FTSE takes cautious steps to including China-listed shares in benchmark

Updated: 2015-05-27 10:36

(Agencies)

|

|||||||||||

|

|

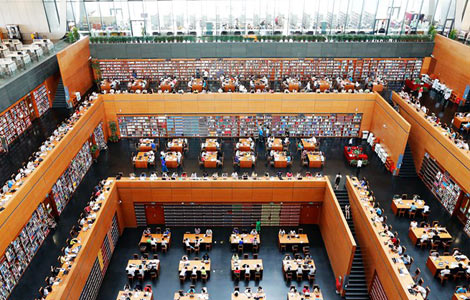

Stock information is displayed at a trading hall of a securities firm in Shanghai.[Photo/Agencies] |

FTSE Russell, one of the world's largest index providers, said it will launch two transitional indexes that include China A shares - a staggered approach that will bring local Chinese shares into its global emerging markets benchmark in two to three years.

Expectations that yuan-denominated shares listed on the Shanghai and Shenzhen exchanges could make the cut have grown as reforms such as the Hong Kong-Shanghai Stock Connect scheme have helped open up China's stock market.

Chinese authorities have lobbied hard for the inclusion in global benchmark indexes which could prompt billions of dollars to pour into China stocks over time, but some of the world's biggest fund managers oppose the move due to investment constraints in the country.

"FTSE have offered a half-measure and that's not completely suprising given the intransigence with which a number of major index users have reacted to the idea of China A share inclusion in global benchmarks," said Michael McCormack, executive director at Shanghai investment consultancy Z-Ben Advisors.

The FTSE announcement comes ahead of a June 9 decision on China A share inclusion by rival MSCI Inc, owner of the world's most influential emerging markets benchmark against which some $1.7 trillion of funds is tracked.

"Some investors want to move much quicker than others," Mark Makepeace, CEO of London Stock Exchange Group-owned FTSE Russell, told Reuters in Hong Kong on Tuesday.

"The biggest funds want to move earlier, it's more complex for some others and they will want a longer period of time to manage this change," he said, adding that some clients had been shocked at the idea of A share inclusion.

Concerns over tax, capital mobility, clearing and settlement remain key barriers to inclusion and the two new indexes would merge with the standard FTSE emerging markets index when China shares meet the provider's criteria, he said.

The indexes will be called FTSE Emerging inclusion indexes, and will have an initial weighting of 5 percent for China A shares. That will rise to 32 percent when the shares become fully available to international investors.

When taken together with other types of China shares including those listed in Hong Kong, Chinese shares would then account for 50 percent of the emerging markets index, said FTSE Russell. It has scheduled an update of its plans in September.

Wu Kan, head of equity trading at hedge fund Shanshan Finance in Shanghai, said global money inflows could be limited at first.

"China hasn't fully opened its capital markets, and there's a shortage of derivative and shorting tools global investors can use to hedge risks," he added.

Related Stories

Internet finance regains popularity amid volatile stock market 2015-05-13 09:51

Stars make huge profits from stock market increase 2015-05-12 08:11

Built on sand and bubbles, stock market had to crash 2015-05-08 07:48

China's stock market bull run might continue, risks remain 2015-05-04 10:31

Finance chief dismisses stock market bubble blues 2015-04-29 07:10

Turnover explosion crashes Shanghai stock market software 2015-04-21 09:31

Today's Top News

FTSE takes cautious steps to including China-listed shares in benchmark

China calls for durable settlement of Kosovo issue

China urges BRICS to unite for promoting multi-lateralism

New way to enjoy movie in Berlin

China issues first white paper on military strategy

China, Chile ink multi-billion-USD currency swap deal

China, Russia vow to boost cooperation

Chinese couple arrested in Lisbon on suspicion of money laundering

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|