No reining in Chinese vehicle firms

Updated: 2014-03-04 07:59

By Andrew Thomson (China Daily)

|

|||||||||||

The main focus of these latter markets will be affordable cars.

But the fast-growing sophistication of consumers in even the most remote regions means taste and demand patterns are rapidly converging with those of the eastern seaboard.

|

|

|

The continuing success of the global carmakers, able to apply the strengths of their global supply chains through their joint ventures in China, makes it hard for domestic companies to compete.

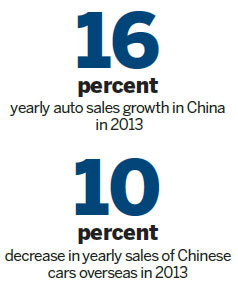

It looks likely that while the domestic original equipment manufacturers' volumes may continue to rise in China, their market share will fall. It is noteworthy that Great Wall Motors Co Ltd saw total sales rise 21 percent in 2013 to 754,000 units, almost solely due to a 48 percent rise in demand for its SUVs (to 417,000) rather than its sedans, where volume fell.

Demand for electric vehicles shows no sign of rising to significant levels, even with central government subsidies of up to 60,000 yuan ($9,836) per car. Total passenger sales of EVs amounted to fewer than 15,000 units last year.

Exports remain one of the few areas of weakness, with sales of Chinese cars overseas dropping nearly 10 percent in 2013 due to softening demand in emerging markets in South America and the Middle East.

Consolidation of China's fragmented auto industry still looks a long way off. Despite being home to more than 170 vehicle makers, and reducing that number having been an official goal for the past seven years, the combination of local government support for companies in their own backyards, plus the need for any merger or acquisition to be signed off by a host of central government bodies, has resulted in almost no progress.

This year is also unlikely to see any significant lifting of the rules restricting foreign ownership of carmakers in China to a maximum of 50 percent. Although officials have spoken out about relaxing these conditions, with foreign brands dominating the Chinese market (indeed, slightly increasing their share) it's hard to see any change before at least one domestic carmaker has established itself as a force in the market.

When that might happen is anyone's guess. For certain, it won't be in the Year of the Horse, which will continue to be dominated by heavyweight Sino-foreign joint ventures. But as Ford's rapid rise last year demonstrated, who will be the eventual winners in the China car market remains an open question, and one unlikely to be decided before the end of this decade. Which horse to back is the main issue for discussion.

The author is Asia Pacific and China head of automotive and a partner at KPMG China. The views do not necessarily reflect those of China Daily.

|

|

| Top 10 most valuable auto brands | Top 10 moves by carmakers in China |

Related Stories

Growth in China support stable outlook for auto industry: Moody's 2014-02-28 10:54

China's new energy vehicles fueled up 2014-02-13 11:22

Vehicle sales accelerate to record 2014-02-13 08:27

China to extend electric car subsidies beyond 2015 2014-02-11 22:25

Year of Horsepower: Car industry shifts gears 2014-02-10 07:21

2013 Major Vehicle Recalls in China 2014-02-07 17:31

Today's Top News

Last 3 suspects caught in Kunming manhunt

Ukraine crisis hits Poland economy

Geely buys British startup Emerald

CNOOC licensed to seek Arctic oil

CNOOC licensed to seek Arctic oil

G7 leaders condemn Russia over Ukraine

Terrorist group in Kunming attack busted

Political advisers vow to help deepen reforms

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|