Phone firms dial into smarter world

Updated: 2015-05-29 08:20

By Hu Haiyan and Gao Yuan(China Daily Europe)

|

|||||||||||

Chinese manufacturers aim to take a bite out of Apple, at home and abroad

For Zhou Hongyi, China's smartphone market is like "an ocean of blood", and yet it is an ocean he is happy to dive into. "I'm getting into this because I believe you can shake up any market, and those at the top cannot stay there forever," says Zhou, founder and CEO of Qihoo 360 Technology Co Ltd.

Zhou was speaking at a news conference on May 6 at which Qiku, his smartphone brand, was unveiled.

Global smartphone shipments surpassed 1 billion units last year, a year-on-year increase of 40 percent, according to market researchers International Data Corp. It is expected China's shipments alone will reach 360 million this year.

China is a key market for smartphone companies worldwide, not only because the country has 1.3 billion potential customers, but also because it dominates global smartphone manufacturing.

With a share of such a massive pie up for grabs, unconventional players such as Qihoo 360 Technology are going up against more-established companies by launching their own mobile devices.

Zhou has promised that his "exquisite" handsets will beat rivals on both quality and price.

The 45-year-old, who headed Yahoo China in the early 2000s, defeated Internet security firms that charged customers royalties by introducing free anti-virus software products about a decade ago. Qihoo 360 accounts for the lion's share of the for-private-use, free online security market.

Qiku is a joint venture with Coolpad, already a major contract smartphone maker in China, and is expected to unveil three handsets running on an Android operating system in June.

"Our device could easily sell at 5,000 yuan ($800; 730 euros), but we will offer buyers a remarkably lower price," Zhou said, without elaborating on the products.

Gree Technology, one of China's largest home appliance producers, has already released its smartphone, part of a strategy to enter the smart home market and the Internet of Things sphere.

"Our first phone has gained two key official licenses," its president, Dong Mingzhu, said. "Customers can use Gree phones to control wirelessly connected household appliances, such as refrigerators, ovens and televisions, making their lives more convenient."

Internet companies, including Tencent, are also keen to cater to China's growing legion of mobile users, estimated at 557 million. At the recent Global Mobile Internet Conference in Beijing, the company launched an operating system for smartphones and smart watches.

Ren Yuxin, the chief operating officer, said the system, TencentOS, will improve the experience on social networking apps and allow users to enjoy high-quality services from different smart devices.

Alibaba Group, another Internet giant, also has an operating system, Yun OS, and in February bought a minority stake in smartphone manufacturer Meizu Technology.

After six years of rapid growth in the demand for mobile handsets, competition is now fierce, according to an IDC report on May 11.

About 98.8 million devices entered the Chinese mainland market from January to March, down from more than 103 million during the same period a year earlier, the report said. The 4.3 percent decrease was the first since 2009, the so-called dawn of the smartphone era.

Apple Inc, Xiaomi Corp and Huawei Technologies Co Ltd were the top three vendors in the first three months in terms of shipments, accounting for more than 39 million devices during the period, almost 40 percent of the market share, the report said.

Antonio Wang, an analyst for IDC, says shipments could continue to drop over the coming quarters due to weak demand. "The number of first-time buyers has slumped because the penetration rate is extremely high," he says.

Hours after IDC warned of the potential trend, Apple CEO Tim Cook created an account on Sina Weibo, a Chinese Twitter-like service, hoping to attract Apple fans. The account gained about 200,000 followers in the first hour.

Apple is facing the strongest challenge in China, as Xiaomi and Lenovo Group Ltd are fast encroaching into the United States company's high-end user base. The two companies, along with Apple and Samsung Electronics Co, have all claimed pole position in the IDC rankings over the past five quarters, more evidence that the country's smartphone market is a battlefield for vendors.

An array of vendors, including Xiaomi, Huawei and Lenovo, are also battling it out in the market for mobile devices costing up to 3,000 yuan.

"With more outsiders entering the game, competition has got more fierce, so overseas manufacturers will need to find a unique feature to attract Chinese buyers," says Wang Jingwen, an analyst with Canalys China in Shanghai.

According to Analysys International, Apple's market share was just a single digit last year, although that is largely because it targets mid- and high-end buyers.

"The mobile market in China is heavily contested, and local vendors are quickly gaining market share," Wang at Canalys China says, adding that Chinese brands have dominated the mid-range and budget markets.

Some manufacturers are challenging Apple in the high-end market, too, by offering quality products at more affordable prices.

China's largest smartphone producer, Xiaomi, which has been running for four years, sells its entry-level product, Mi Note, which has a 5.7-inch (14.5 cm) screen, for 2,299 yuan. By contrast, the iPhone 6 Plus, equipped with a 5.5-inch screen, sells for more than 6,000 yuan.

However, Wang at Canalys China says price is no longer the main focus for Chinese buyers. "As expectations increase in line with spending power, combined with rising market saturation, there is a major shift to devices that provide better user experience," she says.

Looking ahead

Chinese smartphone producers are latecomers to the market compared with Apple and Sumsung, yet they are eager to build their legend through innovation and design, as well as price.

Lei Jun, co-founder and CEO of Xiaomi, says his company's success is based on in-house innovation and a unique relationship with its customers. Xiaomi sold 61.12 million smartphones last year, up 227 percent on 2013, and most purchases were made in China.

The company will "consistently focus on" product innovation and strive to produce high-quality, high-performance devices that ensure great user experience, Lei says. "We have to outperform Apple in some areas. It represents the rising power of Chinese innovation and creativity."

At Xiaomi's development center in a northern suburb of Beijing, 1,800 developers, many aged about 30, have been busy updating the MIUI, an intricately tailored Android operating system for its mobile devices, Lei says.

Eric Chen, who is starting his second year at Xiaomi as a software engineer, says he is excited to be working on one of the most talked-about smartphones in the industry.

"It makes no difference for me to work for a local company or a foreign one," says Chen, who previously worked for a major overseas brand. "The salary is OK here. As long as the company is passionate about new ideas, it is a good place to work for an engineer. I like working for a startup company rather than at (a large company such as) Apple."

Lei says his company will introduce more products that use top-tier technologies and are available at low prices. "We value innovation," he says. "Xiaomi will have tens of thousands of patents in 10 years' time."

The biggest innovation breakthrough has come in software and user experience, he says. The MIUI can automatically block scam calls while putting through calls from delivery services using a constantly updated phone number database. Xiaomi is also building deeply localized services in China, including free Wi-Fi connections in at least 50,000 restaurants and railway stations.

Tian Zheng, a senior analyst at Analysys International, says Xiaomi's ambitious attempt to build a wider ecosystem in online media, smart homes and other markets is what makes the company stand out. The company has overtaken Samsung to become the top smartphone maker in China, in terms of shipments, at the end of last year, he says.

Another major domestic smartphone producer, Huawei Technology, also contributes its success to innovation. The company, once an obscure electronics plant with a registered capital of 21,000 yuan, is now a global giant that generates more than $46 billion in annual sales.

Executives at Huawei say the company's many years of investment in research and development is finally paying off. The company entered the foreign market 16 years ago and in 2010 restructured its business units to improve its global business.

"We have 16 research centers globally, so we can take advantage of more international talent to upgrade our products," says Guo Ping, chief executive of Huawei. "We hired Russians to write algorithms, French experts in product design, and Japanese scientists to develop new materials.

"Each year we have more than 10,000 graduates joining us as engineers... They will safeguard our competitiveness in the global market."

Huawei is also taking advantage of its relationship with carriers to launch smartphones. In the past year its flagship handset, Mate 7, has been in short supply amid huge demand, quite an achievement given the tough competition.

The company has ambitious goals in the consumer electronics sector - it unveiled its first smartWatch in March, taking on the Apple Watch - and is aiming for a bigger presence in developed markets where profit margins could be higher.

Branching out

Chinese manufacturers are not only confining themselves to the domestic market. They plan to sell their products abroad to boost demand and profits, to offset rising labor costs and slow sales growth in China.

Companies such as Xiaomi have already started with overseas sales, primarily aiming at emerging economies in Southeast Asia, the Middle East and Latin America. The major players even have plans for the US market, despite Apple's dominance, as it offers the highest average profit margins. Xiaomi, which already sells its accessories there, is mulling such a move.

However, Wang at Canalys China warns that it will not be easy. "In developed markets, (Chinese) vendors will find it even harder to build brand awareness," she says. "Most consumers already use smartphones made by the big players such as Apple and Samsung. The operators usually set higher standards for smartphone products."

Cheng Lixin, senior vice-president of telecom equipment maker ZTE Corp, says he has high hopes for its products in the US. "We aim to be one of the top three global smartphone vendors in the world's most competitive market within three years."

That goal is considered aggressive even by the standards of world-famous brands such as Google and Microsoft. However, Cheng, who is in charge of North American operations, says he believes ZTE's strengths in innovation, executing brand campaigns and an "affordable premium" customer strategy all make the target achievable.

"As the world's most important (telecom) market, the US is also a vibrant place for marketing and handset development," he says. "Success in the US will help us explore other markets."

The plan is to impress US customers with high-quality, low-price devices, he says. "Because ZTE is rolling out high-performance handsets at relatively low prices, buyers in the US do not need to pay $500 or even $300 for a smartphone with high performance."

ZTE has invested heavily in the US in recent years, setting up five research centers and recruiting more than 300 employees, about 80 percent of them local. "Only a truly localized company will have a chance to succeed in the US," Cheng says.

According to Strategy Analytics, the US was the best-performing overseas market for ZTE last year. Shipments of its devices rose in the high double digits, even as competitors' shipments were flat or lower, the research firm said. ZTE had 20 million active users in the US as of Dec 31.

Like Samsung, ZTE provides low-end and high-end devices in the US, offering 69 models in total.

Last year, higher sales of 4G network equipment and smartphones lifted the company's global net profit by 94 percent to 2.63 billion yuan. In the smartphone sector, the company shipped 48 million devices, with 70 percent sold outside the Chinese mainland.

Bryan Wang, China director of Forrester Research, says the US is one of the most difficult markets for any emerging player. "About 90 percent of phones (in the US) are sold via carrier channels, so a deep and healthy relationship with the carriers is vital."

As pre-paid and contract phones are sold in partnership with carriers in the US, ZTE said it is already taking advantage of its deep ties with companies such as AT&T and T-Mobile to sell devices.

"We always produce above-standard devices with highly functional features," Cheng says. "After working together for more than a decade, the carriers trust our capabilities in research and development."

Oppo Electronics Corp is also one of the companies aiming at the global market.

"Oppo operates in 22 countries, including China," says Sky Li, vice-president and managing director of international mobile business. "The Southeast Asia region is our first overseas market, and it is the market where we first started our overseas expansion. In 2009, we started selling our products in Thailand. And that helped us accumulate experience to work in other foreign markets."

The company sold 30 million units of smartphones last year, and this year expects the figure to reach 45 million, he says.

Some Oppo products are sold in Europe and the US through e-commerce platforms, but Li says the company has no specific timeline to properly enter those markets.

"We try to understand the different demands our global customers might have. So we rely on localization to develop new products."

Yan Zhanmeng, a senior analyst at IDC China's cellphone market research department, says: "It is likely that in about five years, some big domestic brands such as Huawei can develop into a global brand that can challenge Samsung and Apple."

Yan says Chinese smartphone makers enjoy the advantage of having strong supplying chains, and China also has some strong manufacturing centers as Shenzhen, which can support the development of local smartphone manufacturers.

But there are also some challenges for the Chinese smartphone manufacturers. "Chinese smartphone manufacturers still lack core technologies such as some core chips and high-end screens," says Yan.

Emma Gonzalez contributed to this story.

Contact the writers at huhaiyan@chinadaily.com.cn and gaoyuan@chinadaily.com.cn

|

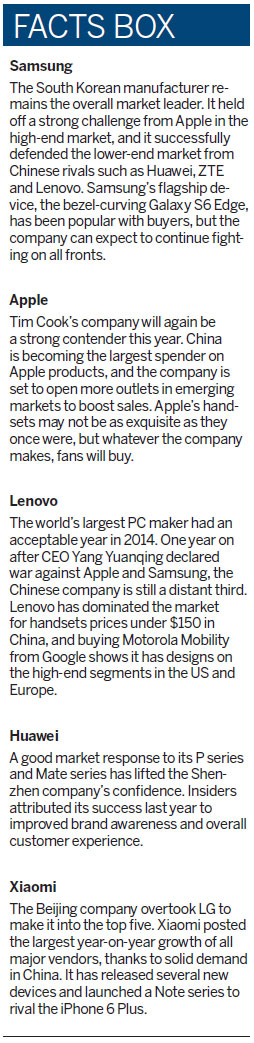

A visitor inspects a ZTE smartphone in the ZTE Corp pavilion at the Mobile World Congress in Barcelona on March 3. Provided to China Daily |

( China Daily European Weekly 05/29/2015 page1)

Today's Top News

British Queen makes references to China in keynote speech

Bayern cashes in on Chinese fans' frenzy for European soccer

German rail giant mulls buying trains from China

Blair to resign as Middle East Quartet envoy

London stock exchange takes steps to include China A shares

China calls for durable settlement of Kosovo issue

China urges BRICS to unite for promoting multi-lateralism

New way to enjoy movie in Berlin

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|