Data point to Chinese economy shrugging off sluggishness and stabilizing

Updated: 2016-04-22 07:08

By Andrew Moody(China Daily Europe)

|

|||||||||

|

Evidence suggests China's economy is continuing to restructure away from traditional manufacturing, such as this production line in Yiwu, Zhejiang province. Provided to China Daily |

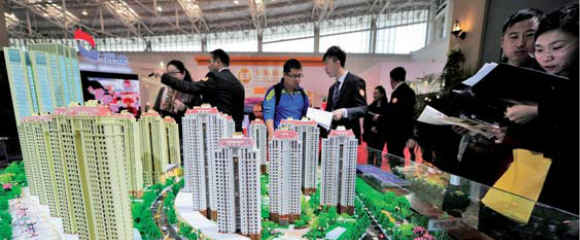

"There is some life in the economy that there wasn't a few months ago, especially in the physical sphere, with the pickup in real estate and even in heavy industry, with more steel being required for the extra construction," he says.

One of the questions, however, is how much the improved performance was down to credit expansion.

Total social financing, which includes bank lending, local government bonds (and also swapping debt for bonds) as well as shadow banking, rose by 6.59 trillion yuan ($1.01 trillion; 898 billion euros) in the first quarter, according to the People's Bank of China.

While this was a clear demonstration of the government's commitment to boost the economy, there were also concerns that the resultant fillip to growth may only serve to further stoke up debt in the longer term.

"The banks have been encouraged rather than discouraged from lending, whereas until recently they have been held on a leash," Kuijs says.

"A lot of the credit has found its way into the real estate market, with property developers finding it easier to get access to finance. They have also benefited from the booming bond markets (with local governments raising money for infrastructure spending) since the middle of last year."

George Magnus, senior independent economic adviser for UBS in London, says he expects the improvement in the economy to last until at least the third quarter this year.

"If the authorities opt to tame the credit boom, slower growth will happen fairly quickly. If they don't, then the wane in momentum will be slower but the financial and economic instability risks for 2017 and 2018 will have been further inflated."

Roger Bootle, executive chairman of Capital Economics, the London-based consultancy, was more optimistic.

"It is too early to sound the all-clear. After all, we haven't yet heard the fat lady sing. She hasn't even begun to mount the rostrum (if indeed she has one)," he wrote in Britain's Daily Telegraph.

"So you could easily accuse me of being premature. But it is beginning to look as though the China economy has stabilized and may even be about to turn up."

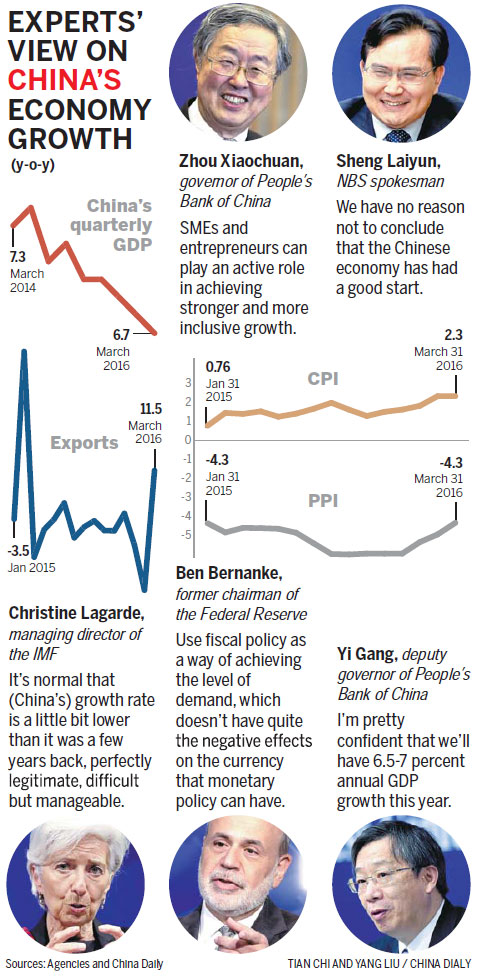

Other figures on China's growth published by the National Bureau of Statistics on April 17, however, paint a less rosy picture.

The quarter-on-quarter growth statistics are sometimes seen as a more reliable indicator of China's underlying rate of growth.

These showed a 1.1 percent increase between the fourth quarter of last year and the first quarter of this year, which suggests an annual growth rate nearer 4.5 percent.

Zhao Hao, Asia economist at Commerzbank based in Singapore, says this data "less positive" than the annual figures.

"They are seasonally adjusted and would tend to strip out the effect of the policy easing. We cannot say the difference between the headline figure and the quarter-on-quarter figures is just down to the stimulus, but it suggests the economy is growing slower than might have been suggested," he says.

The labor market data remains broadly positive. Nearly one-third (30 percent) of companies plan to hire senior executives, according to the latest survey by GMP Talent, the executive search and human resources advisory company.

This was more than the 20 percent who planned to axe senior jobs.

David Wu, GMP Talent's general manager and its managing partner in Shanghai, says much of the hiring is taking place in new sectors of the economy.

"We expect to see more hiring activities in healthcare and medical devices, hospitality, the internet, education, industry automation and clean energy sectors. The jobs tend to be in general management, marketing, sales and operations.

"The momentum is also coming from Chinese enterprises. They are tending to hire more staff, while there is a slowdown in the multinationals recruiting."

China, which drove global economic growth after the financial crisis, has, to some extent, become a bright spot once more.

The latest GDP data was published just two days after the IMF cut its forecast for global growth this year by 0.2 percentage points to 3.2 percent.

Zhu Ning, deputy dean at the Shanghai Advanced Institute of Finance, says there is a sense of relief because China's data could have been a lot worse.

"The numbers are looking better, so that in itself is encouraging. That the IMF at the same time is upgrading its China forecast indicates that they think China has more weapons in its arsenal to maintain growth.

"What the latest data show is that China is avoiding a hard landing that many were worried about and, indeed, predicting."

One wider concern, given the substantial increase in credit in the economy in the first quarter, is what this means for the implementation of the government's economic reform program.

Today's Top News

Chinese runners flood London for marathon

Chinese philanthropists explore British way of 'giving'

Back on the up

China leads way on US adoptions

Ericsson reshapes and sees Q1 profit rising

Snowden sues Norway to seek safe travel to get prize

Nation's drones are in demand

Beacons and gun salutes as Queen turns 90

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|