Investment is a two-way street

Updated: 2011-12-09 08:21

By Fu Jing (China Daily)

|

|||||||||

|

A general view of the Norwegian company Elkem's plant in Kristiansand, some 300 km south of Oslo on Jan 11. Norway's Orkla has agreed to sell its Elkem unit to China National BlueStar for $2 billion in one of the biggest industrial takeovers by a Chinese group in Europe. [Tor Erik Schroeder / Reuters] |

Recent business deals between China and the EU have been successful but difficulties remain

Gerard Lyons, chief economist of Standard Chartered Bank, has famously said that the three most important words in the past decade were not "war on terror" but "made in China".

Citing Lyons' point, European Commissioner for Trade Karel De Gucht recently said the openness of global markets since China's admission to the World Trade Organization (WTO) has helped transform the country into the world's second-largest economy, a position it achieved last year.

This is true but is only a partial picture of the past decade. De Gucht's comment would have been fairer if he had also noted that Chinese factories have provided numerous affordable goods to millions of European families and thousands of European investors have made large profits in China over the past decade thanks to the cheap labor.

In fact, over the past 10 years mutual benefits have always gone hand in hand with complaints and disputes, mainly starting from the European side.

But Chinese government officials and businessmen have not cringed at any conservative views.

Building upon their capital, technology and experiences accumulated over previous years, the Chinese are seeking new driving forces to run businesses and keep China's economy on a fast track.

While still focusing on foreign trade and investment, China is also shifting to domestic consumption and outward investment. And the China-European Union (EU) partnership at various levels has topped this agenda.

"This is a natural and mutually beneficial process," said Peng Xiancheng, president of Decision Chemical, a leading Chinese leather chemical producer and trader from Southwest China's Sichuan province. "Now China and Europe should enter into a marriage of capital and technology."

After more than a decade of development, Peng said his company has established a market network and mastered some key technologies in its field.

"But the most advanced environmentally friendly technologies are still in the hands of European companies," Peng said. "Some of the companies are struggling now and are eager to transfer their technologies."

In addition to newcomers such as Peng, there are many Chinese success stories in international business.

Worldwide, China has made more than $300 billion worth of non-financial investments overseas by the end of 2010, setting up more than 16,000 business establishments in 178 countries and regions with total assets topping $1 trillion, according to the Ministry of Commerce.

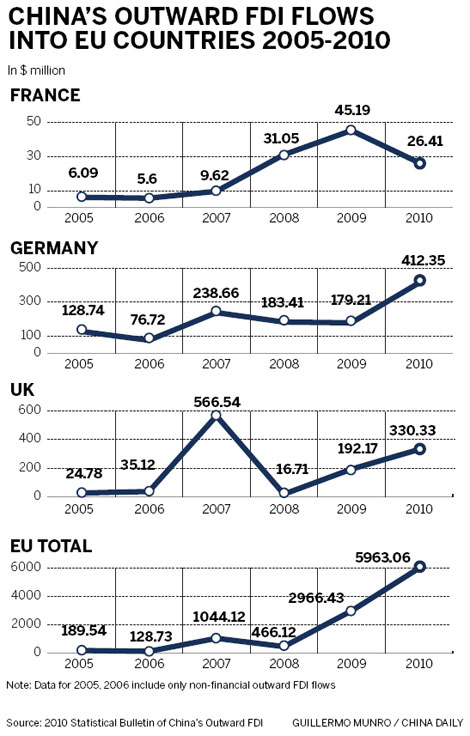

China has started to invest more actively in Europe. By the end of 2010, nearly 1,600 Chinese businesses were making direct investments in Europe with a total portfolio of $12.5 billion, according to the Ministry of Commerce.

The investments have covered a wide range of sectors, including manufacturing, finance, commercial services, retail, wholesale and leasing. Chinese investment can now be found in all 27 EU member states.

Song Zhe, the Chinese ambassador to the EU, said while growing investment in Europe generates revenue for Chinese companies, Europe also benefits from this growth.

Many European companies have been reinvigorated through mergers, acquisitions and restructuring. Take Geely's acquisition of Volvo. Under its new global development strategy, Volvo has managed to refurbish its brand by inheriting high-quality manufacturing and advanced safety technology.

Furthermore, Chinese investment generates new jobs in Europe. By the end of 2010, Chinese companies had employed 37,700 European workers. China National BlueStar, a subsidiary of China National Chemical Corp, employs nearly 3,000 employees in its three branches in France and the United Kingdom.

During this period of financial crisis, Chinese investment also offers some relief for Europe's struggling economies, Song said. For instance, although the China Ocean Shipping (Group) Company (COSCO) faced some difficulties during the financial crisis, it did not give up on its project at the Piraeus container port in Greece, providing hope to the Greek shipping industry during its toughest time.

Despite the rapid expansion of Chinese companies investing overseas, the country is still new to this area and needs to learn and develop through experience.

Song said many Chinese companies at the lower end of the value chain lack transnational operational experience or qualified administrative personnel to properly handle cross-cultural barriers and overseas business risks.

He urged the European side to facilitate a smooth flow of Chinese investment. "In Europe, the sovereign debt crisis is laying out a breeding ground for protectionism," he said.

Song also said inconsistencies in laws and policies among some member states had made the gaining of visas, work permits and residency permits more complex. In addition, some Europeans still view China with suspicion and propose background investigations into Chinese investment simply because of groundless suspicion or uncertainty.

Recently, European authorities have blocked several cases of Chinese investment. This has left many Chinese business people with the impression that the European investment environment is deteriorating, causing them to postpone or even cancel plans to invest there.

"Actions like this from the European side could seriously obstruct investment flow from China," Song warned. "This is not the scenario we want to see."