Calmer financial waters on the horizon

Updated: 2016-10-28 07:26

By Zhihuan E(China Daily Europe)

|

|||||||||

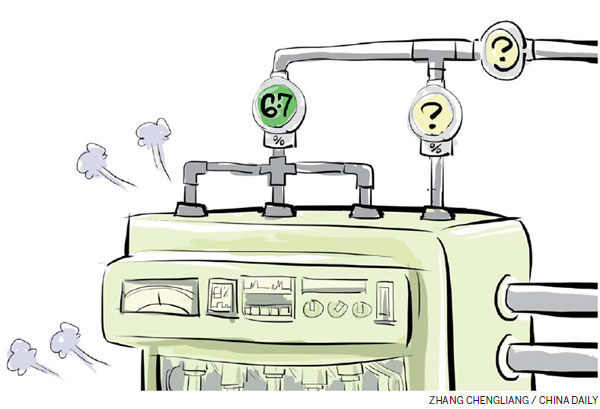

Welcome economic upturn not far off, thanks to positive impact of supply-side reforms

China's economic growth remained stable at 6.7 percent year-on-year in the first three quarters of 2016, indicating that the slowing economy might be finding its bottom.

With the positive impact of structural rebalancing and supply-side reforms, the Chinese economy is likely to remain stable and achieve the government's target for this year.

In the first three quarters of 2016, the economy expanded 6.7 percent year-on-year, a slight 0.2 percentage point moderation from the 6.9 percent in the full year of 2015.

Looking into the details, 6.7 percent growth was recorded for each of the first three quarters, in line with the L-shaped trend.

Meanwhile, growth in third quarter jumped 1.8 percent from the second quarter - much stronger than the 1.1 percent from the first quarter, implying that the concerns at the beginning of the year over a hard landing for China were groundless.

Against external headwinds and internal rebalancing pressure, the steady economic performance was achieved because Chinese authorities have successfully struck a fine balance between stabilizing growth and supply-side reform.

On one hand, the authorities have prevented the economy from slowing too fast, while on the other they have further pursued their goals of deleveraging, capacity reduction and destocking.

Together with the implementation of proactive fiscal policy and prudent monetary policy with flexibility, the Chinese economy is likely to maintain healthy and steady growth ahead. It is expected to grow by 6.7 percent this year and achieve the government's target of between 6.5 percent and 7.0 percent.

In tandem with the stabilization of overall economic growth, there were improvements in structure.

Consumption was the main stabilizing force. In the first three quarters of 2016, consumption spending contributed 71.0 percent of the overall GDP growth, 13.3 percentage points higher than the same period last year.

Meanwhile, total retail sales of consumer goods also increased by 10.4 percent year-on-year in the first nine months of 2016, slightly higher than the 10.3 percent growth in the first half.

In September, GDP saw its fastest pace of growth since the beginning of the year, at 10.7 percent. This solid consumption performance was largely driven by buoyant property market activities, tax reduction and subsidies for some automobiles.

Infrastructure and property investment helped stabilize fixed asset investment. In the first nine months of 2016, FAI increased by 8.2 percent year-on-year, somewhat lower than the 9.0 percent growth in the first half. In fact, FAI growth accelerated over the past few months, from 3.9 percent in July, to 8.2 percent and 9.0 percent in August and September, respectively.

Infrastructure was the main driving force, with its growth reaching 19.4 percent year-on-year in the first three quarters. Property investment also rebounded from its trough to 5.8 percent year-on-year in the first three quarters, much better than the 1.0 percent growth in 2015.

This is likely the result of the buoyant property market activities in the first-tier and second-tier cities, as higher property prices helped drive property investment. However, the third and fourth-tier cities were still restrained by the oversupply problem. Thus, property investment has yet to recover completely.

Meanwhile, manufacturing investment was also bottoming at a low level, with stabilization in industrial value-added, industrial profits, manufacturing PMI, and electricity generation and consumption.

The base effect might provide a buffer for trade performance ahead. Against the low-growth environment around the world, the mainland's trade performance remained sluggish over the past year.

The World Trade Organization recently revised its global trade volume forecast down to a mere 1.7 percent. In the first nine months of 2016, mainland exports recorded a 1.6 percent decline in renminbi terms over the previous year, with September even recording a 5.6 percent decline.

Even though the trade outlook remained weak, exports to some Belt and Road countries recorded notable increases. Together with the trade structure adjustment and low base effect, trade performance might improve gradually.

The development of the new economy and supply-side reforms achieved a certain success. As the development of new industries and the new economy received strong attention from the government over the past few years, the new economy has recorded notable growth.

First, value-added in high-technology and equipment manufacturing recorded 10.6 percent and 9.1 percent year-on-year growth in the first nine months of 2016, respectively - 4.6 and 3.1 percentage points higher than the overall industrial value-added.

Second, online retail sales reached 3,465 billion yuan ($511.5 billion; 470.7 billion euros; 419.5 billion) nationwide in the first three quarters, 26.1 percent year-on-year growth accounting for 11.7 percent of total retail sales.

Third, new businesses, like online medical, online education, and online transportation services recorded tremendous growth. With respect to supply side reforms, the production of raw coal declined 10.5 percent year-on-year in the first three quarters of 2016.

The debt-to-asset ratio of industrial enterprises above designated size also declined by 0.6 percentage points over the preceding year to 56.4 percent at the end of August. The inventory of commercial residential buildings (excluding affordable housing) has declined for seven consecutive months since March 2016.

Producer prices turned positive, and fading deflationary pressure could support economic growth. Over the past year, worries about the economic slowdown were somewhat related to the price effect, as deflationary pressure would negatively affect the financial condition of the corporate sector. As such, the slowdown of nominal GDP (particularly in secondary industries) was much deeper than that of real GDP, intensifying market concerns over the mainland's economic slowdown.

Nonetheless, the producer price index turned positive in September after 54 consecutive months of decline, amid the recovery of commodity prices. Nominal GDP growth reached 7.8 percent year-on-year again in the third quarter, above the real GDP level. With fading deflationary pressure, many companies could benefit from higher revenue and profits, which is good for the overall economy as well.

The economic data above show some positive signs for the mainland's economy. For example, the continuous expansion in infrastructure investment could help FAI become the main driving force in stabilizing growth; the relatively fast growth in high-technology and equipment manufacturing could help support structural adjustment toward medium- to high-end industries; and the property market recovery could, in turn, support consumption activities.

In addition, as employment continued to grow notably, together with continuous structural rebalancing, the mainland's economy is likely to grow steadily at the current level and could reach around 6.7 percent growth this year.

Nevertheless, there are still some downward pressures ahead, such as subdued global economic growth, US rate hikes, divergent monetary policies, Brexit, and China's own internal rebalancing pressure.

On the policy front, the probability of further interest rate or RRR cuts is likely to be relatively low, amid the buoyant property market, stabilizing consumer and producer prices, a stronger US dollar exchange rate and slight depreciation pressure on the renminbi exchange rate. The authorities are expected to rely more on open-market operations to adjust liquidity conditions, and fiscal policy will take on a more important role in supporting economic growth.

The author is chief economist with Bank of China (Hong Kong) Limited. The views do not necessarily reflect those of China Daily.

(China Daily European Weekly 10/28/2016 page10)

Today's Top News

Party ramps up supervision

Queen Elizabeth visits new town Poundbury

UK retailers catering for homesick Chinese

UK government opts for new Heathrow runway

China's business leaders optimistic about UK

Workers tear down Calais 'Jungle'

UK university heads Chinese pregnancy research

Chinese hostages freed by pirates are heading home

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|