Four myths that need to be exploded

Updated: 2011-10-07 11:14

By Jiang Shixue (China Daily)

|

|||||||||

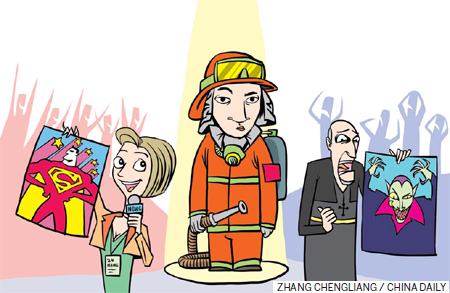

In trying to understand China's willingness to help, some are looking for trouble where there is none

The European debt crisis has sparked concern worldwide, and China, obviously an important player, is keen to help where it can. Such help is aimed at reducing negative impact on the world economy, which is in danger of suffering a double-dip recession.

However, at least four myths that are in circulation regarding China's attitudes to the crisis need to be quashed. Doing so will not only enhance bilateral relations between China and Europe, but also pave the way for international help to debtor nations.

Myth 1: The debt crisis in Europe is none of China's business.

It is true that the European debt crisis has little direct bearing on China because the countries caught in it are considered peripheral European states whose trade and economic relations with China are limited. But China should not stand idly by as the crisis unfolds. China and the EU have signed the Comprehensive Strategic Partnership, of which there are diverse interpretations. A simplistic interpretation of the relationship is that we are brothers. Thus, for the sake of brotherhood, China is obliged to offer a certain kind of help to the EU.

Some of those at the recent Summer Davos of the World Economic Forum in Dalian said Greece and other European countries in crisis needed to bear the responsibility of putting their own houses in order. This view holds that before authentic reforms and belt tightening are undertaken, China's help would be harmful because help from outside tends to delay the crucial reforms needed to tackle a crisis.

That view is problematic. Someone who is ill can recover without taking medicine. But if someone who is gravely ill does not seek medical help he risks dying. Right now Greece is critically ill. It has struggled to get its economy back on track for almost two years, and if no additional external aid is offered, catastrophe looms.

China and other countries should do whatever they can to save Greece. Indeed, a friend in need really is a friend indeed.

Myth 2: China's offer to help the EU is "friendly blackmail".

At the Summer Davos, Chinese Premier Wen Jiabao promised that China would continue to help the EU to overcome the debt crisis. He also expressed his wish during a telephone conversation with the EU President, Jos Manuel Barroso, for the EU to look at China in a strategic perspective by granting it market economy status. Even though China will automatically gain that recognition in 2016, an earlier grant would be understood by China as a token of friendship and bona fides from the EU. Regrettably, Wen's words were interpreted by some as China engaging in "friendly blackmail" of the EU.

Whether you are talking Chinese or English, accusing someone of blackmail is derogatory. If China had done nothing to help ease the European debt crisis it would have been criticized as lacking sympathy. Now that it has bought bonds of European debtor countries and promised to make more investments, it is accused of blackmail. As the English saying goes, if you want to beat a dog, you can easily find a stick.

Over the past 30 years and more, China, because of deep reforms and opening to the outside world, has greatly changed in every way. Its economy is now totally market oriented. The only difference between China's market economy and that of the West is that the former is a socialist one. But the EU refuses to recognize this fact and continues to protect its market against Chinese exports with anti-dumping rules.

Of course, refusing to recognize China as a market economy makes it easier for the EU to invoke those rules.

The EU granted Russia market economy status eight years ago even though the former Communist country in transition was not a member of the World Trade Organization. Is Russia's market system more developed than China's? Not really. Fact: the EU depends heavily on Russia's energy supply.

Myth 3: China can save Europe from its debt crisis.

China's economic strength has been growing rapidly, and now its gross domestic product is the second largest in the world, after the US. Per capita GDP has risen from 152 euros in 1978 to 3,030 euros today. In addition, China has accumulated $3.2 trillion in foreign exchange reserves.

An article in The Economist on April 14 summed up the staggering purchasing power that China enjoys. It could, the article said, as "a triple trillionaire", buy the world's projected oil output this year at $3.41 trillion, or all the US farms at $1.87 trillion, or the total amount of the sovereign debt of Portugal, Ireland, Greece and Spain at $1.51 trillion, or Apple, Microsoft, IBM and Google at $916 billion, or US military equipment at $414 billion, or Manhattan real estate at $287 billion, or Washington real estate at $232 billion, or the world's 50 most valuable sports teams at $50 billion.

The gist of a joke doing the rounds at the moment is that China is Italy's "sugar daddy". Such black humor distorts China's image. After all, far from being a sugar daddy, it is still a developing country. Under World Bank guidelines, more than 200 million of China's people still live in poverty. How then can it "save the capitalist world"? No government anywhere would shunt domestic problems aside to show generosity. China can buy bonds of European debtor countries but would be in no position to get them out of the debt crisis. So China is a helper, not a savior.

Myth 4: China is in a "scramble for Europe".

Since the end of the 1990s China has been implementing the so-called going global strategy, encouraging Chinese investors to make overseas investments all over the world. Europe has political stability, a huge market and well-established infrastructure. For China, it and other emerging markets are an attractive investment destination. Economics textbooks and reality tell us that good investments benefit both the countries making an investment and the countries being invested in. Chinese investment in Europe can create jobs, contribute to tax revenue and promote local development.

But some people in Europe fail to recognize this. As The Economist writes, "Chinese investments make Europeans nervous that China intends to use its amassed surpluses to buy European jewels at knock-down prices."

According to a report published in July by the European Council on Foreign Relations, an NGO well known for criticizing China, says a kind of "scramble for Europe" is under way as China buys European government debt, invests in the continent's companies and exploits its open market for public procurement. "Crisis-hit Europe's need for short-term cash is allowing China not just to strike cut-price deals but also to play off member states against each other and against their own collective interests," the report says. No wonder the fear-China mentality has caused uproar as the Chinese investor Huang Nubo looks at investing $100 million in Iceland to build a tourist resort. Something sinister is seen in the project because Huang used to work in the publicity department of the Central Committee of the Communist Party of China and the Ministry of Construction. Worse, the investment is perceived to provide cover for China's geopolitical interests in the Atlantic island nation, which is a member of NATO.

So that China's benign intentions are not misinterpreted, these four myths need to be given short shrift.

The author is a professor and deputy director of Institute of European Studies, Chinese Academy of Social Sciences. The opinions expressed in the article do not necessarily reflect those of China Daily.