Waiting game for action on economic solutions

Updated: 2014-03-24 07:34

By Ed Zhang (China Daily)

|

|||||||||||

Their observations are not only important for forecasting China's long-term performance; investors had better keep them in mind and compare them with the short-term realities across various industrial sectors. Opportunities, if defined as meaningful growth, can only come along where bankruptcies are reported, old funds allowed to default or collapse, large companies break up, small companies multiply and rules are remade to allow new services to reach out to young customers.

|

|

When the government doles out an investment stimulus or consumer incentives, the stock market may respond favorably, but just for a short period, because they are unlikely to generate steady growth.

So we can look forward to an uneventful first quarter, and perhaps the next, when many local governments remain disorganized over their funds and unfinished projects, and when only some large State-owned corporations begin to talk about their plans to work together with private capital to build subsidiaries with mixed ownership.

Important projects, such as the pilot free trade zone in Shanghai, or the urban cluster covering Beijing, Tianjin and Hebei, are yet to generate tangible results or any innovation in the government's service to society and the business community.

The only truly area of robust business is the mobile Internet service, where real money, not just ideas and plans, is flowing and making an impact.

Even the central bank's ban on virtual credit cards on security grounds can be expected to be made obsolete when more sophisticated solutions are developed.

The author is editor-at-large of China Daily.

Related Stories

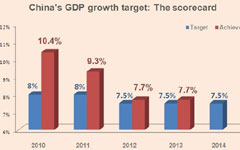

GDP target of 7.5% 'may be possible', expert says 2014-03-10 12:04

Finance minister downplays GDP growth target 2014-03-06 16:05

GDP and sustainable growth 2014-03-06 13:25

GDP target tallies with China's reality 2014-03-05 15:35

Today's Top News

Xi pledges to bolster nuclear security

Kremlin 'ready' to work with G7

Beijing among most polluted areas

China eyes 'Cathay' tulip import

President takes detour on state visit to France

US mudslide death toll climbs to 14, 176 missing

Courier, customer brawl in Chongqing

Tibet Airlines to open four new routes

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|