European investment takes on a new shine

Updated: 2013-09-27 09:40

By Zhu Ning (China Daily)

|

|||||||||||

With emerging markets harnessed, another, older, option beckons

The recently published annual report of China Investment Corp, the Chinese sovereign wealth fund, had encouraging news for all Chinese. The fund had a return of 10.6 percent last year, greatly outstripping its performance the previous year, when it was -4.3 percent. Given that CIC has billions of dollars of assets under management, even a 1 percent difference in investment returns can make a lot of difference in absolute terms. So the fund's performance last year is reassuring, particularly given the size of assets under its management.

Of course, the returns on any investment can be cyclical and subject to changes in global macroeconomic situations, and the fund's risk exposure. Further, given that CIC holds many illiquid assets, whose returns cannot be accurately evaluated in the short term, it is not out of the question that some one-time item contributed to the fund's performance last year. Nevertheless, many believe CIC's improving performance may indicate that China's sovereign wealth fund has become more mature and its early investment is gradually paying off.

Starting with a few controversial private-equity type investments in international financial institutions during the 2007-08 global financial crisis, the Chinese sovereign wealth fund's investments have become more diversified in asset classes, geography, duration and exposure to risk.

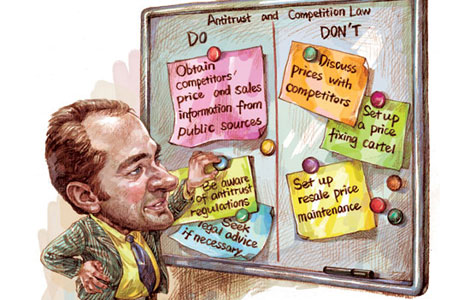

It is worth noting that such a shift does not come completely voluntarily. With China's growing economic development and increasing international influence, some developed economies have more concerns with Chinese overseas investment, especially in their own markets. Chinese companies, including CIC, have felt resistance against their attempts to expand their presence in such markets, in areas such as labor laws, tax and accounting standards, and antitrust regulations.

As a result, CIC, like many other Chinese companies, decided to venture more into developing markets, which are more welcoming and whose growth has been faster over the past several years. Now that the CIC portfolio is more diversified and tilted more toward emerging markets, it is properly evaluating its options in investing in developed markets, especially Europe, again.

Europe, it seems to many, is the best destination for CIC investment among developed markets. First, Europe is China's largest trade partner. The trade ties and geographical proximity have certainly fostered more collaboration opportunities than the Sino-US relationship. Second, geo-politically, China always considers Europe to be more friendly, or at least neutral, compared with the US and Japan. As a result there may be more areas of collaboration between China and Europe than other developed markets. Finally, many European countries' economies are still recovering from the sovereign debt crisis so have a greater need for capital and investment from outside the region. At the same time, many Chinese companies, CIC included, are anxious to seek and engage overseas investment targets. Such a good match between demand and supply may spawn attractive opportunities for both sides, out of which a few areas seem particularly promising.

One area of expertise and advantage in CIC's investment is infrastructure, given the corporation's abundant capital arsenal and long-term investment horizon. Infrastructure may seem a surprising field to developed markets. However, a lot of European infrastructure was built just after World War II, and many European countries are now relaxing regulations to welcome overseas investment in an effort to jump-start their economies out of financial crisis.

Another of CIC's natural areas is China-themed investment. As Chinese consumers become more enamored with European luxury brands and lifestyle, many European companies are gaining bigger market share from China. Following the logic, CIC may be able to benefit from Chinese economic growth even when investing overseas by picking sectors and companies with great exposure to the increasing wealth of Chinese. At the same time, there are also distribution channels and strategic partners whose value would sour as more Chinese companies vie to increase their influence in the European market at the same time.

Last, but certainly not least, European companies have perfected the science and technologies in many high-end manufacturing and R&D intensive areas. These companies may command sustainable market leadership and bargaining power. Although this may require even more leg work and due diligence, investing in such companies may not only diversify CIC's portfolio, but also improve its long-term investment returns.

The author is deputy director of the Advanced Institute of Finance at Shanghai Jiao Tong University.

( China Daily European Weekly 09/27/2013 page9)

Today's Top News

Website launched to assist expat professionals

50 foreign experts honored with Friendship Awards

Up, up, Huawei finds new friends in Europe nations

Visible face of CIC investment

Shanghai opens free trade zone

Academic warns Obama on Pacific policy

Little-known now, but a big future

NSA mapping social networks of US citizens

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|