Currency: Faster yuan rise on cards

Updated: 2011-08-12 11:25

By Zhong Nan and Ding Zhongxin (China Daily)

|

|||||||||

Stronger currency will help in fight against inflation

The ongoing debt crisis in the US and Europe may force China to move faster on renminbi appreciation to mitigate the fallout on the domestic economy, experts say.

"Taming inflation is the top priority for the government and a faster appreciation of renminbi will help rein in the price of imports and limit their spillover impact on domestic prices, particularly if global commodity prices spike further," says Ding Yuanzhu, deputy head of the Policy Advisory Department at the Chinese Academy of Governance.

|

|

Such actions are deemed necessary especially as the recent consumer price index numbers, a major gauge of inflation, are signaling the chances of a hard landing for the economy.

Ding says that with the US likely to launch a third round of quantitative easing in an attempt to stimulate its economy, it is time to realize that the two earlier US attempts had led to spiraling commodity prices and huge inflows of hot money into China, and further increased inflationary pressures.

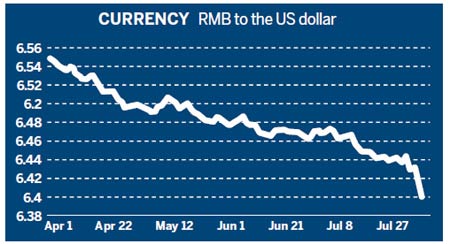

The weakening of the US dollar has also not helped matters. The greenback dropped to a record low against the renminbi on Aug 10, forcing the central bank to set the official median trading price of the renminbi at 6.4167 against the US dollar, the highest since Beijing initiated exchange rate reforms in 2005.

"Further action on the renminbi front depends largely on three factors - inflation, unemployment and overseas conditions. China's decision on currency appreciation should be based more on whether inflation or unemployment is the bigger threat," says Derek Scissors, a research fellow in Asia Economic Policy at The Heritage Foundation. "Right now, an appreciating renminbi is a much better choice."

The sharp increase in labor and imported raw material costs, partly attributable to the relatively lower currency exchange rate between the yuan and the US dollar, is also squeezing the profit margins of small and medium-sized enterprises in particular.

"Under such circumstances, the government should make the renminbi stronger and readjust its industrial structure," Ding says.

"Rather than focus on growing the export numbers, policymakers must focus on inflation. International experience shows that high and sustained inflation can damage macroeconomic and social stability," says Wang Jiacheng, a senior researcher at the Academy of Macroeconomic Research under the National Development and Reform Commission.

Dale Jorgenson, a professor from Harvard University, feels there will be a lot of upward pressure on the renminbi due to the unattractiveness of China's policy of accumulating large foreign exchange reserves.

"Appreciation of the renminbi will dampen inflation, the main problem in China for now," Jorgenson says.

Yu Yongding, a former adviser to the People's Bank of China, says China holds a large stash of dollar-denominated foreign assets that does not do any good for the Chinese economy. At the same time China also has sizable amounts of renminbi-denominated liabilities.

"Clearly this currency structure of assets and liabilities makes its net international investment position very vulnerable to any devaluation of the dollar against the renminbi," Yu says.