China top suitor for Greek port share

Updated: 2015-12-11 08:19

By Maria Petrakis(China Daily Europe)

|

|||||||||||

State-owned Cosco has opportunity this month to consolidate its spot at Piraeus Port as an anchor for Belt and Road aspirations in Europe

Red, blue, orange and green containers are stacked up on the road leading to Piraeus Pier II like giant Lego bricks, so high they cast a shadow over the cars and trucks rumbling into China Ocean Shipping Co's Greek container port.

From the sea, the cobalt-blue gantry cranes and mosaic of multicolored containers are a magnet for the monster cargo ships steaming into the harbor.

|

Container ships sit on the dockside in the Cosco Pacific terminal at Piraeus Port in Athens, Greece. Bloomberg via Getty Images |

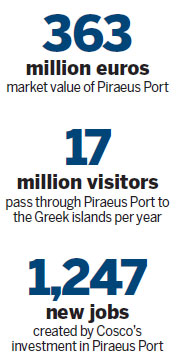

Since the Chinese shipping behemoth agreed to take over container operations at two piers in Piraeus in 2008, traffic has surged at Greece's biggest harbor, making Piraeus one of the fastest-growing ports in the world.

For Cosco, the Chinese state-owned company listed in Hong Kong, Piraeus is the point at which China nudges into Europe as part of its plan to create a modern commercial empire pumping Chinese goods throughout the continent. It is, Premier Li Keqiang said in June last year, China's gateway to Europe.

Now, Cosco may be poised to consolidate its position in the Greek port. This month, Greece will seek binding bids for a 67 percent stake in the Piraeus Port Authority, the state-run company that operates the harbor. Cosco is among three bidders for the stake and considered a front-runner, given its investments so far and promise of more.

But as China pumps money into creating President Xi Jinping's vision of the Belt and Road Initiative, a modern-day Silk Road to Europe, it has bumped into a modern fiscal odyssey in Greece, the eurozone's most troubled nation, where foreign investment has slumped and stalled amid political turmoil and concerns of financial collapse.

The sale of the port has been delayed twice in just the past few months after being formally launched in March 2014, years after being included in the Greek state asset sales plan mandated by the European Union and International Monetary Fund in return for what became 240 billion euros ($260 billion) in rescue funds. The latest delay came at the request of the potential investors, Cosco included, with the Greeks setting Dec 21 as a new deadline for bids.

"They have been tested," admits Stergios Pitsiorlas, the sixth chairman of the 4-year-old Hellenic Republic Asset Development Fund, the agency charged with selling the Piraeus Port stake. "The issue has been pending for years now. But what's important is that now, for the first time, we are close to completion. We are very close."

For Greece, the stakes are higher now than they were six years ago, when the country's fiscal mess sparked a crisis that led to bailouts for countries including Ireland and Portugal, and called the existence of the common currency into question. Unemployment is still hovering at one-fourth of the workforce, the highest in the European Union; the economy has shrunk by about a third since the first bailout, and capital controls have been in place since late June on Greek banks to prevent their collapse, strangling businesses and individuals in need of liquidity.

Alexis Tsipras came to power in January as the firebrand young prime minister who opposed state asset sales and vowed to tear up the two bailout agreements that forced higher taxes and cuts in wages and pensions. He has tempered his tone since being forced in July to accept a new, 86 billion euro bailout to keep the country in the eurozone.

The Piraeus Port sale has taken on emblematic significance. Winning could unleash more Chinese investment, Pitsiorlas says, citing interest in a plan to build a major freight and logistics center on the Thriasio plain, an expanse that's been described as the industrial backyard of Athens. A major new airport planned for Crete, tendered in 2009 on the eve of general election, then canceled and now dusted off again, would give the Chinese an additional foothold in the Mediterranean.

Fosun, China's largest private conglomerate, is one of the investors in a group destined to develop the Hellinikon site, the Greek capital's former airport and Olympic Games venue, a project that could create 70,000 jobs and add 2 percent to Greece's economic output.

Today's Top News

Xi calls for shared future in cyberspace

China successfully launches its first dark matter satellite

China becomes shareholder in European bank

Jeb Bush calls Trump a 'chaos candidate'

French report stresses China's growth offers new opportunities

Reasonable economomic growth rate targeted

French far-right fails to win any regions

Obama says anti-IS fight continues to be difficult

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|