A consuming passion for quality eats away at the nation's heart

Updated: 2013-10-14 06:32

By Lyu Chang in Beijing and Qiu Bo in London (China Daily)

|

|||||||||||

Last year, in Jinan, capital of Shandong province, the Municipal Bureau of Commerce established a system for tracking pork. The bureau uses a bar-code reader to track meat in more than 80 stores.

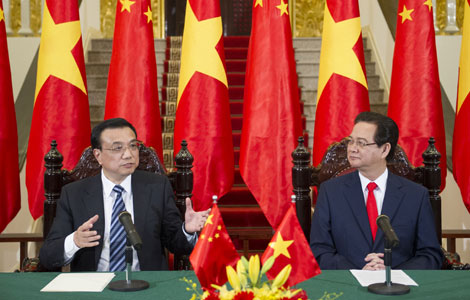

Marcia Mogelonsky, a food and drink analyst at London-based research company Mintel Group Ltd, says Chinese companies can learn best practices through acquisitions.

"There are many companies in the West that have processes to guarantee the safety of food processing from start to finish. Chinese companies would benefit by seeking out Western companies with high-quality traceable food safety systems," she says.

In Europe, for example, obtaining best practices and technologies is an important factor behind Shanghai-based Bright Food Group Co's acquisition of a 60 percent stake in British cereal maker Weetabix Ltd for more than $1 billion last year.

At the time of the acquisition, Bright Food's chairman, Wang Zongnan, said Weetabix's "best-in-class production standards and excellent record for innovation" should bring in long-term profits.

This kind of guarded optimism has opened doors for many of the recent Chinese acquisitions of foreign food makers, underlining the growing appetite of Chinese food companies for foreign mergers and acquisitions.

Purchases by Chinese buyers in the food sector included State-owned COFCO Corp's acquisition last year of Australian sugar producer Tully Sugar Ltd for $140 million and Bright Food (Group) Co's purchase in 2011 of Australian food producer and importer Manassen Foods Australia Pty Ltd for an estimated $522 million.

"Some Chinese companies have access to capital at very competitive rates," says Michael Swanson, the chief agricultural economist for Wells Fargo Bank, the largest agricultural lender in the US.

"They have decided that acquiring US assets represents a good and quick path to achieving the food safety they need," he says.

However from a strategic perspective, limiting inflation is likely to be the biggest driver for overseas acquisitions, Barron says.

With more money in their pockets, millions of Chinese are seeking richer diets and switching to meat such as pork, which is China's second-most important staple. China's pork industry also produces and uses about half of the world's pork and accounts for a large chunk of the country's GDP.

Pork price swings are also a frequent source of anxiety. Worries about the safety of pork supplies mounted earlier this year when 16,000 dead pigs were found floating in a river near Shanghai.

"Pork prices are the largest component in the Consumer Price Index basket," Barron says. "There are legitimate fears that the current weak pork prices will reduce enthusiasm of pig farmers, leading to lower domestic pork supplies and higher prices over the next year."

According to China customs statistics, during the first six months of this year, China imported nearly 272,000 tons of pork valued at $510 million, up 0.3 percent year-on-year.

James O'Donnell, Asia manager of Bord Bia, the Irish Food Board, says that China plans to increase meat production by 85 million tons by 2015, an increase of 17 percent over the 2010 levels. Pork would account for 54 million tons of the increase, boosting production by 7 percent compared with 2010.

"More efficient domestic production and fixed overseas supplies can also free up land for other uses, which is a growing concern given the need to boost land supplies to support China's longer-term urbanization plans," he says.

In the past, many of the investments from China were focused on energy, advanced manufacturing and technology, as well as entertainment, hospitality and safe-haven assets such as real estate in overseas markets, but recent years have seen an increase in investment from the food sector.

"It's good news for both the US economy and manufacturing," Thilo Hanemann of New York research firm Rhodium Group was quoted by the New York Times as saying. "But the level of Chinese investment is still too low to call it a savior. The potential for future growth is huge."

Cecily Liu contributed to the story.

Related Stories

China urges higher food safety standards 2013-09-24 09:29

Chinese vice-premier stresses food safety 2013-09-11 17:46

Food safety tops public's concerns 2013-08-21 00:02

Food safety concerns in updated 'Whys' books for kids 2013-08-10 16:19

Shanghai issues food safety blacklist 2013-06-19 19:53

Over 8,200 arrested in China for food safety crimes 2013-06-19 16:58

Today's Top News

Senate leader 'confident' fiscal crisis can be averted

China's Sept CPI rose 3.1%

Li Peng's daughter denies 'rumors'

No new findings over Arafat's death: official

Nobel economists rarely get to influence policy

Working group to discuss sea issues

Chinese firm joins UK airport enterprise

Draft rule raises fines for polluters

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|