PMI drop indicates further slowdown

Updated: 2011-12-02 08:04

By Li Xiang and Yu Ran (China Daily)

|

|||||||||

China needs to loosen policies to maintain growth, analysts say

BEIJING / SHANGHAI - China's manufacturing sector shrank in November for the first time in nearly three years, a fresh sign of a further economic slowdown that analysts say may prompt the country to loosen monetary policies.

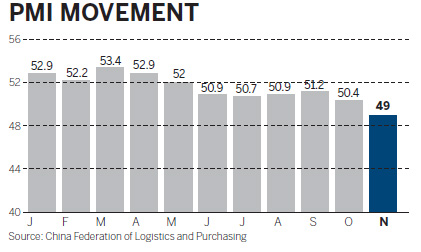

The purchasing managers' index (PMI), a main gauge of manufacturing activity, tumbled to 49 from 50.4 in October, according to the China Federation of Logistics and Purchasing.

A PMI under 50 indicates a contraction of manufacturing activity - a situation that hasn't been seen since February 2009.

| ||||

Some analysts said a lull in China's property market also contributed to the economic slowdown with both prices and sales dropping significantly under the previous round of credit tightening.

"It reinforces our view that China's economy will fall sharply in the months ahead as the property sector has reached a tipping point," said Zhang Zhiwei, an economist with Nomura Securities.

Zhang said that the risk of a sharp deterioration of GDP growth in the first quarter of next year is rising significantly.

The poor PMI data, released on Thursday, came one day after a cut in the reserve ratio for the country's commercial lenders.

"The message is clear: the economy is slowing much faster than expected and the government has stepped into the ring. The loosening campaign has begun," Alistair Thornton, an analyst with IHS Global Insight, wrote in a research note.

Analysts now expect the government to resort to greater loosening.

"Judging from the PMI, China is experiencing the most difficult time since the global financial crisis in 2008 and this demands the Chinese government further loosen its policies," said Liu Ligang, director of the economic research department of ANZ Banking Group.

But Cai Jin, deputy director of the China Federation of Logistics and Purchasing, said the pace of the economic slowdown will remain steady and the chance for a great fluctuation is slim.

Zhang Liqun, a researcher with the Development Research Center of the State Council, also said the relatively strong momentum of domestic investment and consumption will help stave off a plunge.

The Chinese stock market on Thursday rallied on the central bank's cut of the reserve ratio but it fell flat toward closing, indicating that market confidence remains fragile, market watchers said.

Economists expect that the central bank's move is the beginning of a slew of loosening policies, which may help ease the financing difficulties of the country's cash-strapped small businesses.

The country's central bank had raised the reserve ratio for banks 12 times since January 2010, bringing it to a record high of 21.5 percent.

Although the tightening stance helps ease consumer prices, it also leads to increasing complaints about credit strains from the country's businesses, especially from small enterprises.

Analysts said that poor PMI figures will prompt policymakers to shift the focus from taming inflation to stabilizing growth.

"It (the central bank move) is a clear signal that Beijing now sees the balance of risks as lying with growth rather than inflation," said Stephen Green, an economist with Standard Chartered Bank.

He added that the lending quota for Chinese banks will be expanded.

Vice-Minister of Finance Zhu Guangyao said at a conference in Beijing on Thursday that uncertainties and unstable factors in the world economy are challenging China's effort to maintain steady and relatively fast growth.

"We must make policies more focused, flexible and pre-emptive and manage the pace and strength of macroeconomic controls," he said.

Economists predict that one more reserve ratio cut is possible in December or January while interest rates are likely to remain at the current level in the first quarter of 2012.

However, some experts said China will not turn about its monetary policy dramatically.

Cao Yuanzheng, chief economist of Bank of China, said inflation remains the top risk in the Chinese economy and a too hasty loosening will not help stabilize growth.

The country's GDP growth slowed to 9.1 percent in the third quarter of the year, from 9.5 percent in the second quarter and 9.7 percent in the first.

Wei Tian and Xinhua contributed to this story.

China Daily