Delivery industry's wings keep growing

Updated: 2012-08-24 09:23

By Zhong Nan (China Daily)

|

|||||||||||

|

DHL has set up an express hub in Shanghai to meet the increasing demand for delivery services in China. Provided to China Daily |

The e-commerce boom has given a new burst of life to an already thriving business

|

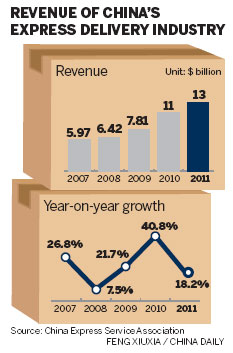

China is now the third-largest market for express services behind the United States and Japan. Last year, 7,575 express companies were operating in China, compared with 5,327 in 2010. The average number of pieces of mail delivered reached 130 million a day last year.

With such growth opportunities, the competition for market share will intensify. International companies such as United Parcel Service Inc, FedEx Corp and Deutsche Post DHL have all been consolidating their presence by applying new tactics to collect more mail or parcels from Chinese consumers.

At the same time, big Chinese express service companies have been working hard to gain a greater share of the domestic market. Against tough international competition they have shown a willingness to bare their knuckles for a tough fight.

The rise of local private firms such as SF Express (Group) Co, YTO Express Co Ltd and Shentong Express Co Ltd even threatens China Postal Express & Logistics Co Ltd, the largest company in the domestic postal market. The domestic market share of this State-owned enterprise, which operates Express Mail Service, has fallen from the nearly 60 percent it enjoyed in 2006 to less than a third last year.

|

With an eager eye on expanding in China, FedEx, the operator of the world's largest cargo airline, and UPS, the world's largest package delivery company, are both seeking permits from the State Post Bureau of China to operate a domestic express business in China this year.

FedEx wants to operate innercity express businesses in eight large cities, including Shanghai, Guangzhou and Hangzhou, and the State Postal Bureau has given UPS the green light do so in five cities, including Xi'an and Shanghai. In the meantime, FedEx Express, a subsidiary of FedEx Corp, is seeking more business opportunities in China-Europe air routes and the country's western regions.

The US company launched operations using a Boeing 777 freighter in Shanghai and Guangzhou last month, each city having five 777F flights a week, Tuesday to Saturday, connecting Shanghai and Guangzhou to the FedEx hub in Cologne, Germany.

It is the first time that FedEx has launched a 777F direct flight from its Asia-Pacific hub at Guangzhou Baiyun International Airport to Europe, which provides more capacity for the company's international express services from China to Europe.

|

||||

Eddy Chan, head of FedEx Express China, believes FedEx will also find new market growth in the country's west, as more companies move their manufacturing bases from the coastal cities to western provinces. There is a growing demand for fast and efficient international express services in the second- and third-tier cities in the region.

"As coastal cities shed basic manufacturing to concentrate on higher-value activities and inland cities begin to grow economically, there will be increased need for efficient transport and logistics services."

The transformation will not happen overnight, he says, and the government needs to continue its focus on putting in place the right policy framework and investing in hard infrastructure such as roads, airports and railways. The nation's investment in infrastructure will continue to underpin strong growth in the logistics industry.

But private companies are also chipping in large sums with an eye on long-term profits. One of those is DHL of Germany, which is bankrolling a number of strategies to retain and grow its market share in China.

The company opened its biggest express hub in Asia, the $175 million DHL Express North Asia hub at Shanghai Pudong International Airport this year. It can process up to 20,000 documents or 20,000 parcels an hour.

DHL has also announced plans to invest another $132 million to add eight freight aircraft to service high-demand routes between Shanghai and North Asia, Europe and the US by 2014. The planned flights will be operated by its partners and equity-held airlines: Polar Air, Aerologic and DHL Air UK.

Frank Appel, CEO of Deutsche Post DHL, says the current instability of the world economy will heavily affect the express environment. He predicts an increasing demand for express delivery and logistics services, that logistics services will need to be outsourced, and that new trade routes will be needed.

"The new Pudong hub would strengthen DHL's Asia Pacific network and its aviation strategy that cements our position in terms of connections, convenience and cost-effectiveness," Appel says.

Besides buying the aircraft, DHL is setting up an integrated logistics center in the Qianhai area, a zone of South China's Shenzhen city, to create a regional shipping hub and distribution center. The area will be used as a pilot for financial sector reforms after an array of steps taken by the government to boost the international use of the renminbi, China's currency.

Appel says that with Chinese economies fast integrating and free trade agreements reducing barriers to international commerce, logistics companies need capabilities that "are ahead of the curve and offer simplicity, speed and service".

"We basically believe that the perspective for the next decade or even two is still unlimited in China."

Last year DHL's sales in China reached 4.2 billion euros, representing half of its Asia-Pacific revenue and 10 percent of its global income. The company now expects China to account for a third of its revenue by 2017.

As some international companies step up their activities by setting up more air routes or cargo hubs, others have found that e-commerce is another exciting area to develop in China.

With two major hubs established in China and an extensive network already in place, UPS is well positioned to capture the next growth wave. E-commerce is the fastest-growing form of retail trade in the world, and many logistics enterprises in China are focusing on that area.

In China, UPS has been driving the development of e-commerce and has formed partnerships with small and medium enterprises as well as AliExpress, e-commerce giant Alibaba Group's online wholesale platform. UPS devised a solution that gives Alibaba's customers two-day guaranteed express shipping service options and enables them to manage their shipping and tracking processes online by integrating its shipping technology into the AliExpress system.

The increasing demand in the US, Europe and elsewhere for more sophisticated express delivery services is reflected in China, where more and more customers are calling for time-definite shipping, later cut-off times and earlier delivery.

"With China's rapid economic development and a rising middle class with enormous spending power, the country is transforming itself into a market driven by consumption. An increasing number of individual customers and the popularity of e-commerce will provide us with more chances of development," says Lim Tze Hsien, vice-president, strategy and operations, UPS China.

In anticipation of the increases in the nation's online transactions, UPS has expanded its business networks across the country with 33 fully controlled locations in China, including Beijing, Shanghai, Tianjin, Guangzhou, Shenzhen and Hangzhou, and has extended services to an additional 330 cities and counties.

UPS owns and operates two large hubs in China. Located in South China's Guangdong province, the US company's Shenzhen Intra-Asia Hub provides services for customers doing business with emerging Asia. Its Shanghai international hub links Asia to the rest of the world. UPS operates 190 flights a week with destinations to the US, Europe, Asia and major Chinese cities.

UPS says China is always one of the most important markets and that the company will continue to invest here. In addition to cashing in on e-commerce, the company is developing its business in the increasingly important healthcare logistics sector.

Even though the four biggest express and logistics companies in the world, UPS, FedEx, DHL and TNT Express NV, entered the China market during the 1980s, none has been able to dominate the market for its services. The main reason international companies in China have failed to match the successes they have achieved elsewhere is that Chinese express companies can still offer services at relatively lower prices because of their low management and labor overheads. That means, too, that is easy for almost anyone to set up an express delivery business.

Da Wa, secretary-general of the China Express Service Association, says that even though Chinese companies account for more than 94 percent of the domestic market share, foreign companies have prepared well to set up their business networks in China in different ways. With steady government support, a growing middle class and an internationalizing currency, the future demand of this industry is seen as highly attractive.

Da says foreign companies' advantages are in company size, branding, capital, management, technology and the quantity of aircraft, which domestic companies can learn from.

"Surely there is enough room for players from both home and abroad," Da says. "However, their combined abilities to provide services still lag far behind what's needed to meet the demand in China."

zhongnan@chinadaily.com.cn

(China Daily 08/24/2012 page12)

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|