On the rocks

Updated: 2011-11-18 08:53

By Lu Chang (China Daily)

|

|||||||||

|

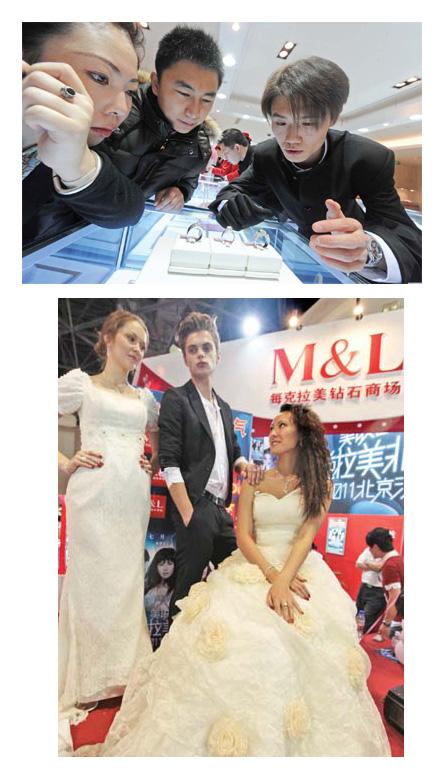

Top: The potential of China's diamond consumption market is huge with the rising demand from the middle class. Above: M&L, which sells diamonds at lower prices, targets young couples who are looking to get married on budget. Photos Provided to China Daily |

Jewelers spruce up offerings as lasting popularity fuels demand surge

Wang Tuo believes "diamonds are a girl's best friend", but he also says they are a token of love. But Wang, 30, wasn't in love with the idea of a small diamond ring with a big brand name bleeding him dry. The betrothed wasn't worried about draining his bank account after he found a one-carat diamond ring for half of the retail price - only 50,000 yuan ($7,879, 5,854 euros). And Wang is exactly the kind of consumer that the diamond store M&L, packed with Chinese buyers even on weekdays, is wooing - young couples who are looking to get married on budget.

The rising demand from the middle class has turned China into the world's second largest diamond consumer market after the United States.

|

||||

Budget-conscious couples have made it a "golden decade" for luxury brands such as Tiffany and Cartier and middle and high-end Hong Kong brands such as Chow Tai Fook and TSL, as well as the mainland's budget sales latecomers like M&L.

Figures from the Diamond Administration of China show the total transaction volume on the Shanghai Diamond Exchange soared 91.9 percent year-on-year to $2.9 billion in 2010.

The import volume of polished diamonds surged 87.6 percent from 2009 to $1.3 billion.

According to the 2011 Rapaport Diamond report, the jewelry industry standard for the pricing of diamonds, the annual turnover of the Chinese jewelry market is forecast to double its market share in global jewelry revenue from 8 to 16 percent and will approach $50 billion by 2015.

"In my opinion, diamonds are the only imported product that can obtain a long-lasting popularity in China. If the country sustains its current economic growth, then it is likely to take the place of the US as the world's biggest diamond consumer market," says Sun Fengmin, executive vice-president of the Gems and Jewelry Trade Association of China.

Kent Wong, the managing director of Chow Tai Fook, Hong Kong-based jewelry company which is planning a HK$23.4 billion ($3 billion, 2.2 billion euros) initial public offering on the Hong Kong Stock Exchange in December, further forecast that China will account for 29 percent of the global diamond market by 2020, while the US share will shrink to 30 percent from the current 45 percent.

De Beers, one of the world's largest producers for rough diamonds, debuted its slogan "a diamond is forever" in a television commercial campaign in China during the 90s. In the meantime, diamonds were widely accepted by Chinese consumers as a precious stone, in particular, for weddings.

"It's not just couples who buy diamonds," says Hao Yi, president of M&L, "but single women living in metropolises influenced by the Western culture also purchase diamonds for themselves."

M&L, which stands for Meikelamei in Chinese and translates to each carat is beautiful, took in 12 million yuan in just three days after opening last January, mostly from young couples ready to tie the knot.

Over the past two years, it undercut its competition by selling diamonds at half the price of other brands.

In the normal practice, jewelry companies process rough diamonds from factories in south China's Guangdong province, who also take a cut from the sale, so the diamond companies eventually pass the cost to the consumers.

"The trick is that most of our loose and rough diamonds are imported directly from dealers in South Africa, Japan and India. Then we have them polished and put them directly on sale in our own department stores," Hao says.

By cutting out the middleman, Hao says his profit margin is about 20 percent, higher than the average of other diamond sellers, which range from 10 to 15 percent.

The jewelry company, which owns four stores, is expected to make a profit of about 20 million yuan this year. Sales of diamonds in three of its stores has already topped 500 million yuan this year.

Many other companies have to cooperate with department stores to sell diamonds or open their own stores.

Chow Sang Sang, the largest public jeweler in Hong Kong, said in its mid-year financial report on Aug 18 that its first-half revenue rose by almost 60 percent to HK$8.29 billion from the same period last year.

It was boosted by strong consumption from mainland consumers who contributed to two-thirds of its revenue, up from 60 percent one year ago.

The number of its stores on the mainland rose to 193 at the end of June, compared with 181 at the end of last year. Same-store sales increased by 43 percent year-on-year, the financial results show.

"One key to our fast growth on the mainland is we grasped the mainland consumers' love for diamonds and platinum and established our brand image of high-end fashion," says Winston Chow, deputy general manager of Chow Sang Sang Holdings International Ltd.

He says smaller cities such as Hohhot, Baotou, and Erdos in the Inner Mongolia autonomous region where a lot of rich mining bosses live are becoming stars in the company.

While diamonds remain a luxury to many China residents, local retailers, which do not have the same branding, financial and marketing resources as major competitors, have tried to expand the size of the market by launching attractive price campaigns to win the hearts of younger and less affluent consumers.

M&L also plans to open 30 to 50 stores in the next five years not only in large cities, but also in second- and third-tier cities in China.

Attracted by the booming diamond market, venture capital firms including Sequoia Capital and Legend Capital wanted to invest in the profitable company but were turned down.

"We are not short of money and aren't considering equity financing at the moment," Hao says. "We chose debt financing for the expansion and one or two investors have promised to provide support."

In Love, another major local diamond retailer that was started by former president of M&L Wan Zihong, has also stepped up efforts to place stakes on the diamond's "golden decade".

The company opened its first store in Beijing in mid-September. Wan quickly grew the number to five in just two months and believes it is bringing fiercer competition in the upper crust of China's consumer market by introducing a budget-diamond concept.

Liu Jianmin, vice-president of All-China Chamber of Commerce for Jewelry and Precious Metals Industry, attributes the success of companies such as M&L and In Love to government measures that encourage investment and the smart marketing strategies that meet the demands of the growing middle class by separating the jewelry store from department stores and boutique shops.

Luxury marketing expert Ye Jian says low pricing can rapidly promote sales, get the public's attention and promote its identity.

But the concept is a double-edged sword. "If your brand is marked as 'cheap and low end', then it will be really difficult to change that image," he says.