China to lead Asian cruise industry

Updated: 2014-04-07 07:42

By Wang Wen (China Daily)

|

|||||||||||

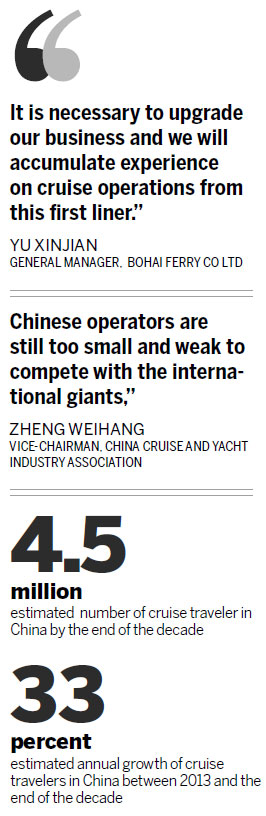

Region promises 33 percent annual growth until the end of the decade, government says

China will become the Asia-Pacific region's largest cruise market by 2020, the government said. Some domestic operators are already digging for the industry's gold.

There will be 4.5 million cruise travelers in China by the end of the decade, representing 33 percent annual growth from 2013, according to a guidance of the Ministry of Transport on March 18.

Bohai Ferry Co Ltd, a listed shipper based in Shandong province, established a subsidiary for cruise operations in February.

Its first liner, to be re-christened Zhonghua Taishan (Chinese Mount Tai), was delivered at end-March and cost $43.68 million. It was bought from Italy's Costa Crociere SpA and arrives in China in May.

The 24,000 gross tonnage, mid-size, liner has 1,000 seats and was built in Germany in 2000. Its main work on nearby routes will include South Korea, Japan and Southeast Asian countries.

Bohai Ferry established a travel agency in 2013 to promote its liner business.

"It is necessary to upgrade our business and we will accumulate experience on cruise operations from this first liner," General Manager Yu Xinjian said.

Yu said his ambition lays not just in the second-hand liner business. Bohai Ferry wants to build or buy five-star luxury ships and be China's leading cruise operator.

China's cruise market grew rapidly in recent years. Statistics from the China Cruise and Yacht Industry Association show people made 1.4 million trips on cruise liners last year compared with about 10,000 in 2005.

"Traveler numbers soared these years and Chinese enterprises rushed into the business," association Vice-Chairman Zheng Weihang said.

Another domestic operator, HNA Tourism Holding (Group) Co Ltd, saw the passenger load factor of its first domestic vessel, the Henna, rise to 75 percent this winter from 60 percent at the start of 2013.

Winter is seen as the industry's off-season. Load factor measures capacity usage.

The Henna has worked four routes since January 2013 and new ones, including Xiamen-Taiwan and Tianjin-Japan are planned.

"The company expects to enlarge our fleet by 12 to 13 liners in the next 10 years," HNA said in a statement to China Daily.

Some tour companies - seeing just two domestic cruise operators and the high level of investment needed to enter the industry - are seeking ways to get a slice of the market.

Ctrip.com International Ltd sees the cruise industry as a main path to development, Senior Vice-President Tang Lan, said.

Almost 10 percent of Chinese cruise travel was booked through Ctrip.com, the country's largest online travel agency, in 2013. It will launch 15 exclusive cruise trips this year, catering to about 40,000 travelers.

Ctrip.com invested more than 200 million yuan ($32.45 million) in its cruise operations this year, director of its cruise business Yang Lei, said.

Other travel agencies, such as Beijing UTour International Travel Service and China International Travel Service Co Ltd, also invested.

"Seats on liners in peak season, like summer and winter vacations and some public holidays, sold out very early," said a Utour manager.

China's cruise industry still faces challenges as it's at an early stage of development, some experts said.

This year, only two liners out of eight operating in China had domestic owners, the Henna and Zhonghua Taishan, Zheng at the industry association said.

"Chinese operators are still too small and weak to compete with the international giants," he said, regardless of their "facilities or services".

Chinese companies have capital to buy vessels but lack talent and operational experience, according to Zheng.

"The managers and service staff on liners need knowledge of both voyages and high-end hotels," he said. "There are so few in China now."

International operators also have management systems from ticket selling and onboard service, but no Chinese company has, Zheng said.

He criticized the low-price strategy usually taken by Chinese companies, saying it's not a long-term policy where high quality, not just price, is important. At the same time, few options for routes are also limiting industry development, he said.

"The market is actually virgin territory," Zheng said.

The transport ministry guidance identified Northeast and Southeast Asia, the Taiwan Strait and South China Sea islands as the main areas for the country's cruise industry by 2020.

"There's still a long way to go before we achieve the target" set in the guidance, Zheng said. "But the industry is very promising."

wangwen@chinadaily.com.cn

|

Debut of The Henna cruise in Sanya, Hainan province, on Jan 26, 2013. The Henna, operated by domestic operator HNA Tourism Holding (Group) Co Ltd, has worked four routes since January 2013 and new ones, including Xiamen-Taiwan and Tianjin-Japan, are planned. Huang Yiming / China Daily |

|

Costa Victoria cruise at Wusongkou International cruise port in Shanghai. Wusongkou is expected to be built into an international cruise port of East China. Provided to China Daily |

(China Daily 04/07/2014 page9)

Today's Top News

Australia also detects suspicious pulse signal

Afghans vote amid Taliban scare

Hostages taken to Philippine island

Huawei and China Daily inks co-op

Pulse signal discovered

in MH370 hunt area

Challenges in search for MH370 'unprecedented'

China urges rescue of abductee

Satellite to monitor disasters in Europe

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|