US QE potential risks on emerging markets

Updated: 2014-01-27 10:43

(Xinhua)

|

|||||||||||

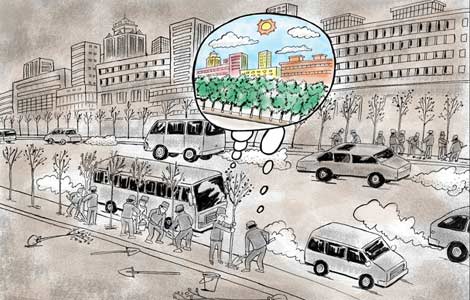

DAVOS - The spillover effects on emerging markets caused by the tapering of US quantitative easing (QE) could be varied from country to country, participants to the World Economic Forum (WEF)'s Davos meeting said Saturday.

Late last year, the Federal Reserve (FED) announced a "modest reduction" in monthly asset purchases. The official kick-off of the American central bank's gradual exit from the five-year-long stimulus was feared to throw the global markets, especially the emerging markets, into volatility, which has naturally become a hot topic in the annual gathering of global elites amid the expectation of a fragile recovery in global economy.

Christine Lagarde, Managing Director of the International Monetary Fund (IMF), said on a plenary session of the four-day event in Davos this afternoon that in May last year when the hint of FED to gradually wind down its asset purchase gave the markets a heavy blow, the actual flow of capitals (from emerging economies) has not been not that big, and not all emerging markets have been effected in the same way.

"Markets and investors are very cunning, they look at the fundamentals of economies, look at the strength of government, look at the predictability of policies, look at the policy-making, and they decide to move in, to stay, (or) to move out. There are countries that have hardly any currency movement, and there are countries that have seen significant currency movement as the result of the talk of tapering and subsequently the announcement in December", said the head of IMF.

She then emphasized that what has been happening between May and December, the official announcement of US unwinding of QE, has been beneficial for many countries, having taken India as an example to explain the impact of monetary policy, and as well as reaffirmation of fiscal policy on how prepared of the South-Asian country, which was greatly hit in May the rupee fell to a record low later, to the potential risks at present.

Palaniappan Chidambaram, Finance Minister of India, said earlier at the Davos meeting that developing economies would feel the certain pinch of the tapering, and India is better prepared than last year with its estimated strong economic growth this year, fiscal consolidation, reserves' augmentation, and other measures to stabilize its capital market.

"The risks associated with emerging markets remain high, but the way in which QE tapering is applied can play a role in either enabling growth or throwing currencies and economies into turmoil," FTI Consulting said in a report published at the beginning of this year's event.

The company warned that inflation destabilization and the rising costs of borrowing can be possible threats to emerging economies should they give poor responses.

Related Stories

World economy getting back on track, but no party time yet 2014-01-25 14:01

Davos important to exchange ideas in time of rapid change 2014-01-24 10:05

Vigor of global capital market in doubt as liquidity falls off 2014-01-24 09:53

Global economy grows on 'two engines': World Bank chief 2014-01-23 15:54

World's political, business leaders gather in Davos for WEF 2014-01-23 15:52

World economy not yet flying on all engines: IMF chief 2014-01-23 11:10

Today's Top News

8.8% salary hikes expected for 2014

China turns the tables on gamblers

China takes measures against H7N9

Terrorists behind twin explosions in Xinjiang

2014 diplomatic strategy outlined at Davos

China reports another H10N8 case

Big events in the Sino-French relations

IMF chief warns of risks to recovery

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|