Gold the answer to currency wars

Updated: 2012-07-06 12:31

By Gao Changxin (China Daily)

|

|||||||||||

|

James Rickards, author of Currency Wars, says China has to figure out a new way to sustain economic growth. Provided by bloomberg TV |

|

Hedge fund manager says yellow metal should be an integral part of investor portfolios

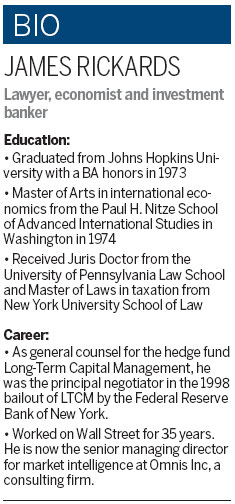

Global capital markets specialist and best-selling author James Rickards says that the ongoing currency wars are a combination of deflationary and inflationary factors that could leave painful scars on the global economy.

The New York-based hedge fund manager and author of Currency Wars: The Making of the Next Global Crisis says that the US dollar may no longer be the force it was in the past. Rather there will be a general swing in the financial system toward the gold standard, he says.

"Gold is not a commodity. Gold is not an investment. Gold is money par excellence," Rickards says.

The veteran fund manager says his target price of $7,000 (5,560 euros) for an ounce of gold makes even the most ardent of gold trumpeters seem conservative.

Rickards says during the currency wars, the global economies often engage in frequent devaluations of their currencies against the currencies of their trading partners in an effort to steal growth from those trading partners.

With both inflationary and deflationary factors at play, it is natural for investors to seek a safe haven for their investments. This, in turn, has pushed up the prices of gold, the historic hedge against inflation.

Gold prices reached a high of $1,600 an ounce in June, more than double the level in 2008. The price of the precious metal had dropped by about 15 percent from a record of $1,921 an ounce set in September, partly due to a stronger dollar.

The current currency war is the third such in recent times, and is more a combination of the deflation caused by the global financial crisis and the inflation from the US Federal Reserve printing more money.

Currency War I (1921-36) was dominated by deflation and ended in World War II, he says. However, Currency War II (1967-87), dominated by inflation, had a more "soft landing".

Rickards says that inflation in most of the emerging economies, including China, is a direct consequence of the Federal Reserve's decision to prop up the greenback by printing more money.

China has been facing an uphill task to keep inflation under control. Last year, the consumer price index, a major measure of inflation, averaged a high of 5.4 percent. In May this year the indicator dropped to a 23-month low of 3 percent after repeated tightening. But the Chinese economy has also been scarred by monetary austerity, leading to a three-year low GDP growth of 8.1 percent during the first quarter.

To prevent the dollar system from falling apart, the US needs to adopt a series of policies, including breaking up big banks, raising interest rates and cutting government spending.

"But it's highly unlikely that these policies will be implemented. So a dollar system collapse must be considered," he says.

Rickards says that going back to the gold standard will help people regain confidence in the currency because they will know they can convert their paper money to gold at any time and the government will make payment and this will keep the system honest.

Even if the dollar system collapses, the US will still be a superpower in the global financial system, he says, as it holds a substantial amount of gold reserves. Washington is believed to have gold reserves of more than 8,000 tons.

China, however, is at disadvantage in the gold standard system, as its reserves are still small, Rickards says. Only 1.8 percent of China's foreign reserves are in gold. With a population of 1.34 billion, the country holds just about $40.46 worth of gold per person. The nation last made its gold reserves known more than two years ago, and estimated them at 1,054 tons.

But China has also been steadily increasing its holdings. Gold imports through Hong Kong were 135,529 kilograms during the first three months of the year compared with 19,729 kilograms a year earlier, according to data provided by the Census and Statistics Department of the Hong Kong Special Administrative Region.

The ideal portfolio, Rickards says, should comprise 20 percent gold and silver holdings, 30 percent land, 20 percent fine art and 30 percent cash. He says he likes to stay liquid because cash gives investors "short-term wealth preservation" and the option to change into other assets.

Rickards says that both China and the US are enemies in the "Currency War III". Many believe that China has an edge over the US as it holds more than $2 trillion of US dollar-denominated debt. "Some even argue that China can dump the debt and destabilize the dollar. But I don't think it will happen," he says.

"In fact, the US has the upper hand in this case as it can freeze Chinese accounts in the face of any attempted dumping and also substantially devalue the dollar," he says.

"China has been slow to realize this fact. In hindsight, their greatest blunder will turn out to be the trusting of the US to maintain the value of its currency."

China will never dump dollar assets, he says, but will slowly shorten the maturity structure and diversify its portfolio to include the euro, the yen and gold, as well as making direct investment in hard assets like mines and railroads.

In fact, China has been actively moving away from the US dollar in recent years. Besides buying more gold, China is also increasing position in other major currencies, including the Japanese yen. The percentage of dollar holdings in China's foreign-exchange reserves fell to a decade low of 54 percent in the year that ended June 30 last year, from 65 percent in 2010, according to data provided by the US Treasury.

China is also launching direct trading between the yuan and other foreign currencies, as part of its efforts to depeg the yuan from the dollar. Last month, China and Japan decided to start direct trading of their currencies in both markets.

"China will diversify away from the dollar in a much faster tempo in the future," he says.

As far as China's economic growth is concerned, Rickards says that he remains bearish, and anticipates China's GDP growth to slow to 4 to 5 percent over the next 10 years, which will in turn hammer the world economy.

Chinese economic growth has slowed this year and the government has lowered the country's growth target to 7.5 percent. It is the first time that the government has set a target under 8 percent, which was deemed as a must to provide sufficient employment. During the first quarter, growth slowed to a three-year low of 8.1 percent. Economists expect growth in China to further slow in the second quarter to below 8 percent.

The government said it intentionally slowed growth so as to upgrade industries and transform the economy from export and investment-driven to consumption-driven.

"Everybody knows China needs to transform into a consumption-driven economy, but it is hard to achieve that goal," he says.

In Rickard's view, the private sector, instead of the State, should spearhead China's investment drive, as it is more efficient.

"Massive investments on infrastructure, which led China's growth in the past, can no longer be sustained and the country has to figure out a new way to keep growing."

As far as Chinese equities are concerned, Rickards says they are still not good investment choices. "Bad accounting standards and weak regulatory framework makes it hard to make sound investment decisions in China's equity markets," he says.

gaochangxin@chinadaily.com.cn

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|