Lust for property divorced from what really counts

Updated: 2016-10-21 07:12

By Lin Jinghua(China Daily Europe)

|

|||||||||

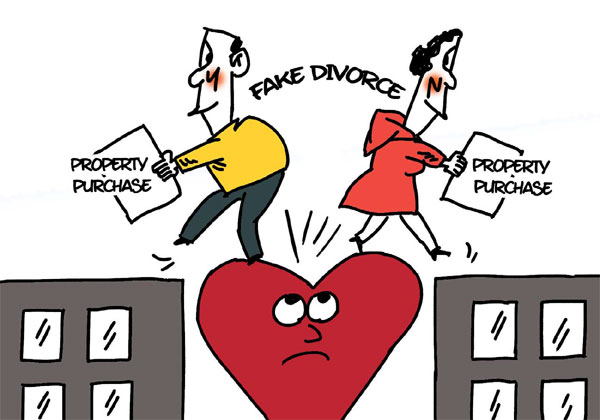

In their rush to improve their property portfolios, couples are overlooking one important thing

Today, more than ever in China, possessing a home is central to getting married and starting a family.

In fact, the issue of buying a house can often either make or break a marriage.

One old saying propounded that only after buying a house and marrying should one embark on a career.

Our forebears wouldn't have nursed for a second the proposition that their descendants put off marriage on the grounds of a lack of housing - or indeed abandon a marriage to bolster one's property portfolio.

But that is exactly what is happening now.

For a long time, city dwellers in China did not own property. Indeed, 30 years ago many young people could not get married because they possessed no living space.

Then it was one's danwei, essentially one's employer, which allotted housing to its married staff. They had to apply and then wait in line for their turn to move into any vacant room that became available.

A young couple who landed a small room in a big courtyard or shared a two- or three-bedroom apartment with another family considered themselves lucky. The queue was long, and it often took several years for anything to turn up, particularly for young people, because seniority and length of service was a key factor in determining who to give housing to.

It also depended on where you worked. If you worked in a strong state-owned company or a public institution you were likely to stand a better chance of landing a room with low rent.

Any man looking for a bride and who happened to work in a small factory was doomed in his quest, because his employer would have been unable to supply him or any of its workers with accommodation.

This sort of welfare-oriented distribution of housing ended in the late 1990s thanks to a policy change under which housing was declared to be property that anyone had the right to buy. Couples were then able to buy the apartment they lived in relatively cheaply.

Some businesspeople developed residential communities in big cities such as Beijing, Shanghai, Guangzhou and Shenzhen, and the property market began to grow.

It was also a time when anyone could buy as many properties as they liked, and essentially anywhere, so long as they could afford it, and some people began to borrow money so they could buy several properties.

One of my cousins in Shanghai was one of them, and he has since experienced the drastic changes in the property market.

He was single until he was 38 because of a lack of housing. He is now 68. Thanks to the reform and opening-up policy, he left the small factory he worked for and started a business trading in textiles. He bought a two-bedroom apartment in the Pudong area of Shanghai after the city started to develop real estate in the 1990s. He has bought two properties in the city over the past 20 years. For him it is the best investment he has ever made, and he has encouraged friends and relatives to do likewise.

Life has been kind to him, his wife and their son. But early this year he told me he was going to divorce. The reason was simple: He wanted to buy another property, and heard that the government planned to tighten rules on home buying to cool the property market.

Under the new policy, a family in Shanghai can buy up to two properties, but for the second one the couple needs to pay a 50 percent deposit. Anyone with two residential properties already is barred from buying any more.

Those buying their first home need pay only a 20 percent deposit. He said that if he and his wife divorced, and their properties were in her name he would be regarded as a first-time buyer if he bought another property.

"The idea is bizarre," I told him, not wishing to encourage him in any way.

"You already have three properties, so why risk your marriage just to get another one? If your wife (who is 16 years younger) took off with all the properties, you would be left with absolutely nothing -no houses and no family."

But he said he was confident enough of their relationship, and he saw it as a surefire investment with a great return.

However, it turned out that there was an age limit of 60 on applying for the low-deposit loan, so that killed his grand scheme.

"So why don't you let your wife do it?" I joked.

"She said she's not sure about me," he laughed.

Many couples with plans similar to my cousin's have been lining up to get divorced and registering what they had under one person's name. The idea is that once the house purchase is finalized, the happy pair get back together. At least that is the plan.

But it does not always work out that way. My cousin told me of a woman in Shanghai who apparently quite liked the look of her divorce papers and decided to respect them to the letter, keeping their two properties and leaving her now ex-husband with a new property and a 3 million yuan loan.

Soaring house prices in big cities have driven people to the property market, but why are the Chinese so fixated on owning property?

The biggest driving force, apart from the traditional desire to own a home, is poor rental housing and the inordinate desire to make a financial killing. Housing is considered as the most reliable investment.

"The first property I bought in Pudong cost 200,000 yuan ($29,800; 27,000 euros; 24,300 pounds) and is now worth 2 million yuan," my cousin says.

As for the rental issue, a friend of mine tells of how happy he now feels owning a property after years of landlords and real estate agencies taking advantage of him.

Housing is a complex social and economic issue in which all of us have a stake, and surely sitting at the bottom line we should see much more than piles of cash.

That cash may in turn buy you piles of bricks and mortar, but who would swap that for the happiness of a marriage built on true love?

linjinghua@chinadaily.com.cn

(China Daily European Weekly 10/21/2016 page21)

Today's Top News

EU leaders mull new trade rules

English cities hope to woo Chinese investment

UK's May tries to reassure EU on Brexit

Lawmakers stage walkout to protest anti-China acts

Syrian army declares 3-day truce in Aleppo

BBC report on Terracotta Warriors refuted

Iraqi forces recapture more villages around Mosul

Greeks rally against labor reforms

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|