Economy

Taste of luxury

Updated: 2010-12-10 14:18

By Tang Zhihao (China Daily European Weekly)

A production worker checks 6.25-kilogram slabs of molded chocolate on the line at the Barry Callebaut chocolate plant in Singapore in this file photo. The Swiss chocolatier moved its Asia headquarters from Singapore to China in 2008 and built a production factory in Suzhou, East China's Jiangsu province. Provided to China Daily

Handmade designer chocolates from Europe become latest status symbols for China's nouveau riche

Samantha Yang, an office worker in Shanghai, loves designer chocolates, especially those from Europe. Sharing a piece of the sweet with her boyfriend as they walked out of a Godiva store, Yang says: "I think it's worth any price ... I meant the bonding."

And the price is very high. A box of 12 pieces of chocolate can cost more than 250 yuan (28.10 euros). To put it in context, that money can buy 8 kilograms of prime pork, the staple food for most Chinese families, even at its inflated prices in Shanghai.

Yang is among a growing group of young Chinese who have taken to designer chocolates, preferably handmade, with sometimes unpronounceable names in Belgian, French or Italian.

"Like owning luxury products such as LV bags or Cartier jewelry, luxury chocolate is the new status symbol of young city folks," says Lu Zhiliang, marketing manager of the Belgian chocolate maker Godiva in Shanghai.

"High-end chocolates in fancy wrappers are affordable luxury items that make people feel good."

Affordability is, of course, a relative term. Many young office workers, especially women, are skimping on other things to splurge on their favorite designer chocolate in many shapes and colors that are designed to strike their fancies.

Leonidas, one of China's longest established and more popular European candy brands, stocks a wide variety of chocolates sold at an average price of 98 yuan for 100 grams. The more upscale Godiva cost 150 yuan, gift-wrapping not included.

Except for a few brands, most European-branded chocolates are sold only through small franchise stores to lend a sense of exclusivity.

Few European chocolate vendors have made as big a splash in Shanghai as Godiva, which recently opened its large flagship store together with a European-style cafe in the heart of Xintiandi, the city's popular affluent entertainment enclave. It has four stores in the city.

Lu says the average customer spends about 200-300 yuan at his store each time. And "we got quite a few regular customers buying chocolate and having coffee and cakes every day", he says.

Chocolate vendors are claiming much of the credit for helping to spread the chocolate culture among the young in Shanghai and its neighboring region.

"When we opened our first sales outlet in Shanghai's Hongqiao Friendship Shopping Center, hardly any customers could connect the sweet and bitter taste of chocolate with romance and wholesomeness," says Ruan Wen, general manager assistant of Xuanhuai Trading Company, the sole distributor of Leonidas chocolate in China.

"Now, many customers are buying our chocolate for their sweethearts."

Some designer chocolates sold in China are made locally using imported ingredients. They appear to be getting more popular among the young, thanks to more affordable prices and better taste, compared with chocolates made by some domestic producers.

Baixas, a store in Shanghai's Times Square, has a reputation for fresh chocolates made with ingredients from Belgium at its factory next to the store.

"The taste is similar to those imported chocolates from Europe, but the price is much lower than some high-end brands," says Liu Li, a consumer at Baixas store.

Sold at 74 yuan per 100 grams, consumers will pay 23 percent less than Leonidas and 50 percent less for Godiva.

Lu says many Chinese became familiar with high-end chocolate brands through contacts abroad.

"Consumers are willing to try some premier products when they realize the luxury brands have branches in China," Lu says.

By opening stores or counters in upmarket areas such as Xintiandi and the International Financial Center in Shanghai, European chocolate factories have successfully introduced themselves to Chinese consumers as high-end confectionary.

"The stores in affluent areas function like show windows that tell people we are a high-end chocolatier from Belgium," says Lu.

China has experienced a boom in chocolate consumption in recent years. The UK-based market research firm Mintel said chocolate sales in China increased by 18 percent in 2009. However, the annual consumption of chocolate per capita is only 70 grams, much lower than in US or Japan.

The distributor of Leonidas in China anticipates sales in Shanghai to increase by 30 percent by the end of this year.

Many other manufacturers are now targeting China as a market with huge potential. The Switzerland-based Barry Callebaut established a production plant in 2008 in Suzhou, in East China's Jiangsu province, to enhance its competitiveness.

Patrick G. De Maeseneire, chief executive officer of Barry Callebaut, says China would become a key target market for the chocolates in the next few years and the company would try to bring better chocolate experiences to consumers.

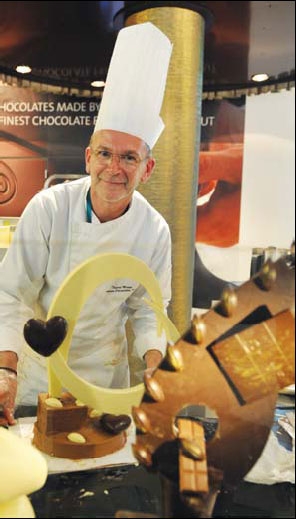

Belgian chocolate proved to be popular at the Shanghai World Expo. Zhang Ke / For China Daily

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Preview of the coming issue

Carrefour finds the going tough in China

Maid to Order

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.