The gadgets that will drive car demand

Updated: 2012-04-27 10:41

By Bob Bao and Ben Wang (China Daily)

|

|||||||||||

Chinese drivers want to keep up with the latest technology in cars that keep them connected

|

The news that China's vehicle sales are set to miss their 8 percent growth forecast has surprised many in the industry after the recent boom in car sales. In 2009 China overtook the US to become the world's largest auto market and went on to grow more than 30 percent in 2010, according to figures from China Association of Automobile Manufacturers. Despite the withdrawal of the incentive policy for car buying, China's auto market still enjoyed a growth rate of more than 5 percent last year.

But, with forecasts in March of a slowdown, auto makers are asking what features and trends will drive the next wave of growth in China's car market. An Accenture survey on in-vehicle infotainment (IVI) examined current and future demand for car technologies in Brazil, China, France, Italy, Malaysia, South Korea and the US as we believe this is a key area for brand differentiation and future market success. We analyzed data that covered consumers' car preferences, car replacement frequency and the demand for in-car technologies.

The survey shows that IVI and telematics systems are forcing auto makers to move closer to a connected vehicle. The connected vehicle refers to the rising number of cars or trucks that use the latest on-board devices, telematics and mobile connectivity.

Accenture believes that competitive pressures driven by the demand for IVI may have some auto makers focused on individual functions, rather than a complete operating system that could enable long-term success. The research demonstrates the risks of this approach.

Accenture expects the global IVI and telematics market to exceed $70 billion (53 billion euros) this year and $80 billion by 2014. While our research found that IVI penetration is relatively low in the mid- and lower-priced vehicle segments, its application is expected to rise among all segments in the near future and will reach almost complete penetration in luxury brands.

So how do Chinese car consumers perceive the IVI and telematics systems and how should car makers respond to the business opportunities this presents? The Accenture survey highlights that China's auto market, while slow to mature, now demonstrates a high level of consumption. This is illustrated by high market shares of luxury cars and SUVs, the intention of nearly half the car owners to buy a second car in the near future, and the strong interest and demand of Chinese consumers for advanced in-car technologies.

This demand for new cars and new technology could be important for sustaining the growth of China's car market. Drivers in China show a strong desire to see the latest in-car technologies in their next cars. These include streaming music as well as reading and dictating emails, support services such as automated breakdown calls, automated warnings for problems such as congestion or accidents and lane-changing warnings, fatigue warning and night-vision systems.

This demand will directly contribute to the growth of IVI and telematics systems, including eco-efficiency, security and safety, and comfort. In terms of in-vehicle services, the annual turnover of the global services market is expected to grow to $20 billion in 2014.

According to the survey, some in-vehicle technologies are more widely applied in China than the other six countries surveyed, such as digital radio, using on-board devices to read and dictate e mails while driving and streaming music. Accenture believes a convergence of these devices with the latest mobility services will aid auto companies in their pursuit of competitive positioning as they respond to consumer demand for the future in-car technologies, services and capabilities.

The marketplace is exploding with a proliferation of connected-vehicle solutions and applications to meet customer priorities. Accenture estimates that IVI could deliver up to $200 a year in revenues for each new car as drivers and passengers increase the use of services provided by in-car technology.

If sales for 2012 in China reached 75 percent of the 20 million units forecast at the beginning of the year, this would represent total IVI revenues of up to $3 billion. The revenue growth will gather pace as more systems are produced to give consumers access to new technologies, such as cloud computing, and full Internet capability.

It is clear that consumers are, for the first time, determining in-car technology, and the automakers are being forced to satisfy demand, not create it as they used to. This means shorter timeframes for new ranges and changes to vehicle specifications.

This consumer desire for ever more sophisticated in-vehicle systems that can accommodate the latest advances in technologies, such as smart phones, portable devices, and apps store capability, will make it increasingly difficult for companies to keep up with and make money out of changing preferences unless they have the appropriate operating systems and processes in place to absorb them.

Providing the newest technology is important, but even more important is developing the operational capability to effectively respond to any potential advances down the road. This will be critical to sustaining success in the connected-vehicle market.

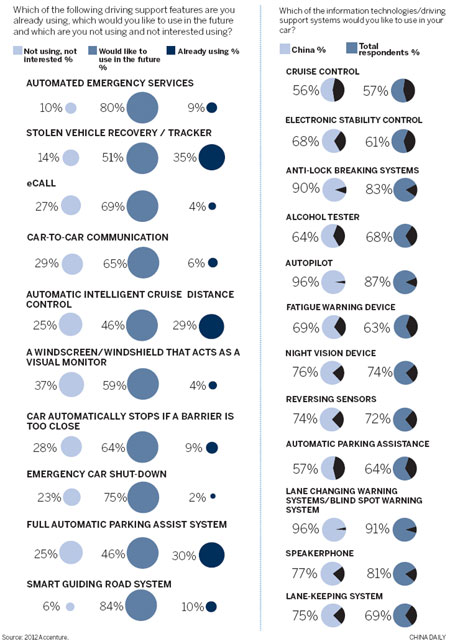

The industry is already beginning to move in that direction, adopting operating systems to match consumer technologies. Such systems and others like them will give auto companies the agility required to respond to the aggressive pace of technology change, as well as address the emerging trend of product and services customization, while reducing costs on research and development. Furthermore, the Accenture survey reveals two major trends regarding Chinese consumers' use of, and demand for, in-car technologies that show the importance of this approach. Chinese drivers are particularly focused on in-car safety systems.

A higher number of Chinese respondents plan to use these driving support systems than the average level of all the surveyed countries. These include electronic stability control, anti-lock breaking system, autopilot, fatigue warning device, night vision device, reversing sensors, lane-changing warning system/blind spot warning system and lane keeping system.

Chinese drivers are showing great interest in and demand for many advanced in-car technologies, such as automated breakdown call, automatic stop if a barrier is too close, windscreen that acts as a visual monitor and car-to-car communication.

Taking the automated breakdown call as an example, only 9 percent of Chinese respondents are using this technology, but as many as 80 percent respondents would like to. Chinese consumers' interest in and demand for these advanced in-car technologies will promote their wide application across the auto market.

With the withdrawal of the national incentive policy, it will be very hard to sustain the explosive growth of China's auto market that occurred in 2009 and 2010. But Chinese consumers' steady demand for luxury cars, forecasts for vehicle replacement as well as the expected demand for advanced in-car technologies will help maintain a stable and rapid growth for the auto industry in China. However, the car makers, car parts companies and related IT companies planning to target the Chinese market will need to understand consumer expectations for IVI and take a strategic approach for this business opportunity if they are to take a share of this opportunity.

Robert Bao is principle of Products, Automotive, Accenture China; Ben Wang is executive director of Products, Automotive, Accenture China. The views do not necessarily reflect those of China Daily.

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|