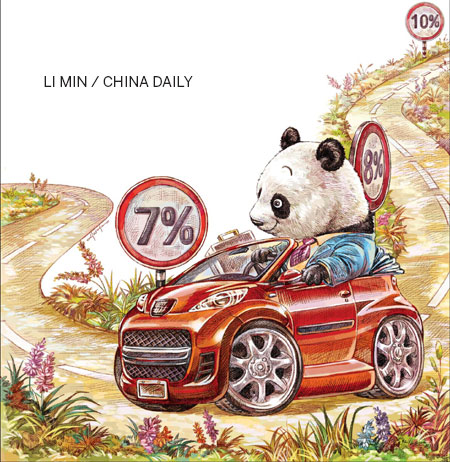

China's growth: Fundamental challenges still remain

What effect will China's slowing economy have on its growth prospects - and the rest of the world?

|

The Chinese economy is slowing. Even if GDP growth meets the government's target of 7.5 percent for the year as a whole, it will still be at a 14-year low. Premier Li Keqiang made it clear at the World Economic Forum Annual Meeting of the New Champions 2013 in Dalian earlier this month that the world's second-largest economy was entering a "crucial stage" of its development. He said a "structural transformation" had to take place if the economy was to maintain economic growth in the long term. That transformation will involve the economy moving from one driven by investment, much of it in infrastructure and other major projects, to one more fueled by the spending power of Chinese consumers. One of the uncertainties this year has been about the pace of deceleration of the Chinese economy. In the middle of the year there were fears that China's debt (combining government, local government and consumer borrowing) had risen by some estimates to 200 percent of GDP and that China's growth might be heading below the psychological 7 percent floor. In fact, only this week Sheng Laiyun, a spokesman for the National Bureau of Statistics, said this figure was the government's minimum tolerance level. Concerns about growth led to the government announcing a mini stimulus with targeted investments in railways and public housing. Recent data with factory output hitting a 17-month high in August, growing at 10.4 percent year-on-year and retail sales growth rising to 13.4 percent in the same month as well as fixed asset investment recording 20.3 percent growth (boosted partly by the mini stimulus), point to a more robust second half. Yet the trajectory for growth is almost certain to remain downward in the medium and long term as the economy adjusts to a new model. So what are the prospects for China's growth, what type of structural transformation needs to take place and what the implications of slowing growth may be, not just for China, but also the rest of the world?

|

Henry Bell, first secretary, economic, the British Embassy in Beijing, says the concerns about China's growth are not going to go away.

However, he also says that a lot of the more hysterical reporting is probably far off the mark. "I don't think there is much danger of Chinasuffering a hard landing - however, that might be defined - in the coming period."

Oliver Barron, head of the China office of London-based China economics research company NSBO, believes it is easy to underestimate the scale of the transformation China has to make if it wants to move away from its export and investment-led model.

Jian Chang, China economist at Barclays Capital, is one who does not feel the recent more buoyant economic data relating to trade and production fundamentally changes the picture.

"For me the fundamental challenges relating to the Chinese economy have not changed. This includes overcapacity in industry, manufacturing losing competitiveness, a property bubble and you have this financial risk with debt at 200 percent of GDP, combined with a slowing economy that implies rising non-performing loans," she says.

China's economic reform agenda is likely to be outlined at a crucial meeting of the Communist Party of China Central Committee in November.

Many observers are looking for measures that might boost consumption such as the reform of the hukou (household) registration system allowing migrant workers to bring their families to urban centers and live a higher spending lifestyle instead of just saving money and remitting it home.

Steps to strengthen China's social safety net, which will give people the confidence to spend and not save, are also seen as vital.

Further moves toward interest rate liberalization, seen as vital for the private sector to get finance and better capital allocation, are also anticipated.

"We are all putting a lot of hope in what is going to come out of the Third Plenary meeting and we are hoping for a great deal of reform and historically these policies always have a big impact on how the economy is going to pan out. I am sort of confident about what is going to happen in November," Zhu Ning, deputy director of the Shanghai Advanced Institute of Finance at Shanghai Jiao Tong University says.

|

Jian Chang (left), China economist at Barclays Capital; and Louis Kuijs, China economist at the Royal Bank of Scotland. |

China's level of growth is not just an issue for China but for the rest of the world. Some 40 percent of global economic growth since the onset of the financial crisis has come from China.

Williams at Capital Economics says falls in China's growth mainly affect commodity-producing nations in Africa, Latin America and also Australia while Magnus at UBS and Kuijs at RBS believes the level of China's growth now matters way beyond just the commodity producing countries.

Chang at Barclays says this level of contribution to the overall global picture was never sustainable anyway.

"It has been a period when global growth has also been very slow. The sharp rebound that China had following the global financial crisis was stimulated by domestic investment and rapid credit expansion. she says. [Full Story]

|

Outlook for the future |

|

Qian Liu, Deputy director, China Service, the Economist Intelligence Unit Q3 GDP forecast:7.5 percent 2013 GDP forecast:7.5 percent Forget about the magic double-digit growth but 7.5 percent is still very high internationally. If the hukou system is reformed, urbanization could still be a growth engine. China's growth will still impact the world and the next big theme could be major M&A activities in Europe and the US over the next five years. |

Oliver Barron, Head of the China office of NSBO Q3 GDP forecast:N/A 2013 GDP forecast:Slightly above 7.5 percent China's growth is clearly slowing but in the short term there is only so much the government can accept. To move from a consumption-driven economy China has to overturn a lot of momentum. Slowing growth will affect African commodity producers but the Chinese will want to own assets there. |

|

Zhu Ning, Deputy director of the Shanghai Advanced Institute of Finance at Shanghai Jiao Tong University Q3 GDP forecast:7.8 percent 2013 GDP forecast:7.6 percent Local government debt and the problems stoked up by the 2009 stimulus package remain concerns for economic growth. Banking and financial system reform is key to China's future growth. China's growth will continue to have a big impact on the resource-rich economies. |

George Magnus, Senior independent economic adviser for UBS, London Q3 GDP forecast:7.7 percent 2013 GDP forecast:7.5 percent Debt could be 250 percent this year but that alone is unlikely to cause the economy to slow down. Short-term measures to tackle debt and excessive credit could slow progress on reform. Slowing growth would have consequences for the world as a whole that it couldn't easily compensate for. |

|

Henry Bell, First secretary, economic, British Embassy Q3 GDP forecast:N/A 2013 GDP forecast:7.5 percent China is in transition and there has been too much hysterical reporting about China's slowing growth. Government reforms are likely to see growth decline in the short term. If China does rebalance its economy, its overall contribution to global GDP growth will fall. |

Jian Chang, China economist at Barclays Capital Q3 GDP forecast:7.6 percent 2013 GDP forecast:7.5 percent Major downside risks exist in the economy because of property bubbles and overcapacity in industry. The reformists have to deal with a lot of fundamental challenges. China contributing 40 percent to global growth was never going to be sustainable. |

|

Mark Williams, Chief economist, Asia, Capital Economics Q3 GDP forecast:N/A 2013 GDP forecast:7.5 percent Given credit has been expanding at an annual pace of 20 percent it would have been a surprise if growth hadn't rebounded. The key challenge for China's government is to steer income away from large state firms toward average households. Despite China's size, developments in its economy have a far smaller impact overseas than shifts in the US or Europe. |

Louis Kuijs, Chief China economist of RBS in Hong Kong Q3 GDP forecast:7.5 percent 2013 GDP forecast:7.5 percent China has not run out of surplus labor since 30 percent of the population still live in the countryside. Growth will continue to be fueled by capital deepening and increasing know-how of the workforce. International economy is now highly sensitive to China. |

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------

On the path of steady growth

Qian Liu believes "magic" high growth rate figures are now firmly in the past for China.

The deputy director of the Economist Intelligence Unit's Access China Service, based in Beijing, insists such rates will be difficult to achieve as the economy matures and weans itself off being mainly investment-driven.

Liu was always skeptical about whether these estimates reflected the actual level of debt in the economy.

She believes that local government debt (the main source of overall debt in China) could be between 50 and 60 percent, above the official estimates of between 20 and 25 percent, but not high enough to raise a major alert.

"That number is not a very low number but if you compare it to a lot of the troubled Western states, where the number is easily above 100 percent and to Japan, where it is 200 percent, I would say we are in a pretty good position."

Liu, who regularly appears as a commentator on BBC and CNBC and other platforms, says the economy has to move away from its investment-fueled model with money pumped into the economy directed at infrastructure projects also creating too much liquidity that has resulted in property bubbles.

"China cannot just be a liquidity play. Some of the investment in recent years has created over-liquidity just to sustain fast growth."

She believes for the economy to make the transition to being more consumer-led than investment-driven, a more natural balance has to be achieved.

"When a country has reached a certain level of investment, it reaches a point where no more massive amount of investment is needed and the consumption story can follow from that. It is not that we should stop investing and people should just spend more from now on. Nobody has ever got rich by spending more."

Liu, who is also part-time visiting research fellow at Fudan University and lectures at both the Chinese Academy of Social Sciences and Tsinghua University, says analyzing and researching the Chinese economy from within China is very different than from without.

"When you talk to economists outside of China they are a lot more bearish than when you talk to economists actually in China," she says.

"I don't think it is just a sample selection thing but more that there is a lot of misunderstanding on China. I think they do not understand it psychologically. They have this idea that China is not going to work and tend to pick up on stories that support that view."

Liu, who has published articles in a range of journals, including Oxford Economic Papers and China Economic Review, says the performance of the Chinese economy has become increasingly important as a key barometer for other countries, particularly the resources-exporting nations in Africa.

She says, however, that China's impact on the rest of the world will be felt differently in future from the way it is now.

The world's second-largest economy will no longer just be seen as a major exporter of manufactured goods and an importer of resources from Africa and Latin America but as a major overseas investor.

She believes one aspect that outside commentators often fail to pick up on is the fact that some of China's inland regions are very much part of the developing world.

"I sometimes find it shocking to see how undeveloped some parts of China are. Even in China's second-tier cities there is so much potential to be released.

Liu also says that growth driven by urbanization in China still has some way to go and that economist Paul Krugman is wrong to argue that China has run out of "surplus peasants".

Liu also does not believe that rising labor costs in China will lead to an exodus of jobs from the country as companies seek to locate in cheaper locations like Vietnam, Bangladesh or Africa.

"One of the reasons why manufacturers want to stay here and not move outside is because of the economies of scale that China can offer. I was in Suzhou recently and when you talk to people in factories, they say that if they want to source any part they can just call a supplier and it can be shipped in 20 minutes. You couldn't do that in Vietnam or Bangladesh," she says.

Despite recent concerns, Liu maintains she remains optimistic about the growth outlook for the Chinese economy.

"I am pretty confident that for at least now and next year, there won't be any hard landing. For the long term, I am also relatively optimistic because there is a lot of fundamental potential and productivity that China can offer." [Full story]

|

Related stories: |

| Two Views |

|

China set to be major investor abroad [by Giles Chance, visiting professor at Guanghua School of Management, Peking University.] As China slows, its global impact won't diminish, but it will change. There is no doubt that a changing China will affect the rest of the world. But the change in the speed and shape of China's growth means that the impact will be different. The widespread perception of a China-boom world is set to change. Australia will be one of the nations that would find it extremely difficult to adapt to a changing China. Others like Brazil, Peru and Chile in South America, and South Africa, Angola, Zambia and Zaire in Africa may also feel the pinch. In Asia, South Korea, Malaysia, Thailand, Indonesia and even Japan will be affected by China's slowdown. In Europe, much of Germany's economic success has been provided by Chinese growth. Nearly 2.5 percent of German GDP depends on exports to China. A slowdown in China will affect the rest of Europe also. But it won't all be bad news. Driven by competitive domestic markets and a strong currency that makes foreign assets affordable, many Chinese companies will look to expand overseas. Chinese outward investment, which grew last year by 14 percent to $77 billion (58 billion euros), is set to boom. China's need to expand into high-end markets around the world will continue, underpinned by a currency which is on its way to joining the dollar and the euro as a major global reserve currency. As China continues recycling its current account surplus, investment in foreign government debt will be gradually replaced by overseas equity investments that confer ownership of foreign brands and technology to Chinese companies. Acquisitions made by Chinese companies will make the country a large equity owner around the world. Last month's agreement at the China-US Strategic and Economic Dialogue to negotiate a mutual direct investment agreement recognizes the inevitability and desirability of China's new global role as an investor. [Full story] |

Why economic slowdown can mean good news [by Mark Williams, chief China economist at Capital Economics, a London-based macroeconomic consultancy.] Slower growth, weaker investments are essential tools for achieving sustainability goals There are three reasons why such a high investment rate can be a problem. The first is that it can increase the vulnerability of the economy to shocks. In general, firms are more likely to cut back on investment when conditions worsen than households are to reduce their spending, so high investment economies are at risk of more volatile growth. In China, the ability of the state to direct SOEs to spend when the economy slows means this problem is less severe than elsewhere. But greater short-term stability is achieved only by magnifying other risks. For example - and this is the second reason that rapid investment growth can be a problem - China's dependence on investment in good times and bad is undermining the stability of its financial system by generating an unsustainable expansion of credit. A recent study by the IMF concluded that an increase in credit to GDP of more than 3 percentage points a year could serve as an early warning signal of financial stress. In China, credit has risen from 130 percent to 200 percent of GDP in just five years. The third reason a high investment rate is a concern is that it raises the chances that investment is misallocated and that resources are wasted. Rapid investment in a sector will tend to squeeze the profits of even the best-run firms. The good news, and the main reason that earlier fears of an imminent landing in China were misplaced, is that Chinese firms in general still appear to be generating decent profits, which suggests that the over-investment problem is still manageable, at least for now. Conditions have improved considerably since 2009, when profit margins shrank in the wake of the global financial crisis. Yet it is not hard to find signs of stress in individual sectors. In the steel industry, for example, nearly half of domestic producers were running at a loss in the first half of the year. The auto sector is also struggling. Capacity has increased far faster than sales, forcing dealers to cut prices in order to offload inventories. [Full story] |

|

Related stories |