Investment-led growth still a concern for China

Updated: 2014-01-24 08:55

By Wei Tian in Shanghai (China Daily Europe)

|

|||||||||||

|

A customer in a supermarket in Suzhou, Jiangsu province, chooses decorations for the Lunar New Year, which starts on Jan 31. Consumption accounted for half of GDP growth in 2013, 1.8 percentage points lower than in 2012. Wang Jiankang / For China Daily |

Market-oriented reforms expected to unleash potential of private investments in service sector, say experts

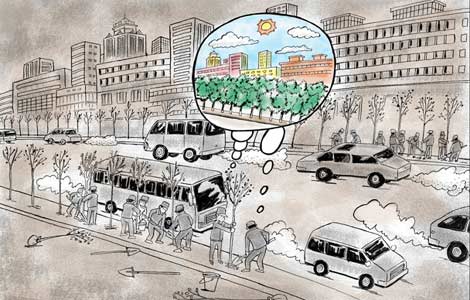

Although 2013 turned out better than expected in many ways, risks still hang over the Chinese economy, with analysts warning that investment-driven growth cannot be sustained indefinitely.

The world's second-largest economy expanded 7.7 percent in 2013, exceeding the official target of 7.5 percent and coming in slightly above market expectations, the National Bureau of Statistics said on Jan 20.

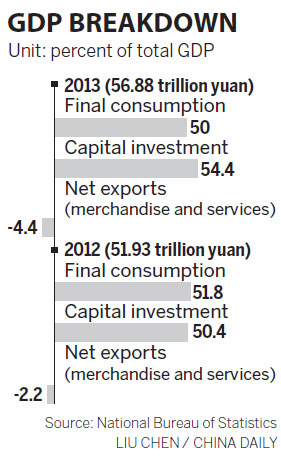

Ma Jiantang, the bureau chief, says investment was the chief driver of the economy, accounting for 54.4 percent of overall growth, 4 percentage points more than in 2012.

Despite efforts to boost spending, consumption's contribution to GDP growth dropped 1.8 percentage points from the previous year, to 50 percent.

The contribution of net exports to overall GDP growth was a negative 4.4 percent.

"GDP growing 7.7 percent has brought more concern than joy, because last year's rise was still largely driven by investment," says Li Xunlei, chief economist of Haitong Securities Co.

Li says that investment-driven growth has resulted in rapid expansion in local government and corporate debt, heightening risks without generating adequate cash flow.

He says deleveraging will remain a major task for China this year, and that may lead to slower GDP growth of 7 to 7.2 percent.

The government has already taken steps to curb investment, with figures showing a slowdown in fourth-quarter GDP growth that was mainly due to falling public investment.

"Growth in fixed investment is at decade lows as Beijing tries to steer the economy away from investment-led growth," says Fred Gibson, an associate economist at Moody's Analytics.

"We're likely to see a continuation of slower but more sustainable investment growth in 2014 as policymakers focus on rebalancing the economy to domestic consumption."

Tang Jianwei, a senior macroeconomic analyst at Bank of Communications Ltd, says the fallback in investment was mainly a result of mounting government debt pressure and worsening excess industrial capacity.

Tang says slowing growth in public investment is likely to continue this year, but market-oriented reforms will unleash the potential of private investment, especially in the service sector, meaning steady growth in investment this year of about 19.3 percent.

Ma Jun, the chief economist for Deutsche Bank's Greater China Region, says steady investment growth this year will benefit sectors such as ports and shipping, textiles and electronics, and formerly restricted sectors such as medical care, renewable energy, railways and the Internet.

Zhu Baoliang, a senior economist with the State Information Center, a government think tank, says: "Although we've been emphasizing the importance of consumption-driven growth, it's undeniable that investment will remain the major economic driver for a while, and the economic structure will be largely unchanged in 2014."

weitian@chinadaily.com.cn

(China Daily European Weekly 01/24/2014 page15)

Today's Top News

8.8% salary hikes expected for 2014

China turns the tables on gamblers

China takes measures against H7N9

Terrorists behind twin explosions in Xinjiang

2014 diplomatic strategy outlined at Davos

China reports another H10N8 case

Big events in the Sino-French relations

IMF chief warns of risks to recovery

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|