Auto mode

Updated: 2011-10-07 10:07

By Alexis Hooi (China Daily)

|

|||||||||

|

Li Min / China Daily |

French factory owner Nicolas Mazeaud points to one of his Chinese workers and says the young man might not stay for long in his company. "Some of these turn up with colorful, dyed hair. They work maybe two days and then they leave. They want to be DJs instead and work in some club at night."

Mazeaud, 35, is the director of Foshan Asytec Metal and Plastic Products Ltd (Asytec), an original equipment manufacturer (OEM) that makes plastic and metal products like remote controls and water heaters for French companies. Mazeaud's 4,000-square-meter factory is located in Foshan city of southern Guangdong province. Launched with an initial investment of 300,000 euros ($401,230) seven years ago, Asytec now records annual revenue of 3 million euros.

| ||||

Fueled by low-cost manufacturing and export-oriented industries following the country's reform and opening-up in the late 1970s, Guangdong has been one of the main engines of China's economic growth in the past three decades and one of the reasons why the country is known as the "factory of the world".

Last year, the province's GDP ranked first nationwide, accounting for 11.4 percent of the country's total. Besides Foshan, other key cities like Shenzhen, Zhuhai, Dongguan and provincial capital Guangzhou clocked GDP growth ranging from 10 percent to 13 percent, according to industry figures.

For Mazeaud, the advantages offered by the PRD mean he is able to easily make products from scratch and at a fraction of what they would cost in Europe.

But as the Frenchman points out, one of the main drivers of the PRD's success - labor - is now also threatening its development and making it seem ironic in a country known for its abundant and inexpensive workforce.

Many areas in the PRD are already raising minimum wages along with rising inflation and labor shortages, as workers find it less attractive to work in the region compared to their home provinces where the cost of living is lower and the quality of life better.

Earlier this year, Shenzhen authorities said they would raise the minimum wage by 20 percent to 1,320 yuan ($200, 150 euros) a month - the highest in the country. Guangzhou is also raising its minimum wage by 18 percent to 1,300 yuan a month. Wages in many areas in the PRD have risen more than 30 percent with pay for ordinary workers averaging nearly 3,000 yuan a month.

|

|

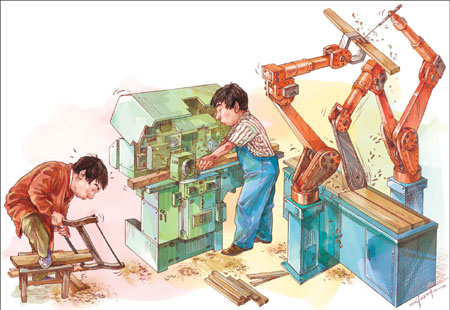

Amid these changes, electronics manufacturing giant Foxconn Technology Group recently announced plans to use 1 million robots to replace some of its workers in its 1.2 million-strong workforce over three years. Foxconn is the leading OEM electronics company in China, making products for companies such as Apple and Hewlett-Packard. It was embroiled over accusations of "mistreating" its employees following a workers' suicide scandal at its Shenzhen factory earlier this year.

The company has reportedly set up an "automation robotics division" and is hiring engineers to design and install the robots. The robots are expected to be used for simple work like assembly, spraying and welding. Foxconn's boss Terry Gou has said the robots will help cut rising labor costs and improve efficiency. The company has 10,000 robots, increasing to 300,000 next year and 1 million in three years.

Robots have steadily moved into factories in Asia. The region (Australia included) took up almost half of the global operational stock of multipurpose robots last year, figures from the International Federation of Robotics show. The US took up 17 percent; and Europe, 33 percent.

Robots could help carry out about half of the production process of electronic products in the future, analysts have said, but other labor analysts say robots replacing humans will only occur on a small scale, with many of the machines actually boosting efficiency and widening job scopes as businesses at all levels find ways to survive amid changing economic trends.

Zhang Yuge, director of the center for public policy at the Shenzhen-based China Development Institute, says businesses in the Pearl River Delta itself are facing a "multi-faceted problem" and labor woes form a large part of that.

The proportion of the cost of labor out of the total cost of goods in the country rose from 11.1 percent in 2009 to 12.3 percent last year, up 1.2 percentage points, while the proportion of the cost of raw materials rose by 0.9 of a percentage point from 63.1 percent to 64 percent over the same period, latest industry figures show.

"Low-end manufacturing in the PRD has thrived because of low wages. But as the economy develops and matures, it is also necessary for wages to go up," Zhang says.

"That means costs will first go up and that will force many industries to look at using more machines and even replacing workers with robots. But all these changes also depend on the nature of the industry. How can industries here move up the value chain and steer away from low-end, labor-intensive sectors?

"This is a problem for the government, companies and society. There must also be a move toward training more highly skilled labor. We hear reports now about how students coming from villages reap the most economic benefit if they have secondary education. Those who make it to the tertiary level, on the other, find it hard to compete. That's because so many sectors are still mired in low-cost manufacturing."

Asytec's Mazeaud himself employs about 100 people in his Foshan factory and almost all of them are Chinese workers from Guangdong as well as provinces like Hunan and Hubei.

The labor problem he is facing is not just rising wages, he says.

"I think Foxconn made the right decision. One of the biggest issues that all companies and factories here have right now is not just the labor shortage, it's also the attitude of workers. They are not so willing to work anymore. There was a labor shortage last year, or about 18 months ago, when you just could not find people. Right now, we can find people, it is easier than one or two years ago, but the quality of labor and the willingness of the workers to work hard is not as good as before," says Mazeaud, who is trained in mechanical engineering and worked for a Canadian company in quality control before starting Asytec.

"A couple of years ago, people would come to work in a factory without thinking that this would be a bad job for them. They would be happy to work in a factory. But in the past year or two, the younger people who are a little more educated are not so willing to work in factories anymore. I guess they prefer office or restaurant jobs," he says.

"So what you get when you hire workers for the factory are uneducated people, older; or younger ones who are not willing to work hard.

"We get a lot of younger people, and they think they can just buy a house, do nothing, wait one year and then sell it for a big profit. So they don't understand that they have to work hard to make money. They don't want to work in a factory. They prefer to work in a restaurant or shop because it can seem much easier than factory work."

That also means some of the "best workers" turn out to be middle-aged women with families and children because they are more stable and stay longer, Mazeaud says.

"We try to hire older workers, women who have children. About half of our workforce are women. When they have a family and children they know what respect and taking care of other people means. They know what they want, they are stable and want to do well. They want to earn higher wages for their family to be better off," he says.

Qiu Dong, deputy director of the small and medium-size enterprises (SMEs) department under the Ministry of Industry and Information Technology, said at a recent industry forum in Guangzhou that businesses in the region are facing increasing manpower, material and other resource challenges with the country's economic development.

"One of the most important priorities for the government now is for SMEs to successfully transform themselves with the help of technology to deal with the changes and become more sustainable for the long term," Qiu said.

Martijn van der Woude, who heads the Shenzhen-based human resources company ShangZhi HR Solutions, says the labor crunch is a major problem that his clients are facing every day. That adds to rapidly rising costs in the region that are also fueled by higher taxes and inflation.

"Companies are being hit on three fronts - taxation, inflation and a shortage of workers - so they either move inland where costs are lower, boost automation in their production process, or simply leave," Van der Woude says.

"Not all businesses can also have the option of increasing automation to replace workers; that really depends on the nature of their business. Those that are too labor-intensive might actually not find it that easy to immediately do so."

Chen Guanghan, an economics professor and director of the center for studies of Hong Kong, Macao and the Pearl River Delta at Sun Yat-sen University, says using more machines and robots for businesses that can afford them is the "inevitable way to go for enterprises in the region".

"It's a natural and practical step for the economy here to develop into the next stage. There are many advantages to this. For one, boosting automation and using robots for those enterprises that have the capacity to invest in them will help to reduce labor costs and ensure that businesses do not cut back on quality instead," Chen says.

"Yes, there might be immediate concerns that using more machines will take away jobs. But it's ultimately good for Guangdong because the changes will push the economy to include more high-tech, highly skilled and even service-oriented industries. That is the direction that Japan and Taiwan went and that direction will also bode well for the PRD."

Mazeaud says he has also had to use more machines to improve his production and plug the current challenges of finding the right people.

"We are a small company, we are not going to buy a million robots next year. But this is something that we take into account when we buy a new machine or when we design a new manufacturing process. Starting from a year ago, we have been thinking about how many workers will be needed to improve our processes."

Boosting automation so that fewer workers are needed would cost 30 to 40 percent more than relying more on simple tooling and machines, he says.

"It is something that we have to do now. We spend more money to become more efficient. We're upgrading the tooling to put onto machines so that we use fewer workers. We spend more money first but less afterwards. But it's not just about money, it's about reducing the headaches and issues related to workers," says Mazeaud, adding that he had to face a strike by his workers one day when a move to restructure salaries to their benefit was not communicated properly.

"We spent more time explaining the changes to them and it was resolved in a day," he says.

"One of the biggest challenges we face here every day is training and communication. We are a French company speaking English to Chinese people. There are communication issues and cultural issues. All that put together is very challenging."

Still, for many factory owners and manufacturers like himself, the Pearl River Delta is where it all continues to happen.

"This is paradise for me, in terms of factories and industries. China is so far ahead in terms of manufacturing," he says.

"You want to buy plastics, metal, you want to do welding and machines you can find any supplier you want in the PRD region, from the whole supply chain down to the shipping of the products. The PRD is the place to be."