Growth and reform

Updated: 2016-01-01 08:16

By Andrew Moody(China Daily Europe)

|

|||||||||||

Official statements from the Central Economic Work Conference spoke of a more "proactive" as well as a "flexible" fiscal policy. Fiscal policy refers to taxing and spending by governments.

This would represent a shift in direction since there has been recent emphasis on monetary policy as the main economic tool. Monetary policy refers mainly to management of interest rates. In October, the People's Bank of China cut the one-year benchmark interest rate by 0.25 percent to 4.35 percent, its sixth such move in 12 months.

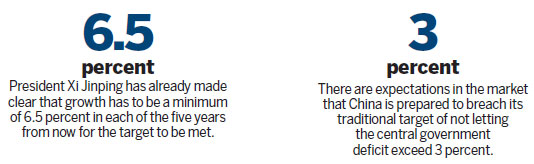

There have been expectations in the market that China is now prepared to breach its traditional target of not letting the central government deficit exceed 3 percent.

Louis Kuijs, head of Asia economics at Oxford Economics, who is based in Hong Kong, says this is partly because the government has taken monetary policy as far as it will go.

"We are starting to see more reliance on fiscal policy rather than just monetary policy to stimulate growth.

"I think this is welcome because China has really pushed the envelope in terms of credit growth and there have been a lot of concerns in the market about credit growth becoming too rapid."

Kuijs, a former World Bank economist, believes the fiscal stimulus will be used to direct more spending on infrastructure.

"I think this will help compensate for the fact that local governments, because of their debt position, have been more constrained in this area," he says.

"The government may also take over some expenditure responsibilities that have been traditionally assigned to local governments, one of which could be taking control of a new nationwide pension."

Julian Evans-Pritchard, the Singapore-based China economist for Capital Economics, a consultancy, also expects a more expansionary fiscal stance, although he still believes monetary policy will be a significant policy tool.

Today's Top News

Trading halted after shares fall 7% in opening minutes

China voices its 'resolute opposition' to DPRK test

Design exhibition to attract Chinese art works

Germans shaken by mass attacks on women

Concerns grow over Saudi-Iranian rising tensions

Obama tightens gun rules, requires background check

Refugee boy becomes first casualty in 2016

China's high-tech exports beat Japan and South Korea

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|