A consuming passion for quality eats away at the nation's heart

Updated: 2013-10-14 06:32

By Lyu Chang in Beijing and Qiu Bo in London (China Daily)

|

|||||||||||

|

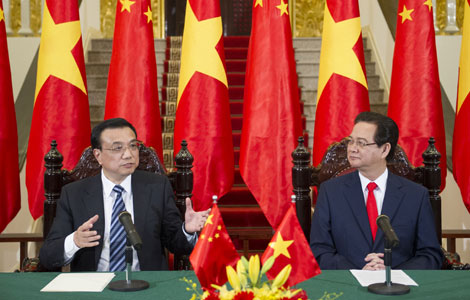

Chinese meat processor Shuanghui International Holdings completed the acquisition of US pork producer Smithfield Foods Inc last month. [Photo / Provided to China Daily]

|

Chinese companies eye more overseas mergers and acquisitions to offset rising safety concerns at home

Donna Wang is one of the several shoppers buying ham at a busy supermarket in downtown Shanghai. Unlike most of her peers who are scouring the shelves for reputable foreign brands, Wang prefers to buy ham made by the Chinese pork producer Shuanghui Group.

"My actions may seem rather strange," Wang says. "Food safety has become a matter of grave concern in China, especially after the recurrent scandals over contaminated products and substandard ingredients. As a result most of the shoppers prefer to shun local products and opt for foreign brands," Donna says.

As an old customer of Shuanghui, Wang feels that the brand does have the vital ingredients - trust factor and quality - needed to build confidence with customers.

"The Chinese company has moved further up the quality ladder with its recent $7.1 billion purchase of US pork producer Smithfield Foods Inc.

|

Shoppers such as Wang who are keen on quality as well as homegrown brands are now spurring Chinese food companies to shop overseas for modern production techniques, safety systems and reputed brands to cater to the growing demand.

Experts say that the Smithfield acquisition, when complete, will help Shuanghui gain access to the brands perceived to be of higher quality and over the long term provide it with products for China's burgeoning middle class, especially those that are made abroad.

Chinese food companies have for long sold products at low prices, but have now discovered that buyers are willing to spend more for products they believe are better or more prestigious. They are seeking to offer them everything from milk to bacon at premium prices, Vineet Sharma, head of consumer research at Barclays Capital's Asia (excluding Japan) division, commented in a recent interview to The Wall Street Journal.

"Consumers aren't just looking at the cheapest brand. They want the better brand," said Sharma.

Global consultancy firm McKinsey & Co found in a recent survey covering 10,000 Chinese shoppers that more than 80 percent of the respondents said they were spending more money on food than before, while a third of the respondents said they were buying more high-end brands.

Xu Hang, a 30-year-old professional services employee, who has recently returned to China from Canada, says he has to buy huge quantities of milk powder for his family and friends every time he flies to Hong Kong for business.

"It is hard to trust domestic brands when it comes to food," he says. "The price of imported food is a bit higher, but it is also safer because it comes with the hallmark of quality."

In May, Mengniu Dairy Co, one of China's largest milk producers, struck a deal with French food products firm Danone SA to create a joint venture to expand yogurt production in a market where foreign brands are generally preferred. Oliver Barron, head of the Beijing branch of UK-based investment bank NSBO, says that more such deals are likely to be struck in the food sector between Chinese and foreign firms in the next few months.

These alliances, however, are not just about offering an up-scale range of products, experts say.

The fact that Shuanghui has decided to retain the US operations and brands and also uphold safety standards indicates that the deal is more about gaining access to technology and quality know-how.

"The deal will create a leading global animal protein enterprise," says Shuanghui chief executive Zhijun Yang. "Shuanghui and Smithfield have a long and consistent record of providing customers around the world with high-quality food, and we look forward to moving ahead together as one company."

Many safety scares in China have eroded trust among the middle class in domestic food products, ranging from pork to dairy products. In 2011, Shuanghui was allegedly found to be selling pork from pigs that had been fed banned additives, which made the pigs leaner but posed health risks to humans.

Melamine-tainted milk powder in 2008 that killed at least six children and sickened about 300,000 others, have further fueled people's concerns about the safety of domestic milk powder.

In response, the Chinese government called for efforts to make infant formula, ingredient milk, meat, vegetables, liquor and wine, as well as dietary supplement products traceable by building up a national electronic food-tracking system to boost food safety supervision.

Related Stories

China urges higher food safety standards 2013-09-24 09:29

Chinese vice-premier stresses food safety 2013-09-11 17:46

Food safety tops public's concerns 2013-08-21 00:02

Food safety concerns in updated 'Whys' books for kids 2013-08-10 16:19

Shanghai issues food safety blacklist 2013-06-19 19:53

Over 8,200 arrested in China for food safety crimes 2013-06-19 16:58

Today's Top News

Senate leader 'confident' fiscal crisis can be averted

China's Sept CPI rose 3.1%

Li Peng's daughter denies 'rumors'

No new findings over Arafat's death: official

Nobel economists rarely get to influence policy

Working group to discuss sea issues

Chinese firm joins UK airport enterprise

Draft rule raises fines for polluters

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|