more than just fancy designs.

"The stiff competition among brands is in fact the competition between different brand cultures," Zhou says.

Septwolves, founded in the city in 1985, has become the leader among domestic menswear manufacturers. It has more than 4,000 stores across China, and it had turnover of 3.45 billion yuan in 2012, 19 percent higher than the year before. For 13 years straight, its jackets have held the largest market share in China.

But for Zhou, rising sales figures are not enough. He wants to build Septwolves by improving its brand value, doing that by strengthening its cultural connotations.

"The greatest appeal of a clothing brand lies not only in creativity and originality, but also in the brand's rich cultural connotations," he says.

The tradition behind a brand and the stories behind it have long been the mainstay for globally recognized luxury products, he says, in contrast to Chinese fashion brands, which are still in their infancy and lack history and prestige, and therefore competitive pull.

"What Chinese garment brands need most is to forge our own cultural DNA," Zhou says. "China is an emerging nation with a strong culture, so Chinese designers should not blindly imitate or copy designs from the West but rather include ones' own cultural elements in their designs."

China's rich cultural heritage has inspired Septwolves' designers, who are from China, Japan, France and Italy, Zhou says. Their combined inspiration means their clothes can interpret Chinese culture and at the same time match current international trends, he says.

Many other garment producers in Quanzhou that used to rely on orders from overseas are also feeling the urgency to build their brands.

Hong Jianku, chief executive of Qicaihu, one of the world's largest swim suit producers, in Quanzhou, says: "Facing rising labor costs and ever tougher competition from Southeast Asia, textile and garment makers' overseas orders are shrinking, and they are under great pressure to upgrade their old labor-intensive business models."

Qicaihu started its OEM business in 1992, and more than 90 percent of its products have gone overseas. By doing business with big supermarkets such as Wal-Mart and Carrefour, swimsuits made by Qicaihu can now be found in 35 countries, many of them in developed markets.

"We are more like a large processing plant when we heavily rely on orders from overseas," Hong says.

However, in recent years, because of the global economic downturn, the appreciation of the renminbi and other unfavorable factors, Qicaihu's export growth has slowed, forcing Hong to adjust the company's business strategy.

In addition to exploring new markets, including Brazil, Russia and the United Arab Emirates, since 2009 his company has also registered its independent brands and has shifted its focus from overseas to domestic markets.

"Some OEM producers in Quanzhou are on the verge of bankruptcy, and only those that can produce high value-added products will survive," Hong says.

Qicaihu's sales revenue for its own branded swimsuits in China has risen 30 percent a year in recent years and they have been sold to supermarkets in Europe, the United States and South America, he says. Last year the company's sales revenue was $10 million.

Steven Ruan, retail director of Fujian Green Group Co, one of China's largest children's clothing companies, says Quanzhou's apparel industry has begun to upgrade, "which is vital for the sustainable development of the industry".

Green Group, founded in Quanzhou in 1992, started as an OEM producer for the world's top children's wear brands. Its annual sales revenue has topped more than 1 billion yuan in recent years, and its products have been exported to more than 30 countries and regions.

"Lower-end OEM businesses are bypassing China and pouring into Southeast Asian countries such as Vietnam and Cambodia because of their lower labor costs," Ruan says.

"Our price advantage has gradually disappeared."

Under siege, Green Group has turned to developing its own brands.

The China National Garment Association has named Dadida, one of the company's children's wear brands, one of the top 10 children's garment brands in China.

"Our consumer base is getting bigger and bigger, and the easing of the decades-long family planning policy will also give us new opportunities to grow," Ruan says.

The company's exports of OEM products accounted for 80 percent of its sales revenue in 2004, but now the situation is completely reversed, he says, and the domestic market offers the biggest opportunity for growth.

But domestic children's clothing companies face many difficulties in the local market, Ruan says. Among these is that department stores are more willing to lease space to foreign children's wear brands, and shoppers are more willing to pay more for foreign brands, believing they are better.

"Chinese businesses' products, especially those from OEM producers, are not inferior to those of their foreign counterparts, but we need to learn about their advanced design concepts and technical innovation and to put more time and effort into cultivating our own consumer groups."

Green Group is looking beyond big Chinese cities and will look to sell more in smaller ones and promote its brand awareness in overseas markets, he says.

The company has opened 16 chain stores overseas, including in Australia, Kuwait, the Philippines and Russia, and will continue to expand globally.

There is no doubt that when more garment brands spring up, Quanzhou will help China shed its image as a drab producer of low-end textiles and clothing, and the city's garment business owners expect clothes under their own brand names will become increasingly well recognized.

"Quanzhou's clothing entrepreneurs need a platform to show their achievements to the world," says Gao Jinxiang, director of the West Taiwan Strait International Fashion Week, an annual event held since 2008.

Domestic clothing businesses' awareness of brand packaging is weak and their marketing skills poor, he says, and he hopes that large fashion shows will provide them with a platform to promote themselves as well and to learn from others.

"Quanzhou faces Taiwan across the sea. Taiwan's garment manufacturers have more advanced design concepts, and the event has helped Quanzhou's businesses soak up good experience from their counterparts in Taiwan. It has also strengthened exchanges between the two sides and got them working more closely together."

The fashion week has attracted more and more clothing businesses, including from Europe.

The textile and garment industry has become a pillar of Quanzhou's economy, Gao says, and he believes it will continue to be a driver of the city's economic growth.

"Relying on the vast Chinese market, I am confident we can turn the Quanzhou clothing brand into a globally renowned brand one day. It won't be long."

Contact the writers through liulu@chinadaily.com.cn

(China Daily European Weekly 01/24/2014 page16)

Today's Top News

8.8% salary hikes expected for 2014

China turns the tables on gamblers

China takes measures against H7N9

Terrorists behind twin explosions in Xinjiang

2014 diplomatic strategy outlined at Davos

China reports another H10N8 case

Big events in the Sino-French relations

IMF chief warns of risks to recovery

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|