Web Comments

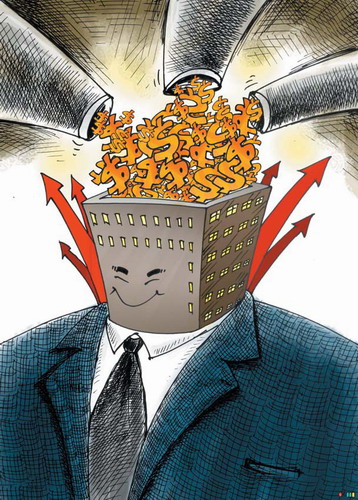

Reality check for realty

Updated: 2011-01-21 10:47

By Liam Bailey (China Daily European Weekly)

The post-crash bounce in global housing market is set to slow considerably in 2011. However, lower price growth across the world masks improving fortunes in Europe and the sustainable market performance in Asia.

The key driver in these locations is that prices are actually beginning to return to something close to a "sustainable" level. This is partly because the relationship between prices, rents and incomes is falling more in line with their long-run average.

In locations such as the United Kingdom, France, Australia and Canada, prices have performed well over the past 18 months. In the UK and France this has happened on the back of low rates and stimulus measures. In Australia a burgeoning economy tied into Asia's economic boom has been the driver.

However, these are all examples of markets that stand well above long-term measures of "fair pricing". In the UK we expect that in 2011 prices will fall following the introduction of austerity measures by the government, such as tax hikes and spending cuts, but most importantly due to a shrinking mortgage market. However, a modest annual fall of 3.3 percent will not address the risk of a more significant adjustment should interest rates rise strongly from 2011 onwards.

While the United States appears to be experiencing a second wave of difficulties in terms of defaults and distressed loans, and again turnover volumes are at historically very low levels, it looks reasonable to assume that pricing will probably remain relatively static over the next 18 months. The US is one market that has actually seen pricing return to much more realistic and sustainable levels over the past three years.

Turning to Asia, we can see the real driver behind our global view of price moderation in 2011. We expect a significant slowing in the rate of growth in locations such as Hong Kong (18 percent in 2010, down to 12 percent in 2011), Singapore (10 percent to 3 percent), Australia (5 percent to 0 percent) and the Chinese mainland (7 percent to 5 percent).

As we discussed, the risks to the above forecast are significant. However, our central scenario is that the global housing market will deliver positive growth in 2011.

The global residential market is undoubtedly in a stronger place than it was earlier, but the number of risks to seem to be rising.

One of the main drivers of price and demand growth in residential markets in the more "international" markets - for example, Europe including London and the main southern European sun-belt markets, the US covering Florida and New York, but also the main Asian and South American second home markets - has been the expansion of cross-border purchasing activity.

During the 12 months to June last year, nearly 50 percent of all the newly built apartments in central London were bought by foreign nationals.

Restrictions on capital transfer have declined and in more and more locations it has become easier to take equity from one country to another.

We can anticipate a further relaxation in the capital transfer rules over time. At the same time there is also a perceived risk, especially from the Asian contributors, that the ongoing expansion of cross-border trading should not be regarded as a given thing.

While in most markets there is a desire to see an expansion of inward investment, this is not always the case, with parts of Switzerland being a prime example. In others, the political or security situation is such that foreign investment has fallen thereby removing the key prop for the market.

The most notable trend from our assessment is that the Asian respondents are more bearish than those in Europe or the US, with the exception of the risk from rising inflation.

The leading factor for the more negative stance from Asia was a concern regarding the position of the region's markets in the property market cycle. While prices have fallen, sometimes significantly, in the West over the past few years, in the majority of Asian markets prices either fell only marginally from 2006 or 2007, or indeed didn't slip at all.

In almost all cases the leading Asian housing markets are substantially higher than the levels seen before the credit crisis first infected the global economy. In short, industry experts in Asia seem to feel that the continent cannot escape weakening market conditions.

Considering the results in detail, the fear of a double-dip recession is high on the list - the very strong relationship between GDP growth and house price performance points to the risk posed by a global economic slowdown.

However, the biggest single theme to emerge from our assessment is the significance ascribed to debt problems -both private and public.

The potential of these existing debt problems to feed into lower new lending volumes, is also factored in our results. In Asia, mortgage market risks are aggravated by recent and plans for government-imposed borrowing restrictions.

Additional credit controls imposed on the Chinese mainland are reducing capital flows to Hong Kong and slowing the market there.

Fears over the impact of inflation or alternatively deflation were not thought to be significant issues for the market - suggesting that at least for 2011, the rising cost of mortgage finance will not to be a critical factor for the market.

The author is head of residential research at Knight Frank, a residential property consultancy.

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Preview of the coming issue

Carrefour finds the going tough in China

Maid to Order

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.