|

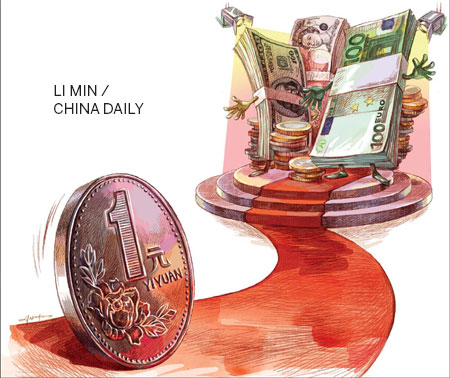

Though the money markets have gone into a tizzy recently, there have been some unrelated developments that clearly underscore the growing global influence of China's currency, the renminbi or the yuan.

Indications that the renminbi is well on its way to becoming an "international" currency heightened after important currency trading centers such as Paris, Luxembourg, Frankfurt, Sydney and Dubai expressed interest in becoming offshore yuan-trading centers. Major money markets, Hong Kong, Taipei, Singapore and London, are already part of the lucrative offshore yuan-trading club.

Vying for top spot

|

| |||||||||||||||||

|

Ravi Menon, managing director, Monetary Authority of Singapore, says a stable and thriving Chinese economy is the best foundation on which to further the use of the yuan globally. The Frankfurt-based European Central Bank is likely to enter into a swap agreement with the People's Bank of China for as much as 800 billion yuan ($130 billion; 100 billion euros), Bloomberg reported earlier this month, citing prominent lobby group Frankfurt Main Finance. The deal, four times the 200-billion-yuan agreement signed in June between the Bank of England and PBOC, is expected to give central banks from the eurozone access to yuan funds.

Luxemburg, the world's eighth largest financial investment center and Europe's biggest fund management center, had secured renminbi deposits of 20 billion yuan by January, the highest in the eurozone. Renminbi loans extended in Luxemburg reached 30 billion yuan, while local fund industries manage renminbi assets of 200 billion yuan. The strong trading position between Germany and China has generated enough momentum for setting up an offshore yuan-trading center in Frankfurt. Outside of Europe, Dubai is likely to become another major offshore yuan-trading center after Taipei as it refocuses on its roles as a regional hub for trading, logistics and tourism, says a recent report published by Standard Chartered Bank. The chances of establishing an offshore yuan center in Africa are also high. Mauritius, with a free flow of dollars and trading with other African countries, is becoming a new regional treasury center, and companies in Africa are moving there from the traditional locations such as London and Dubai, he says. Gregory Chin, a professor at York University in Toronto, says central banks, governments and private investors are seeking alternative foreign exchange reserves and investment options, and for traders, there are real cost efficiencies to be gained by shifting to yuan settlement. Raymaekers says the internationalization of the yuan will continue to increase in the near future, albeit with some volatility. "Based on payment transactions going over SWIFT in June 2013, we see that the yuan again rose up the ranks versus other global currencies and may actually join the list of top 10 currencies soon."

But Standard Chartered indicated that overseas activities of the Chinese currency might soften in the second half, as renminbi current account inflows into offshore markets ease due to the pauses in onshore yuan appreciation. More financially open up There are limits to how far the yuan can be internationalized through offshore channels, or via limited offshore-onshore options, Chin says. Mark Boleat, policy chairman of the City of London Corp, which oversees the running of London's business district, says that opening up the capital account and making the renminbi fully convertible is a must for a prosperous offshore market. The PBOC also announced on July 10 a set of measures to loosen controls on cross-border renminbi flows under both the current and capital accounts. According to the new rules, domestic firms can apply to domestic banks to disburse the yuan overseas, while multinational companies can utilize a yuan capital pool framework to do the same. Chin says other factors also greatly influence the future global use of the yuan. Financial infrastructure upgrades are needed to make transactions in the currency more efficient and secure globally, and whether and to what extent China's own banks will be involved in driving its global use. The role of Chinese banks and that of international financial institutions will be more complementary than competitive, Fang says. Internally, China is also speeding up reforms to make its financial markets more effective. [Full Story]

|

|

|

Paris enters the fray Paris' bid to become a major offshore yuan-trading hub in the eurozone is expected to get new impetus from the anticipated currency swap deal between the European Central Bank and the People's Bank of China. "The ECB and the PBOC have started discussions and they are not far from conclusion," Philippe Mongars, deputy director of the market operation department at the Bank of France, told China Daily at a recent financial forum in Paris.

Governor of the Bank of France Christian Noyer said earlier that Paris is keen to have a currency swap deal with Beijing because the availability of a liquidity safety net in renminbi in the eurozone would foster growth of the yuan business and provide reassurance to market participants that liquidity would remain available in extreme situations. The French capital has laid out three major objectives to transform itself into an offshore yuan-trading market, according to Arnaud de Bresson, chief executive of Paris Europlace, a finance industry group. The first is to develop the best yuan-denominated offer and services for companies including small and medium-sized enterprises and to accompany the development of their trade and investment activities in China, de Bresson says. Meanwhile, the city is aiming to organize an efficient offshore renminbi liquidity pool to retain and recycle renminbi flows including the Sino-African business flows that are traded through Paris. The third objective is to offer the best liquidity and foreign exchange rates to international banks active on the renminbi market at any time in the day complementary with Hong Kong's trading hours. To achieve that, Paris has started to promote products and services in renminbi such as account services, deposits, bank loans, offshore yuan-denominated bond issuance, trade finance and cross-border yuan fund transfer, according to de Bresson. Chinese financial institutions in France have also been benefiting from the growing interest in yuan business in the French capital. [Read More]

| London eyeing a slice of the renminbi pie INHERENT ADVANTAGES HELP LONDON PIP OTHER EUROPEAN RIVALS FOR OFFSHORE YUAN BUSINESS

Apart from its stature as a leading financial center, London is also known to have the largest offshore yuan market in Europe with total deposits exceeding 100 billion yuan ($16.3 billion; 12.5 billion euros). The offshore yuan market is often seen as the test-bed for China's currency internationalization moves. In June, the UK became the first G7 country to sign a yuan currency swap deal with China. Swap lines typically allow banks to access foreign currency in times of crisis. Under the deal, valued at 200 billion yuan, the central banks of UK and China can undertake currency exchanges and lending activities in cases of emergency. According to data released by the City of London, by the end of 2012, London achieved robust growth in trade-related renminbi businesses. The volume of import and export financing increased by 100 percent, compared with the end of 2011, to 33.6 billion yuan. London also saw a few yuan bond issues in 2012, including ones by HSBC and China Construction Bank. As London is not currently an offshore center for yuan, offshore renminbi accumulated in London can only flow into the Chinese mainland via Hong Kong's clearing bank, Bank of China's Hong Kong branch. This allows European banks with renminbi accounts to participate in the yuan Real Time Gross Settlement system in Hong Kong. But Boleat says he does not see an urgent need for London to have a clearing bank because the Hong Kong arrangements serve London's needs. [Read More] | ||||||||||||||

|

------------------------TWO VIEWS -------------------- | ||

|

Freeing up RMB best for all PUSHING AHEAD WITH REFORM SAFER OPTION FOR GOVERNMENT THAN LOOSENING CONTROL Policymaking in China is often more reactive than proactive, but when short-term reactions are consistent with long-term goals, the motivation doesn't really matter. The most obvious benefit of the yuan trade settlement for China and its trading partners is the reduction in currency risk caused by fluctuations in the value of the US dollar. The increasing supply of renminbi that results from it, however, brings further benefits. First, foreign investors can act as a stabilizing force in the domestic equity markets and provide a new funding source for domestic debt markets. Second, the issuance of renminbi-related financial products in Hong Kong and other overseas markets opens more channels for domestic companies to finance themselves. Third, it can make the renminbi more liquid, setting the foundation for it to become a reserve currency.

In order to make holding the yuan more attractive, China needs to first open the capital account to allow for more free investment of the renminbi. Before that can happen, domestic banks must be strengthened to a point where they can manage the impact of capital flows, including both limiting capital flight and being able to absorb capital inflows without contributing to risks of asset bubbles. Banks will never learn these lessons as long as their profit margins are protected by the government-dictated spread between lending and deposit rates, meaning interest rate reform must be accelerated to achieve capital account convertibility. In order to prevent arbitrage opportunities when liberalizing interest rates, however, China must also relax its grip on the currency. [Read More] By Oliver Barron Head of the Beijing branch of the UK-based investment bank NSBO

|

Variable choices on reform map DOMESTIC FACTORS SHOULD BE THE MAIN DRIVERS OF MONETARY REFORMS IN CHINA There have been rumors recently that China would speed up the relaxation of capital controls, a topic closely related to making the renminbi a truly convertible and international currency. One major motivation behind the push to make the renminbi an international currency may be very specific to transforming economies. Many factor prices, including the interest rate that is essentially the price for capital may be distorted within transforming economies. Thus, opening up the capital flow and making the home currency an international one may help even the domestic and overseas interest rate, thereby speeding up reforms in other areas of the domestic economy. Making the renminbi a truly international currency is widely expected to trigger further reform within China. If China's goal in the short term focuses on making the renminbi more widely accepted by foreign trade partners and investors, then it would have to relax its constraints on capital account flows to compensate for the lack of renminbi investment products in offshore markets. Finally, even though opening up the capital account and speeding up the internationalization of the renminbi may have profound and favorable implications on the reform taking place within China, it may be meaningful to ask the question why such changes cannot take place without influence from the outside. Especially given the uncertainties in opening up the flow under capital account, there should be stronger incentives for the domestic financial system to transform itself more aggressively, in the interest of a better, faster and smoother reform in the entire economy. As attractive as an ideal road map may sound, pushing through market-oriented reforms whenever possible may be a more pragmatic and effective path itself. [Read More] By Zhu Ning Faculty fellow at the International Center for Finance, Yale University, and deputy director of the Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University | |

| |||||||