Steel profits continue to suffer

Updated: 2012-08-08 09:17

By Du Juan (China Daily)

|

|||||||||||

|

|

|

A worker in a factory in Ganyu county, Jiangsu province. Steel makers are having a hard time amid the country's slowing economic growth. [Photo/China Daily] |

China's mid-sized steel makers are facing continued falling profits as demand drops as a result of the country's economic slowdown, which industry insiders expect will lessen in the second half of the year.

The predictions come as another of the country's leading industry players, Sutor Technology Group, a Nasdaq-listed Chinese manufacturer of fine-finished steel products, saw its net income decrease in the first quarter of the year.

Zhou Naijiang, its vice-president of finance, said on Monday that the company's net income decreased by 65.7 percent to $1.2 million during the first quarter of the year, according to data provided by the company.

Releasing its results for the quarter, which ended on March 31, Sutor Technology said it expected to see a better performance in the next quarter.

"Although the company's performance was adversely affected by a slowdown in infrastructure investment in the construction industry and a slump in exports, it continues to enjoy the benefits of increasing domestic demand for products such as household appliances and solar water heaters," Zhou said.

Of the products Sutor made in recent quarters, Zhou said, about 15 percent have been for export, and the European debt crisis has adversely affected the steel industry.

And the local real estate industry affected the sales of roughly the same percentage of the company's products.

Meanwhile, the rest of the company's products are being sold at a faster pace, showing the advantages that come from offering a wide array of products, as well as the underlying strength of the Chinese economy, Zhou said.

Despite the current slowdown, the company had $109.9 million in revenue and $7.9 million in gross profits in the first three months of the year. Zhou said the company's manufacturing of a diverse array of products has helped to mitigate the risks it faces from weak demand.

He predicted the steel industry would become more stable in the second half of the year, as the economies of European countries, as well as that of the US, become stronger and the Chinese government adopts a series of policies to boost the domestic economy.

"It's not likely there will be a hard landing," he said.

A decrease in steel prices and demand in the Chinese market since the beginning of the year has led to an increase in the amount of steel held in inventory.

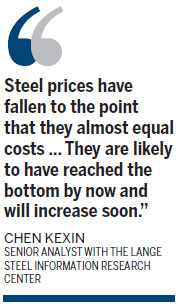

Chen Kexin, senior analyst with the Lange Steel Information Research Center, said he expects to see the market for the metal improve, saying steel prices are likely to rebound soon.

"Steel prices have fallen to the point that they almost equal costs," he said. "As a result of various influences, including demand, supply, currencies and policies, they are likely to have reached the bottom by now and will increase soon."

According to data from Lange Steel, China had 15.81 million tons of steel stockpiled by the end of July, 180,000 tons more than the previous month.

"Demand is going to increase as policies are carried out to boost the economy," said Hou Zhiyun, another Lange analyst. "But the steel industry won't see a full rebound until September, when infrastructure construction starts and seasonal influences lose strength."

She estimated the price of steel will continue to fall in August.

The China Iron and Steel Association said recently the profits of large and medium-sized Chinese steel companies decreased by 95.8 percent year-on-year in the first half of the year.

The industry reported a total profit of 2.39 billion yuan ($376 million) for that period. Among steel companies that ended the first half of the year in the red, their total loss was of 14.25 billion yuan.

Steel factories saw their profits fall mainly as a result of weak demand for low and middle-end steel products, according to the industry information consultancy Mysteel.

There are still many uncertainties about the global economy and China's economic growth is slowing down, the company said. As a result, the demand for steel has weakened among the railway, real estate, shipbuilding and machinery manufacturing industries, according to Mysteel.

"But the companies that had profits in the first half of the year have seen an increase in sales in high-value-added steel products, which suggests that diversifying one's steel products is a good way of adjusting one's product offering and of generating profits," it said.

To increase the domestic supply of steel and import less of the metal, the Chinese government is considering restoring rebates of value-added taxes, said Li Xinchuang, head of the China Metallurgical Industry Planning and Research Institute, during a press conference last week. Such rebates had been offered on high-end steel products bought from domestic steel makers.

He said China imports about 15 million metric tons of high-end steel products every year, and half of those products are bought overseas for the use of domestic processing companies, which can import them without paying duties.

"Chinese companies can provide 7 million to 8 million tons of steel products at the most to replace these imports if everything goes as planned," he said.

Buyers, meanwhile, will need time to assess the quality of high-end steel products made in China, said Zhou Naijiang.

"The policy will be effective for months," he said. "But it might take two to three years to reach the goal."

dujuan@chinadaily.com.cn

Related Stories

US sets duties on Chinese steel tanks 2012-08-01 16:19

Iron and steel industry continues deterioration 2012-07-30 16:48

Chinese steel maker lowers profit goal 2012-07-19 15:32

Steel prices face downward pressures 2012-07-17 17:29

Work on huge steel plant 'not canned' 2012-07-17 14:34

Steel industry downturn to continue in H2 2012-07-11 09:56

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|