Economy

China fueling European recovery

Updated: 2010-12-03 11:42

By Andrew Moody (China Daily)

As the Chinese economy powers ahead, Potential for growth in trade and investment with Europe gives rise to optimism on the continent

How important is China to Europe's economic recovery in 2011? Few can deny the impact China has had on the global economy in its rise to become the world's second-largest economy. Europe has made only a faltering recovery from the economic crisis so far with growth in the 16 eurozone nations expected to slow from 1.7 percent this year to 1.5 percent next year, according to the latest International Monetary Fund (IMF) forecast.

And while, as the IMF also predicts, China's growth rate is expected to fall to 9.6 percent next year from this year's 10.5 percent, it is still racing along by comparison and providing a boost for many of Europe's key industries.

Audi, Volkswagen's premium car brand which has a joint venture with China's FAW Group, announced at the Paris Motor Show in October it expected to sell more than 300,000 cars in China by 2012, more than in its home German market.

Volkswagen, which has been in China since the early-1980s, is itself set to spend 6 billion euros on two new plants over the next three years. BMW is set to put 560 million euros into a second plant in Shenyang in Northeast China's Liaoning province.

Airbus is expected to win the biggest slice of the 300 billion euros China is forecast to spend on aircraft over the next two decades.

Rolls-Royce announced in November it had won a contract worth 1.35 billion euros to supply engines to Air China for 20 Airbus long-haul aircraft

China is also likely to be a key player in propping up the European currency next year, by buying debt instruments from trouble-hit economies such as Greece, Portugal and Ireland.

The dependency of the European economy on China can be exaggerated, however.

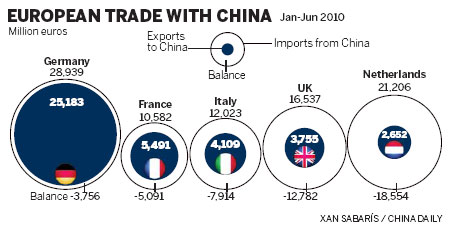

Total exports from the 27 European Union nations to China in the first half of 2010 - 53.5 billion euros - were just 8.5 per cent of Europe's total of 630.4 billion euros, according to statistics agency Eurostat.

But they were significant for Germany, the biggest European economy. Its exports to China in the first half of this year were 25.2 billion euros or 47 percent of all EU exports.

Thomas Mayer, chief economist of Deutsche Bank, says it was the pace of growth of exports to China that meant they were a vital component in Europe emerging from the financial crisis.

Sales of goods and services to China from the EU more than tripled from 26 billion euros in 2000 to 82 billion euros in 2009, according to Eurostat.

"Although the share of exports to China in total exports is still relatively low for European countries, growth is substantial. Moreover, strong growth in China is good for the rest of Asia, and a dynamic Asia helps exports and GDP growth in Europe," he says.

Duncan Innes-Ker, senior economist at the Economist Intelligence Unit (EIU) in Beijing, agrees it is the potential for growth in China and the EU's trading relationship in 2011 and beyond that gave rise to optimism.

"When it comes to direct trade exposure, China is not a very important export market for most EU countries individually, apart from Germany and Finland," he says.

"Very few EU countries have more than 5 percent of their exports going to China. However, although it is a relatively small proportion, it is a growing proportion and it is that potential for growth which is really quite important."

Timothy Stratford, partner at corporate law firm Covington and Burling in Beijing, who was speaking in Brussels this week at a European policy summit called "Doing Business with China in the Wake of the Crisis", said he expected the rebound in trade between the EU and China that has been witnessed since the depths of the economic crisis to continue in 2011.

"There is clearly a rebound taking place. European companies have been more dependent on China than American companies, which tend to be more orientated towards their domestic market. China is Europe's fastest growing export market. I think Europeans strongly recognize that since China is a major growing economy it has to be part of its economic development," he said.

Still, there have been some indications that the China market might not be as favorable to those looking to do business next year.

China raised its interest rates in October for the first time in three years by 0.25 percentage point to contain inflation, particularly in its rampant property sector, which some think will lead to slowing growth in 2011.

Zhang Tianbing, partner in international management consultants AT Kearney based in Shanghai, believes there are risks that 2011 might see a slowing of the China economy that could impact on the demand for European goods.

"The government has signaled its intent that it wants to combat inflation by increasing interest rates. This could have the effect, however, of attracting a lot of 'hot money' into the country since interest rates are still rock bottom in other parts of the world, " he says.

Zhang argues this would put upward pressure on the yuan and depress demand for Chinese exports.

"This would have the effect of slowing the growth of the economy and would mean there was also less demand for European exports," he says.

Zhang is concerned that such effects might have a long-term dampening effect on the China economy with its growth slowing markedly.

"It would create a tricky situation. From that position it would be difficult to lower the level of the yuan and we might have a Japan-type scenario of lower growth over the long term," he says.

Innes-Ker at the Economist Intelligence Unit believes next year will prove something of a crossroads for many European companies trading with China.

Overwhelmingly, European exports to China have been in sectors such as aviation, high-speed rail technology and other forms of high-end engineering, but this could be changing.

"I think we are at a crossroads in terms of European exports to China. As China gets more proficient in these areas itself, Europeans will have to make greater inroads in other sectors such as retail and professional services," he says.

Britain's biggest retailer Tesco announced in November it was doubling the number of hypermarkets it has in China to more than 200, so as to triple its number of customers per week to 12 million in a 6 billion (7.07 billion euros) investment over five years.

Sweden's H&M and Spain's Zara, both major fashion retailers, are also expected to make further inroads into the China market, targeting third-tier cities.

"I think it is these types of companies which will make real inroads into the China market over the next decade. It will also be smaller-end type manufacturers, such as coffee machine makers from Italy and Spanish food producers," adds Innes-Ker.

One of the big questions for Europe over the coming year is whether there will be more Chinese investment in European companies then.

Chinese foreign direct investment in Europe is still at a relatively low level, just 317 million euros in 2009, well below the 2006 figure of 2.186 billion euros.

The most high profile deal was in August, when Zhejiang Geely Holding Group Co completed its takeover of Swedish carmaker Volvo.

Many China companies see the benefits of investing in Europe. Only in November, China's Tianjin Xinmao S&T Investment Corp launched a bid for Dutch giant Draka Holding, Europe's third-largest cable maker.

Andre Loesekrug-Pietri, chief executive officer of private equity concern A Capital Asia, which has offices in Beijing and Shanghai and which advises Chinese companies on overseas investments, believes 2011 could see many more such moves.

"I think more and more Chinese firms instead of exporting will consider making investments," he says.

"This gives them the opportunity not just to distribute their product but the ability to access local talent and tap into local research and development also."

He also believes Chinese companies have realized they need to be closer to European markets in the wake of the economic crisis.

"The financial crisis was a real wake-up call for Chinese firms. They saw a sudden drop in exports and discovered they couldn't do anything about it because they didn't know their customers. Investing in Europe brings them closer to the market, " he says.

There has been speculation there might be a high profile acquisition by a major Chinese investor in the financial services sector with one of the troubled UK banks, Royal Bank of Scotland, in which the UK government has a majority shareholding, being mentioned as a target.

Innes-Ker at the EIU believes such speculation is wide off the mark.

"I think such a takeover would be very complex politically. I know the Irish have been happily discussing whether the Chinese would come in and buy some of their banks but I think that is very unlikely," he says.

Zhang Xiaotao, assistant dean at the School of International Trade and Economics at Beijing's Central University of Finance and Economics, does not rule out the possibility of trade tension between China and Europe in 2011, particularly if current concerns over the euro cause the recovery to falter.

"If the recovery does not go smoothly, the European Union may adopt trade protectionism, leading to enlarged trade friction," he says.

"I think given the current appreciation of the yuan, imports from Europe will rise next year but whether Europe buys more goods will depend on the recovery."

A number of leading European companies have complained about market access, particularly in telecommunications and financial services

Stephen Perry, chairman of the 48 Group Club, the London-based business network club promoting trade with China, says that if European companies want greater access they have to work closely with the Chinese.

"There is no point in lecturing the Chinese on these issues. (Chinese President) Hu Jintao or (Chinese Premier) Wen Jiabao don't get up in the morning and think about exports or the international world. They think about the challenges of China and then they think about the challenges of China.

"It is the companies which are prepared to help them with these which will ultimately succeed."

With China likely to play a major role in the European debt crisis, 2011 could be a pivotal year in the relationship between Europe and China.

"I think by just China being there at the moment is quite helpful to Europe, providing both a vast export market and also having the funds that will be useful in propping up the European market," adds Innes-Ker at the EIU.

Yao Jing contributed to this story.

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Preview of the coming issue

Carrefour finds the going tough in China

Maid to Order

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.