The high cost of ignorance

Updated: 2010-03-29 07:52

By Liu Junhong (China Daily)

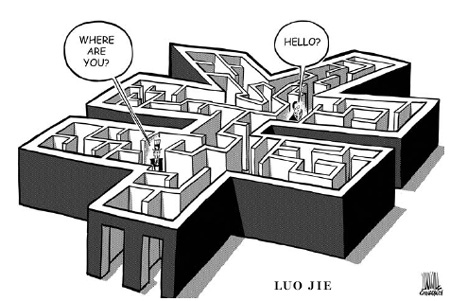

In its demands for China to revalue its currency, the US has turned a blind eye to changes in the Chinese economy

The campaign recently launched by some United States lawmakers to pressure China into appreciating its currency has brought a tit-for-tat war of rhetoric in Sino-US relations that has taken major steps back after US President Barack Obama's meeting with the Dalai Lama and its arms sale to Taiwan.

In so doing, politicians in the White House, who have long been preoccupied with bipartisanism, have shown their sheer ignorance of growing economic interdependence between the largest developed and developing countries and the US' political responsibilities as a superpower.

| ||||

The US should drop its theory that China's rapid economic recovery needs an appreciated yuan to offset the negative effects from the accelerated inflow of international floating capital into its territory, its growing foreign reserves, excessive fluidity and its emerging real estate bubbles.

The preconditions for an appreciated renminbi, China's currency, have tended to subside. Due to a steep drop in global demands following the global financial crisis, China's exports have sharply declined and many of its exports-dependent enterprises in coastal regions have been shut down. The adverse economic conditions, coupled with growing unemployment, have put pressure on the government and plunged the world's fastest-growing economy into a new round of industrial restructuring.

Following the global financial crisis, the US became very active in trade protectionism. Due to a series of its self-saving packages - such as the "buying America" campaign, advocacy of thrift and measures to expand US exports - consumptions in the world's largest economy have declined and its deposit ratio has continued to rise. The long-controversial trade deficit with China has also narrowed, as indicated by the rate of container transportation across the Pacific Ocean. Statistics from Japan's Maritime authorities indicates that the containerized transportation bound to China from the US increased 16 percent last September from the previous year, a seven consecutive monthly increase.

In comparison, the volume from China to the US and other Asian nations declined by 13.4 percent during the same period and had a 27 monthly negative growth by the end of last year. At the same time, the capacity of US air and land transportations last year also surpassed the highest level of the previous year.

The stereotype mentality indicates Washington's lack of knowledge about ongoing changes in the Chinese market and a changed investment relationship with China. Since the Securities Law and the Company Law took effect in China in 2005, international fluid capital has begun to shift investment from the field of fixed assets and stock market to stock acquisitions, private equity as well as enterprise realignment and mergers. Their shift to the nontraditional market makes it difficult for the Chinese authorities to follow their traces and then contribute to an exaggerated "China investment". This could also partly explain worldwide panics about China's "red capital". Decision-makers in Washington have turned a blind eye to the fact that the zero-interest rate adopted by the US Federal Reserve since the crisis has further added to in-pours of a large sum of international capital into China.

For many years, the US has done what it could to strike a balance among the world's other currencies to maximize its own national interests. Since the creation of the euro in 1999, delicate changes have occurred to the dollar-dominated international currency system and a bipolar international monetary order between the two currencies has taken shape. To maintain the dollar's long-established hegemonic status, the US has taken measures available to acquire an expected equilibrium among the world's other major currencies. These Washington tactics was to Japan's advantage and helped Tokyo keep its yen's fluctuations against the dollar to a minimum. As a result, Japan had effectively maintained its trade and investment interests.

Due to Japan's exports revival, foreign trade expansion and its growing surplus in its current account, the yen is currently under huge pressures for appreciation. The dollar's lingering low interest rate against the yen has also pushed international funds to flow into Japan, adding to an appreciated yen. However, the equal foreign policy pursued by the Japanese Yukio Hatoyama government with the US has resulted in increasing frictions with Washington. An appreciated yen, in the eyes of Washington, would possibly squeeze the dollar's space and accelerate its demotion to a US-based local currency. Under these circumstances, Washington believes it is its best choice to force China's currency to revalue while acquiescing to the yen's depreciation to strike a balance in the US-forged international currency system.

But this deliberate policy maneuvering exposes Washington's short-sightedness about the nature of a global financial crisis. In the 21st century, the flow of international capital no longer submits to any single country, no matter how powerful it is. Washington's "RMB appreciation" uproars will also bring itself a huge financial risk. Any large range of revaluation of the Chinese currency, as Washington has required, is likely to plunge the global monetary market into extreme chaos.

Cooperation will bring the two countries a win-win result and help them to play a larger constructive role in global affairs.

The author is a researcher with the China Institutes of Contemporary International Relations.

(China Daily 03/29/2010 page8)

Paper's Digest

Chinese jet takes on Big 2

First large commercial plane set to ride on demand for aircraft as economy grows.

Super-CPU only for domestic eyes

Specials

Gaining ground

Doing business in china for westerners has come a long way, Peter batey says.

Safeguarding environment a priority

China continues to face mounting pressure to curb environmental degradation, despite progress in reducing pollution over the last five years, the environmental protection minister warned.

Employment to remain a continuing challenge

China's top labor official said the country will face a tough employment situation in the next five years.