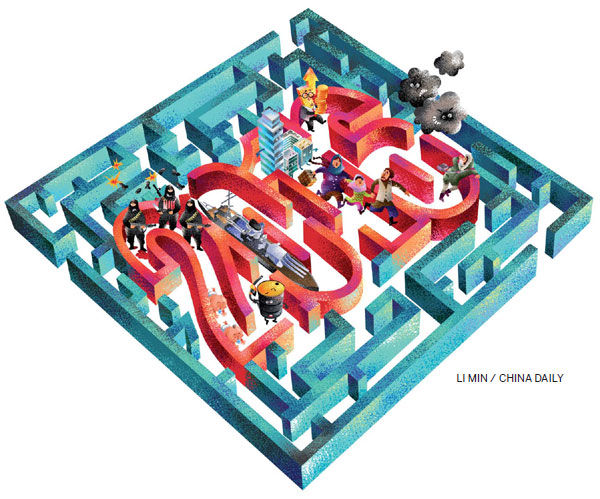

Twelve predictions for the new year

Updated: 2016-01-08 07:57

(China Daily Europe)

|

|||||||||||

China Daily invited researchers and experts to share their thoughts on 12 major issues that are expected to have an impact in 2016

1. Will the Chinese economic slowdown continue?

Cao Heping, professor at the School of Economics, Peking University

Yes. Generally speaking, China's economic growth will slow down. But the Chinese economy will still maintain a sustainable growth rate. I expect China's GDP growth rate to be between 6.7 percent and 7.7 percent in 2016.

The traditional economy will see low-speed growth, signaling a slowdown. But the new economy could come up with a series of surprises, boosting growth. The new economy is the result of the transition from a manufacturing-based to a service-based economy.

For instance, the telecommunications and computer sectors have developed over the three decades since reform and opening-up. With the rapid development of the Internet, which has led to the technological revolution of "Internet Plus", the new economy could get a fresh shot in the arm. The achievements of the new economy in the short term may be more astonishing than the achievements of domestic Internet giants such as Baidu, Alibaba and Tencent in recent years.

In the future, I expect the new economy to overshadow the traditional economy.

2. Will China's inflation rate fall below 1 percent?

Mei Xinyu, senior researcher at the International Trade and Economic Cooperation Institute of the Ministry of Commerce

No. The year 2015 was the first time the inflation rates of the G7 countries were below 2 percent since 1932, and the inflation rate will remain comparatively low globally in 2016. China's overall inflation rate will be less than 2 percent. The low inflation rate in China in 2015 was the result of a sharp decline in the prices of raw materials and energy. Since the prices are not likely to plummet further, China's inflation rate is not expected to fall below 1 percent.

Internationally, prices of raw material and energy will remain low for a long time. In 2015, global crude oil prices fell below $40 a barrel. And in 2016, Saudi Arabia may increase crude production because of domestic political reasons, and Iran will return to the global crude market, increasing the production by 1 million barrels a day. Under such circumstances, crude prices could fall even further.

Also, the producer price index will continue to decline, which will have a negative impact on inflation.

According to my research, China's inflationary pressure has come mainly from the fast rise in labor costs in recent years. But in 2016, the increase in the cost of domestic labor will slow down because of the economic downturn, which will further reduce the pressure of labor costs on inflation.

3. Will the renminbi depreciation continue?

Song Yu, chief economist at Goldman Sachs for China

Yes. Despite top policymakers reiterating their commitment to maintaining exchange rate stability and policy to keep the renminbi largely steady, uncertainty over China's foreign exchange policy and the sustainability of the Chinese currency's value remains high.

We (at Goldman Sachs) see the case for a weaker renminbi given the challenges of domestic growth and deflation and the potentially large pent-up demand of Chinese consumers for foreign assets, although we do not believe that the renminbi is greatly above fair value.

After all, China shows few symptoms of currency overvaluation. China's trade surplus is still strong and Chinese exports' share in the global market has remained quite stable. But letting the exchange rate float freely could conceivably lead to large currency overshooting (much more weakening), depending on the prevailing market environment.

Our baseline expects a moderate 3 to 4 percent depreciation of the renminbi against the US dollar in 2016.

This view envisages what could be characterized as a second-best reform scenario - namely, that a favorable window of opportunity for reform will arrive and the authorities will take advantage of that to transition the renminbi regime to a market-based (clean float) one.

4. Will the Chinese stock market see a steady boom?

Gao Ting, head of China strategy at UBS Securities Co

No. We (at UBS Securities) forecast a 1 percent profit decline for listed companies in the A-share market in 2016, compared with the estimate of 4 percent growth earlier in 2015. Corporate revenue will be under pressure because of weakened demand and economic deflationary pressure in 2016.

We expect the CSI 300 Index to be traded flat around 3,700 points by the end of 2016 (no big rise from the market at the end of 2015). The price-earning ratio is predicted to be 13.5.

Rising debt defaults by companies will hurt the asset quality of banks and reduce investors' risk appetite. Based on experience, the market does not perform well when there are strong expectations for a weaker renminbi.

But sectors such as consumption, healthcare and information technology will continue to outperform the rest of the market in 2016.

The weak growth momentum will weigh heavily on overall market sentiment, and the A-share market will be more liquidity-driven in 2016, when Chinese policymakers are expected to launch more measures to stimulate growth.

The top leaders may strengthen fiscal and credit supports on infrastructure construction, but they are unlikely to launch a new round of aggressive stimulus policies.

5. Can China solve the problem of industrial overcapacity once and for all?

Li Yiping, a professor at the School of Economics, Renmin University of China

No. Solving the excessive production capacity problem is a long-term and difficult task, which cannot be performed in one year. Challenges such as cutting industrial overcapacity require unremitting and long-time efforts.

In recent years, local authorities have regarded the real estate sector, along with large-scale infrastructure construction since the beginning of reform and opening-up, as the driver of rapid economic growth, which has resulted in the overcapacity of the steel and cement industries. Moreover, we have been overdependent on overseas market demand for a long time, which has led to the overcapacity of low-price export products. And the recession in production has resulted in the overcapacity of coal and electricity sectors.

Economic structural adjustment is crucial to reducing overcapacity, which should be mainly decided by market mechanisms. Several Western countries eliminated overcapacity and encouraged innovation to counter economic crises, which helped their economies prosper.

So the Chinese government should intervene in the market as little as possible and let it decide the direction of adjustment and which outdated capacity should be eliminated - and only then China's industries and products can rise to the middle and high end of the global industrial chain through innovation.

6. Is there likely to be a local government debt crisis?

Yang Zhiyong, a researcher at the National Academy of Economic Strategy, affiliated with the Chinese Academy of Social Sciences

No. The risk of China's local government debt is generally controllable, so a local government debt crisis is not likely in 2016. In 2015, China's overall local government debt added up to 16 trillion yuan ($2.5 trillion; 2.3 trillion euros) and the national debt reached about 11 trillion yuan. The overall sum of government debt is less than 50 percent of the national GDP, which is lower than the generally accepted warning line of 60 percent.

However, there are three major problems that we should be aware of. First, local governments' capabilities to cope with debt risk are different. The central government, therefore, should take different measures accordingly, such as supporting areas with low incomes, to avoid the spread of debt risks.

Second, local government debt faces huge pressure from short-term repayment. In 2015, local areas issued 3.18 trillion yuan worth of replacement bonds, which effectively dealt with the short-term repayment issue and reduced the debt financing cost. Hence, in 2016, the authorities should issue more replacement bonds to ease the pressure.

Third, we should expedite the process of building an overall local government debt repayment plan to cope with both the incremental and existing debts. Part of the existing debt should be repaid by selling off government assets. And incremental debts should be repaid through the reasonable and normalized distribution of central and local governments' incomes.

7. Will China's real estate see a rapid recovery?

Zhao Xiao, professor of economics at the University of Science and Technology Beijing

No. I don't think China's real estate market will recover in 2016. Instead, its condition could worsen.

Although China's overall real estate sales improved in 2015 compared with the previous year, property developers are still very cautious. Major real estate indicators such as purchase of land, new investment in the property sector and newly built houses all show poor performance. So I am not optimistic about overall property sales in 2016.

Every index shows that China's real estate industry is reaching a historical turning point, which is the trend of the market. The major market moves in 2016 will be big real estate developers acquiring small companies, rather than investing in new land and new housing construction. I suppose there will be zero growth in real estate investment for the first time.

Destocking of real estate will be under huge pressures in 2016. There are 696 million square meters of unsold housing and more than 7 billion square meters of housing under construction nationwide, which could require five to eight years to be sold.

The central government has launched a series of favorable policies for destocking real estate. The orientation of the policies is good, but whether they will be conducive to destocking depends on how they are implemented.

8. Will there be a dramatic rise in the number of couples applying to have a second child?

Qu Xiaobo, a professor of urban-rural development at Shanghai Academy

No. The two-child policy has been one of the hottest topics in 2015. because Now that the central leadership has allowed all couples to have two children, those eligible will consider all factors before deciding whether to have a second child or not.

With living costs increasing, a couple will have to spend a lot of money and time to raise a second child. A popular practice among Chinese is asking their retired parents to care for the child, but for that their parents have to be healthy enough for the task. Couples whose parents cannot do so must hire a child minder, which only high-income families can afford to do.

Only a limited number of couples meet all the requirements - a stable income, healthy and retired parents, or high income. More importantly, such couples must be relatively young to have a second child. Not all such couples are willing to have two children. Therefore, the number of people applying to have a second child will not be as high as expected.

9. Will global oil prices bottom out and begin to rise?

Lin Boqiang, a professor of energy economy at Xiamen University

Yes. Shrinking economic capacity brought down oil prices in 2015. But the trend of economic decline will reverse and the US Federal Reserve has already raised interest rates. The revival of the US economy means more production, more logistical needs, more electricity, as well as more oil consumption.

The overcapacity in the world is not as high as imagined and oil prices won't fall for too long. Oil prices can be expected to bottom out at the end of the first quarter of 2016 and start rising in the second.

But there will not be a dramatic rise in global oil prices, because global economic growth will not be dramatic. Therefore, global oil prices are expected to rise above $40 a barrel in the second quarter of 2016 but not exceed $50 a barrel at the end of the year.

10. Will the implementation of the Belt and Road Initiative break fresh ground?

Wang Yiwei, a professor in international relations at Renmin University of China

Yes. For the Chinese government, the priority in the past two years has been promoting the Silk Road Economic Belt and the 21st Century Maritime Silk Road worldwide, and seeking to achieve consensuses with relevant countries and international organizations (over 60 have said yes). In 2016, it will be the operation that counts.

The foreseeable breakthroughs at home and abroad will take place in some major inland infrastructure projects such as the China-Pakistan Economic Corridor, and the revamping of roadside harbors, including Jakarta in Indonesia, Sihanoukville in Cambodia, and Gwadar Port in Pakistan.

Besides, China is likely to make progress in negotiations on some major free trade agreements, for example, the ones with Sri Lanka and the Gulf Cooperation Council, as well as the Regional Comprehensive Economic Partnership.

The biggest uncertainty of all may be China's own economic well-being. As for the Belt and Road Initiative, which largely rests upon interconnectivity, strategic synergy, transnational capacity cooperation, and the exploration of the third-party markets, the focus in 2016 should be on enhancing international cooperation to deal with China's excessive capacity in traditional industries such as steel and cement.

More, to avoid potential geopolitical risks, China should give priority to expanding its markets in Southeast Asia, South Asia, Central Asia, and East and Central Europe, with a focus on promoting its new advantageous capacity involving high-speed trains, nuclear power and telecommunications.

11. Will more effective measures be taken to ease air pollution in China?

Zhou Dadi, vice-director of and senior researcher at China Energy Research Society

That depends. Actually, the authorities and researchers have already realized what measures could be effective. The issue now is how to implement them.

These measures include, most importantly, adjusting the economic structure. For example, steel production needs to be reduced. But the move will hurt steel plants, and whether it can be implemented will test the leadership's determination to fight air pollution despite the opposition of interest groups.

Another necessary measure is to optimize energy supply. China still relies on coal as its main energy source, which cannot be fundamentally changed in a few years, let alone 2016. But in the new year, we can at least increase the supply of natural gas to replace some of the coal used to generate energy, which, in turn, would raise heating charges in winter and increase the operation costs of enterprises. The government, therefore, needs transparent discussions to persuade the public.

In particular, for metropolises such as Beijing, there might be a stricter limit on the use of cars. At present, Beijing residents cannot drive their cars one day a week.

12. Will Europe significantly alter its refugee policies?

Chu Yin, an associate professor at the University of International Relations in Beijing, and a research fellow at the Center for China and Globalization

Hard to tell, although in the face of mounting pressure at home and abroad, Europe is already steering its refugee policies in a more conservative direction. Even the optimistic German Chancellor Angela Merkel has agreed to "appreciably reduce the number of refugees".

For the European Union, the major adjustments will be encouraging frontier countries such as Greece and Turkey (a would-be EU member) and stabilizing the Middle East region, in order to accommodate West-bound refugees. As for the asylum-seekers who have managed to enter Europe, they will probably be settled proportionately within the bloc.

What led to the outbreak of the refugee crisis is complicated. European countries' illegitimate interventions in Middle East affairs, which destroyed a few regional stabilizers including the Muammar Gaddafi government of Libya during the so-called color revolution, must be primarily blamed for the mess.

Also, the EU's expansion makes it harder for all members to control the entry of an increasing number of asylum-seekers from Arab countries. For certain political purposes, Turkey loosened its border controls in recent years, knowingly allowing more refugees to enter Europe.

(China Daily European Weekly 01/08/2016 page26)

Today's Top News

Going mobile

Wealth of options for China's super-rich

Man with knife shot dead outside Paris police station

Trading halted after shares fall 7% in opening minutes

China voices its 'resolute opposition' to DPRK test

Design exhibition to attract Chinese art works

Germans shaken by mass attacks on women

Concerns grow over Saudi-Iranian rising tensions

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|